Can I use lookback credit?

Who can use the lookback credit

The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer. This includes those that received unemployment benefits or took lower-paying jobs in 2023.

Cached

How do I use my look back credit

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …

Cached

Can you use lookback rule twice

Myths and realities about the lookback rule

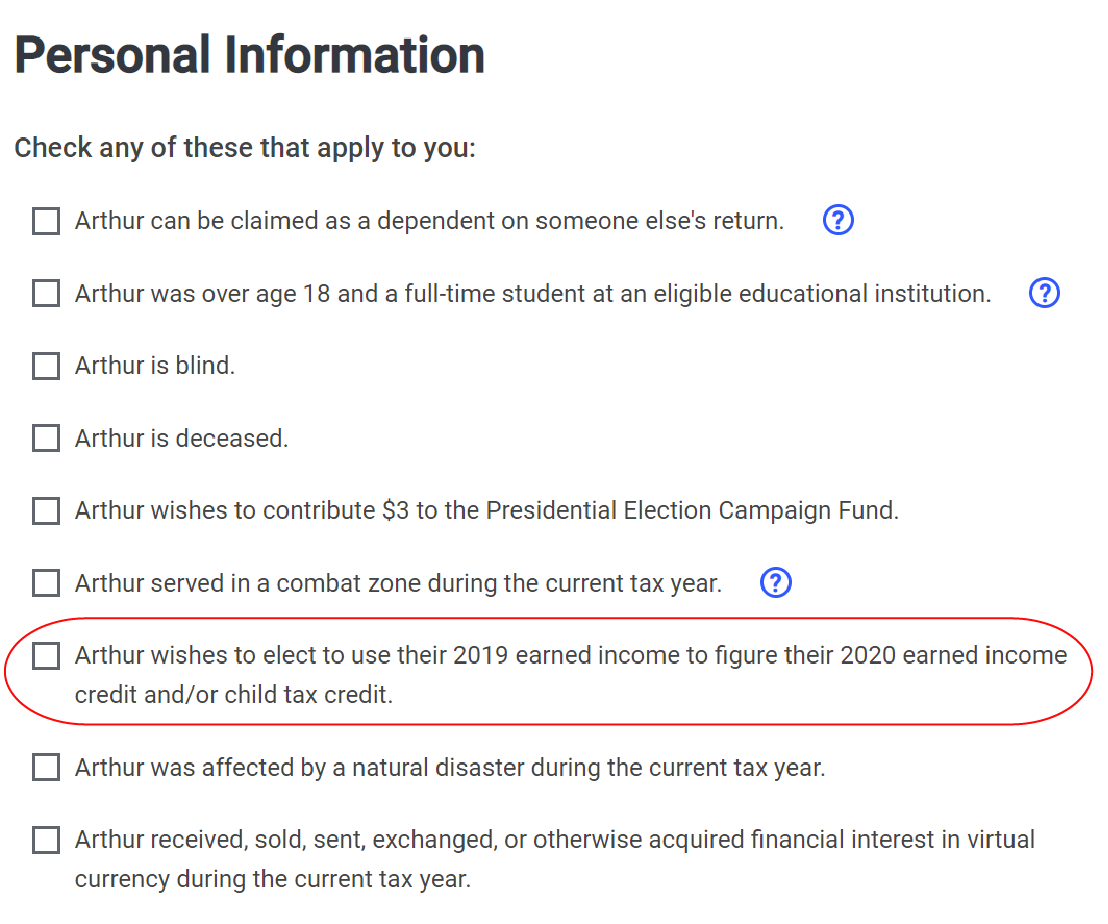

Myth: You can use the lookback provision to apply 2023 to your entire return. Reality: You can only use the lookback provision for your eligibility for the Earned Income Credit and the Additional Child Tax Credit.

What is the lookback rule for EITC 2023

Additionally, there is a 'lookback' rule for the EITC that allows anyone eligible for the credit to choose to use their earnings from 2023 instead of 2023, if it can help you get a larger credit.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What is the look back rule for capital gains tax

When gains exist from the sale of Section 1231 assets, gains will result in ordinary income to the extent of 1231 losses claimed by the given taxpayer in the previous five years. Any remaining gains left over will result in capital gain treatment.

Will the lookback rule apply in 2023

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2023, plus three years).

Does the IRS have a three year lookback for errors

How far back can the IRS go to audit my return Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years.

Can you use previous years income for earned income credit

Claim the EITC for Prior Years

You have three years to file and claim a refund from the due date of your tax return. If you were eligible, you can still claim the EITC for prior years: For 2023 if you file your tax return by April 18, 2025. For 2023 if you file your tax return by May 17, 2024.

Can I borrow from my 2023 tax return

Refund Advance is a no-interest loan that is repaid with your tax refund. Apply between Jan. 3, 2023 and Feb. 28, 2023.

How to get $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

Can my parents sell me their house for $1

Giving someone a house as a gift — or selling it to them for $1 — is legally equivalent to selling it to them at fair market value. The home is now the property of the giftee and they may do with it as they wish.

How to avoid paying capital gains tax on inherited property

Here are five ways to avoid paying capital gains tax on inherited property.Sell the inherited property quickly.Make the inherited property your primary residence.Rent the inherited property.Disclaim the inherited property.Deduct selling expenses from capital gains.

Will the lookback rule be extended

New lookback period applies

Notice 2023-21 specifies that the filing dates were postponed, not extended. Therefore, the lookback period was not extended by Notice 2023-23 or 2023-21 and remained at three years unless a taxpayer actually secured an extension to file.

What is the new IRS rule 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What is the IRS throwback rule

The "throwback rule" is a statute that states can adopt and use to ensure corporations pay their state taxes on 100% of their profits. Every state that levies a corporate income tax must determine, for each company doing business within its borders, how much of the company's profits it can tax.

What disqualifies you from earned income credit

For the EITC, we don't accept: Individual taxpayer identification numbers (ITIN) Adoption taxpayer identification numbers (ATIN) Social Security numbers on Social Security cards that have the words, "Not Valid for Employment," on them.

How many years can you claim earned income credit

four prior

Generally, you may claim CalEITC to receive a refund for up to four prior years by filing or amending your state income tax return. Review the information from past years in the dropdowns below to estimate how much you could get.

Can I borrow from my future tax return

A tax refund loan allows you to borrow money from your upcoming tax refund. The short-term loan comes with fees and, in some cases, interest charges. But you get your money quickly—usually within a day. Tax preparation services typically offer tax refund loans.

Can I get a loan against my tax refund if I already filed

If you're looking to get your refund money quickly, you might consider a loan against your tax refund. If you prepared your tax return through a tax-preparation service and you're expecting a refund, you may be able to apply for a short-term loan against your anticipated federal income-tax refund.