Can I use my available balance on my credit card?

Can I spend my credit card available balance

Your available balance is the amount of money in your account, minus any credits or debts that have not fully posted to the account yet. This is the amount of money you can spend, but it may fully reflect the money you have at your disposal.

Cached

Why can’t I use my available balance on my credit card

For the most part, your available balance is an accurate view of what you have to spend. But if you've made a debit card transaction that the merchant hasn't reported to your bank yet or still have outstanding checks, those items may not be included in your available balance.

Cached

What does available balance mean on a credit card

Your available balance is the total amount of money in your account that you can use for purchases and withdrawals, as it excludes pending transactions and check holds from your account balance. However, the available balance will not show checks that haven't been cashed or deposits which haven't posted.

Cached

How can I use my available balance

The available balance consists of the funds that you can withdraw immediately, including through debit card purchases or ATM withdrawals. Your bank will typically allow you to make transactions up to this amount.

Cached

Can I use my credit card after my limit

Can you go over your credit limit Yes, you can go over your credit limit, but there's no surefire way to know how much you can spend in excess of your limit. Card issuers may consider a variety of factors, such as your past payment history, when deciding the risk of approving an over-the-limit transaction.

Can I use my credit card after its maxed out

Once you've maxed out a credit card, you have no limit left for use. Some card issuers may allow you to exceed your limit with your authorization; however, the company will charge you an over-the-limit fee which just adds to the debt you already owe.

Do I go by current or available balance

While spending the full amount of a current balance with pending payments could result in overdraft fees, spending the full amount of an available balance will not.

Can I use my available balance if I still have money pending

If a large deposit is pending for more than a few business days, it might be worth contacting your bank. That money won't be part of your available balance until it clears, meaning you won't be able to spend it.

What is the difference between available balance and actual balance

Your actual balance, or sometimes just called balance, is the total of all the transactions on your account including any pending transactions. Available balance is what is available for you to use out of this actual balance – typically this is your actual balance minus any pending transactions.

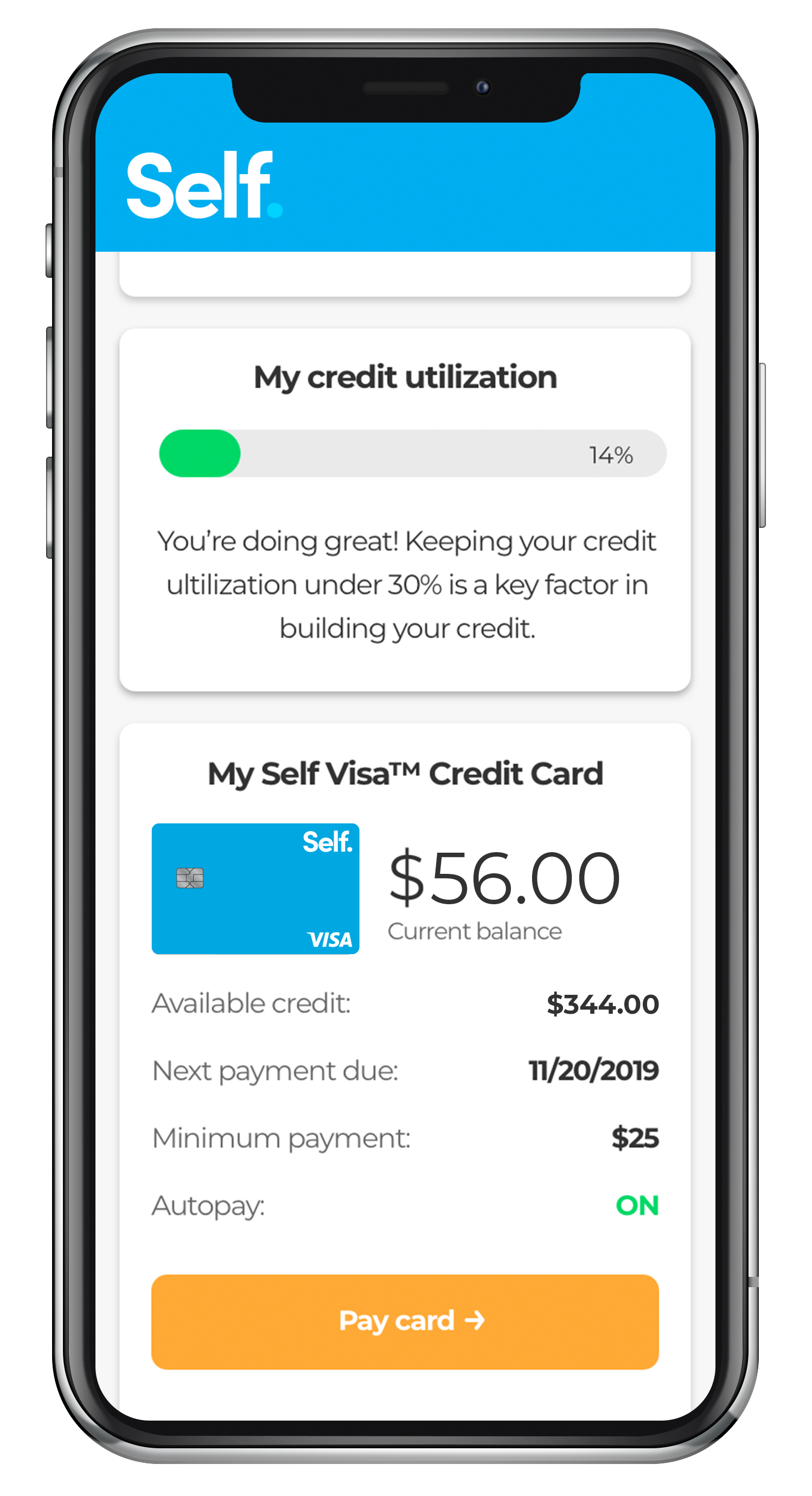

How much of my $500 credit limit should I use

Lenders generally prefer that you use less than 30 percent of your credit limit. It's always a good idea to keep your credit card balance as low as possible in relation to your credit limit. Of course, paying your balance in full each month is the best practice.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

What if I use $100 of my credit card

Using up your entire credit card limit

A credit utilisation ratio of more than 35% can reduce your credit score. This means that if your credit utilisation ratio is 100%, it can lower your credit score.

Why is my balance and available different

The available balance is the amount of funds you currently have available to use. While a transaction is pending, the amount is deducted from your available funds. The account balance is the total amount you have in your account that includes any pending transactions or other amounts yet to clear (e.g. cheques).

What is the difference between available and balance on a credit card

'Balance' is the amount of money in your account before all pending transactions have been processed. 'Available' is the amount that you can spend today, and is a more accurate reflection of how much you can spend at that time.

What’s the difference between balance and available balance

What's the difference between my checking account balance and available balance Your account balance is made up of all posted credit and debit transactions. It's the amount you have in the account before any pending charges are added. Your available balance is the amount you can use for purchases or withdrawals.

How much should I spend on a $200 credit limit

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

How much should I spend on a $300 credit limit

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

How much of $1 500 credit card limit should I use

You should aim to use no more than 30% of your credit limit at any given time. Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score.

How much of $200 credit limit to use

30%

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

How much of my $500 credit card should I use

The less of your available credit you use, the better it is for your credit score (assuming you are also paying on time). Most experts recommend using no more than 30% of available credit on any card.