Can I use cash as proof of funds?

What is acceptable as proof of funds

Proof of funds usually comes in the form of a bank security or custody statement. These can be procured from your bank or the financial institution that holds your money. Bank statements are the most common document to use as POF and can typically be found online or at a bank branch.

Cached

Can you submit an offer without proof of funds

Short of the proverbial briefcase full of cash, the seller has no guarantee that the buyer actually has the funds they say they have, unless they have a document to prove it; many sellers won't accept a cash offer without a POF.

Cached

How is proof of funds verified

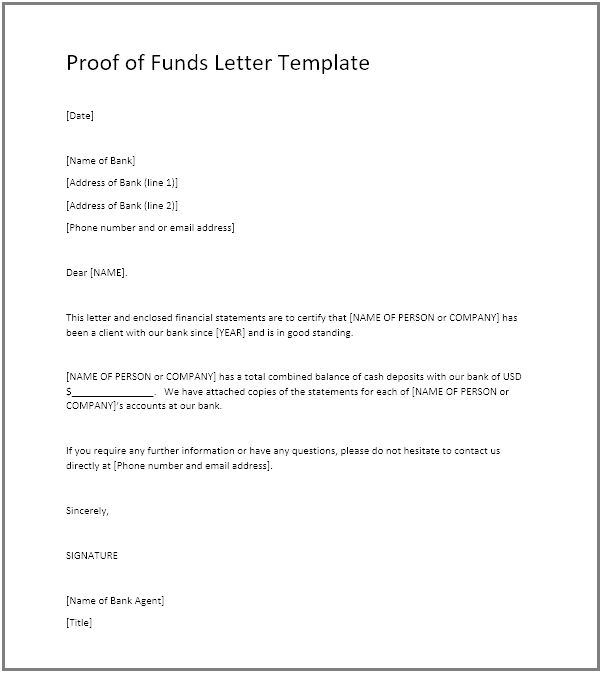

You can apply for a proof of funds verification from your bank. This letter should be signed by authorised bank personnel and must include the following points: Details of the bank, including name, address, and contact information. An official statement from the bank verifying the concerned individual's financial …

Cached

What is proof of funds from

Proof of funds is a document you provide to assert that you have money on hand to cover specific expenses. Proof of funds can come from multiple sources, including bank statements or a proof of funds letter.

Cached

What is hard proof of funds

A hard money Proof of Funds letter is a letter issued by a hard money lender informing sellers and their agents that its client is pre-approved to purchase a property within a certain price range.

Can I use credit card statement as proof of funds

The documents required as proof of purchases and expenses include the following: Invoices. Credit card statements and receipts. Cash register tape receipt.

Is it normal for a realtor to ask for proof of funds

No, a Proof of Funds letter is not always required. If you are buying from a homeowner with no agent, it may not be necessary. However, when an agent is present, and multiple offers are on the table, the agent will want to see Proof of Funds.

Can the seller see proof of funds

Proof of funds in real estate is a document that shows how much money you have available to purchase a home. Sellers typically like to see proof of funds letters, also known as verification of funds letters, to ensure you can cover the costs associated with obtaining a mortgage, such as down payment and closing costs.

What are examples of source of funds

Examples of sources of funds include:Personal savings.Pension releases.Share sales and dividends.Property sales.Gambling winnings.Inheritances and gifts.Compensation from legal rulings.

Can I call a bank to verify proof of funds

Having the buyer get a certified statement from the bank is the easiest way! Verify funds coming from the buyer's bank account by calling the bank lender even if you are provided contact information for the bank lender, this allows you to verify if the bank institution and the lender are legit.

What is an example of a source of funds

Common legitimate sources of funds include personal savings accounts, employment income, property sales, inheritances and gifts, legal settlements, and even gambling winnings.

What is a soft proof of funds

Thousand on XYZ property with a specific property.

What is liquid proof of funds

A proof of funds letter is a document providing evidence that a borrower has enough liquid assets, or cash, to buy a home. Homebuyers need this paperwork to demonstrate to the seller that they can cover purchase costs, including the down payment and closing costs.

What can be used as bank proof

Accepted forms of proofBank statements.Internet banking account screens.Deposit slips.Cheques.Download 'Proof of account balance' document from bank (blank out account balance)

Can I use my bank statement as proof

What can be used as proof of address Here are some of the most common documents that count as valid proof of address: Bank statement; Utility bill for gas, electricity, water, internet, etc.

What is a proof of funds letter for a cash offer

When you're buying a house, a proof of funds letter is a document that proves that a home buyer has enough liquid cash to purchase a home. It's essential paperwork that all home sellers will want to see, so home buyers shouldn't feel prepared to make an offer without one.

Do I have to prove where my down payment came from

The general rule for documenting down-payment funds that will originate from a checking or savings account is that they must have been there for at least two or three months. This is known as “seasoning.” Lenders ask borrowers to provide two or three months of statements for their checking or savings account.

What is cash proof

A proof of cash is a bank reconciliation that includes not only the prior-period and current-period balances but also reconciles the book receipts and disbursements for the periods with the bank statements.

What are the 5 sources of funds

Best Common Sources of Financing Your Business or Startup are:Personal Investment or Personal Savings.Venture Capital.Business Angels.Assistant of Government.Commercial Bank Loans and Overdraft.Financial Bootstrapping.Buyouts.

What are the two basic sources of funds

Debt and equity are the two major sources of financing.