Can I use my credit card 2 days before closing?

Is it okay to use credit card before closing date

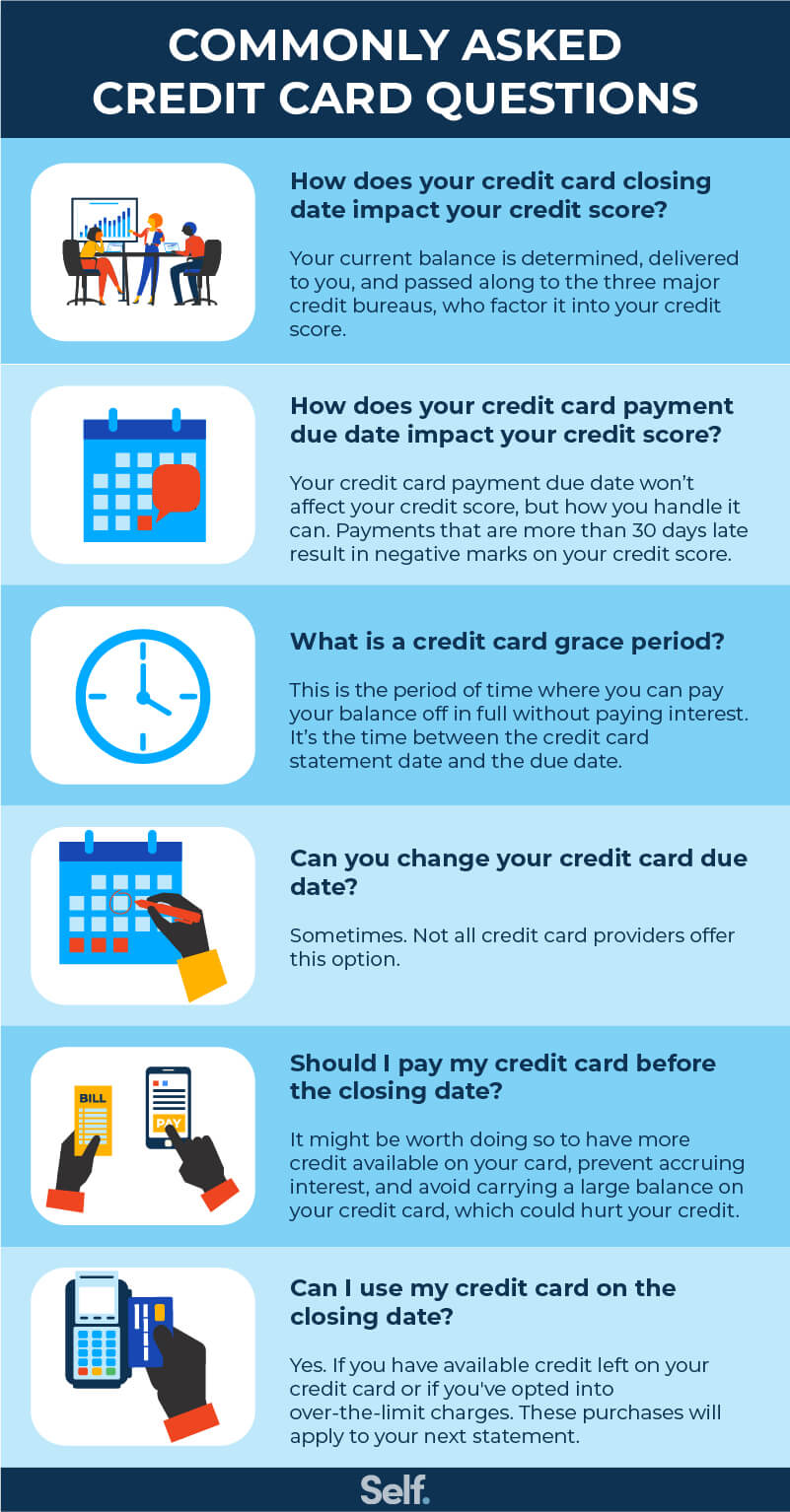

Can I use my credit card between the due date and the closing date Yes, you can use your credit card between the due date and the credit card statement closing date. Purchases made after your credit card due date are simply included in the next billing statement.

How long do you have to use a credit card before closing

New or First Credit Card

If you've just started using credit and recently got your first credit card, it's best to keep that card open for at least six months. That's the minimum amount of time for you to build a credit history to calculate a credit score.

What happens if you open a credit card before closing on a house

A new credit card application before you close on a home could affect your mortgage application. A mortgage lender will usually re-pull your credit before closing to ensure you still qualify and that new credit was not opened.

Cached

Do lenders pull credit day of closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

Cached

Can you use a credit card for closing

You can't show up at the closing with a credit card to pay the closing costs. Instead, you'll need to pay the down payment and the remaining costs at closing.

Should I pay credit card before or after closing

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

Can I spend money before closing

Lenders will check the borrower's credit report to verify any critical financial details. If the lender spots any big purchases that significantly impact your financial picture, it's possible they won't finalize the mortgage. With that, it is important to wait until after closing day before making any big purchases.

How many times is your credit pulled when buying a house

While the number of credit checks for a mortgage can vary depending on the situation, most lenders will check your credit up to three times during the application process.

When should you wire money for closing

You will typically wire the money one to two business days before the closing. The exact day will be in your closing disclosure, which you will receive at least 3 days before your closing. You should also confirm when and how much to wire with your lender.

How does the buyer know how much money to bring to closing

The exact amount you need, for both closing costs and your down payment, will be outlined in your Closing Disclosure, which is a document that you will receive at least three days before your closing.

What is the 15 3 rule

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Can I pay credit card bill immediately after purchase

You can pay the bill on or before the due date at your convenience. However, paying the bill later will incur additional charges. What happens if I pay only the minimum amount due If you pay only the minimum amount due, your card issuer will start levying interest on the remaining amount.

Do lenders check bank account before closing

Yes, they do. One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required.

Can your loan be denied at closing

Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Do lenders check bank statements before closing

Yes, they do. One of the final and most important steps toward closing on your new home mortgage is to produce bank statements showing enough money in your account to cover your down payment, closing costs, and reserves if required.

What is a soft credit pull before closing

Final credit check before closing

Also, if there are any new credit inquiries, we'll need verify what new debt, if any, resulted from the inquiry. This can affect your debt-to-income ratio, which can also affect your loan eligibility. This is known as a soft pull.

What can go wrong day of closing

One of the most common closing problems is an error in documents. It could be as simple as a misspelled name or transposed address number or as serious as an incorrect loan amount or missing pages. Either way, it could cause a delay of hours or even days.

Do I get my money the day of closing

If you're in a wet funding state, you'll get the money within 24 hours. If you're in a dry funding state, you will have to wait three or four days. You can't really control how long it will take to get money after closing.

How much money should I have left after closing

But, at the bare minimum, you'll need to have an additional three to five percent of the price of home saved to pay for costs associated with closing, which could include lender fees, title and escrow fees, transfer tax fees, and possibly money to fund an escrow account, explains Alfredo Arteaga, an Irvine, California- …

Can I wire funds the day of closing

You should not wire funds on the day of closing as it can get chaotic, and anything late could damage your chance of getting inside the home. Ensure you contact your loan officer and stay on top of the process to move the funds over in time.