Can I use credit card and pay it next day?

Can I use credit card and pay same day

Some Issuers Allow Same-Day Use

Provided you apply online, many credit card issuers can provide same-day approval, but only a handful of companies will give you the ability to use your card the same day you're approved.

What happens if I pay my credit card the next day

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Cached

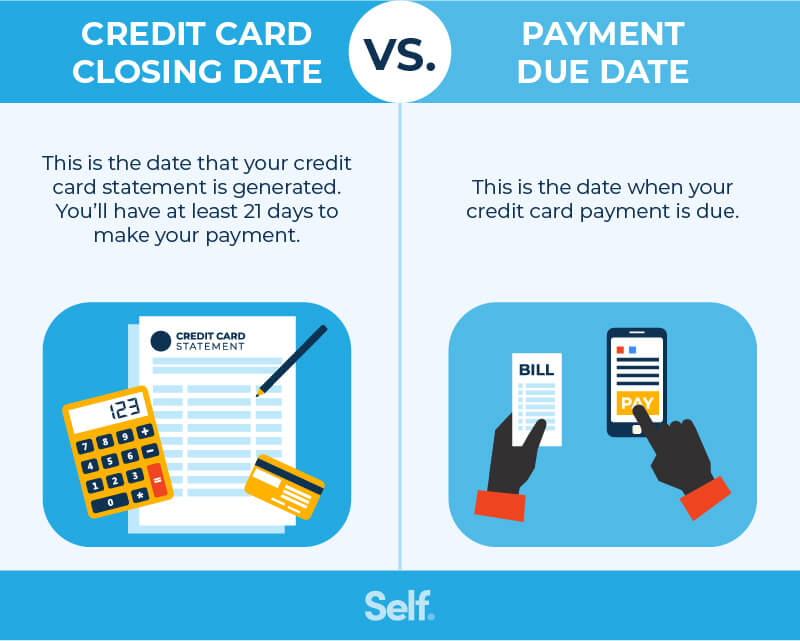

Can I use my credit card the day before its due

Yes, you can use your credit card between the due date and the credit card statement closing date. Purchases made after your credit card due date are simply included in the next billing statement.

Can I pay credit card bill immediately after purchase

You can pay the bill on or before the due date at your convenience. However, paying the bill later will incur additional charges. What happens if I pay only the minimum amount due If you pay only the minimum amount due, your card issuer will start levying interest on the remaining amount.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

How long after using credit card should I pay it

Pay off all your credit cards a few days before each statement closes if you're applying for a loan soon. Paying off your cards early will decrease your overall utilization and boost your credit score for a few days.

Can you pay off credit card right after purchase

While it may be tempting to pay just the minimum payment — which could be as low as $25 — you'll start to accrue interest, leading to years of debt. The best practice is to pay off your credit card bill as soon as you make a purchase. This way, you can get into the habit of paying your bill long before its due date.

What happens if I pay credit card before due date

By making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower, as well. This can mean a boost to your credit scores.

Should I use my credit card then pay it off immediately

You finally used your credit card for a big purchase you've had your eye on, but now you're wondering if you should pay your credit card balance off in full. Generally, it's best to pay off your credit card balance before its due date to avoid interest charges that get tacked onto the balance month to month.

How long after using credit card can I pay it

A grace period is usually between 25 and 55 days. If your card has a grace period, different factors might impact whether it applies to a purchase—like whether you've paid your previous balance in full by the due date each month.

What happens if I go over my credit limit but pay it off immediately

If it is a one-time event and you quickly pay your balance so that it is well below the limit, it may have little or no impact on your credit report. But if you tend to stay close to your limit and go over your credit limit repeatedly, your credit score will suffer.

Is a $500 credit limit good

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.

Is it good to pay your credit card right after using it

By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your chances of increasing your credit scores. Paying early can also help you avoid late fees and additional interest charges on any balance you would otherwise carry.

Can I pay my credit card right after I use it

Yes, you can use your credit card as long as you have an available credit limit. So once you repay it, your limit gets restored and it can be used again.

Is it bad to pay credit card too soon

No. It's not bad to pay your credit card early, and there are many benefits to doing so. Unlike some types of loans and mortgages that come with prepayment penalties, credit cards welcome your money any time you want to send it.

Is it OK to pay credit card right away

To keep credit utilization rates low and bump a credit score up, pay as early as possible. But, never forget: never carry a balance if it can be avoided.

Is it bad to pay off credit card too fast

The answer in almost all cases is no. Paying off credit card debt as quickly as possible will save you money in interest but also help keep your credit in good shape.

How much should you spend on a $500 credit limit

It's commonly said that you should aim to use less than 30% of your available credit, and that's a good rule to follow.

How much of a $1,500 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

How much of a $2000 credit limit should I use

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.