Can I use my USA credit score in Canada?

Is American credit score the same as Canada

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you're looking for a high score.

Does U.S. credit score transfer to other countries

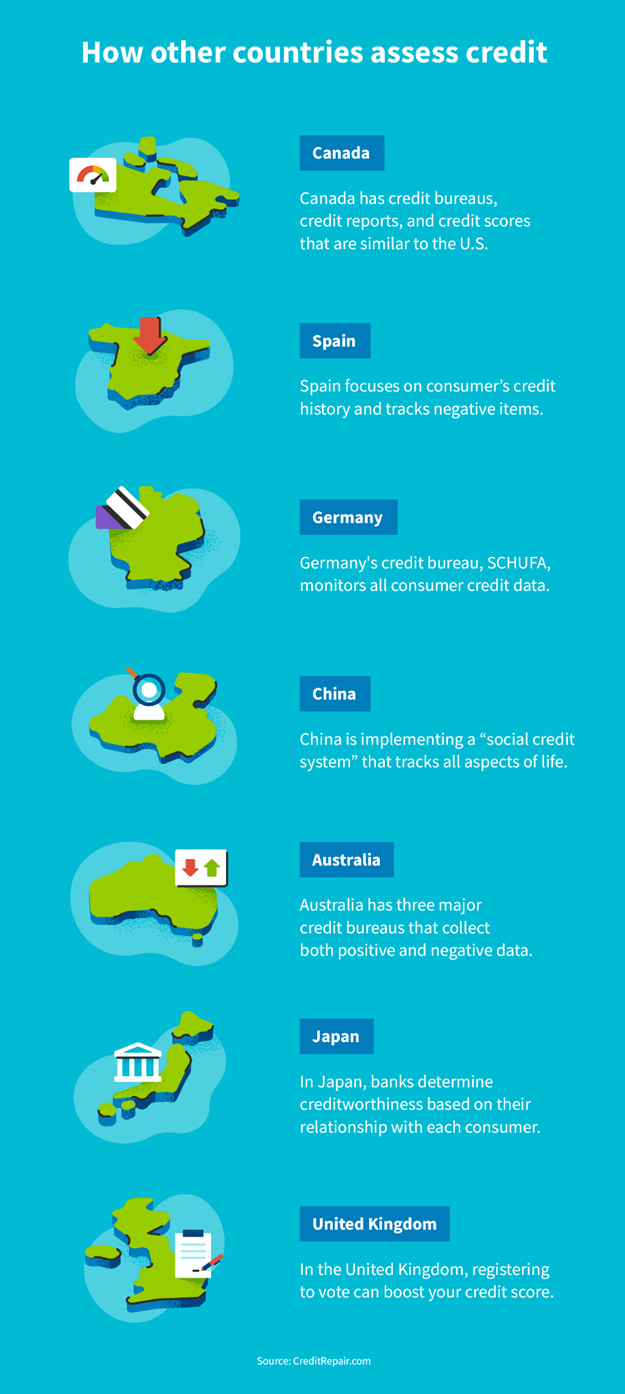

Global credit scores currently don't exist, so you can't transfer a U.S. credit score overseas. Other countries might use their own systems to determine creditworthiness. Giving international lenders a copy of your credit report, employment history and income verification could help you build creditworthiness.

Cached

How can an American establish credit in Canada

Paying your rent monthly and reporting it to the Canadian credit bureau is a smart way to build up your credit without taking on debt. Be mindful that if you are late with your rent payments, this will negatively affect your credit score, so remember to pay your rent on time.

Cached

Does Canada use a different credit score

When it comes to credit scoring systems, Canada is similar to the United States. Canada uses two of the major credit bureaus, Equifax and TransUnion, to determine someone's credit score. Like the U.S., Canada's credit score tracking is determined by factors including: Payment history.

Cached

How do I get my FICO score Canada

You can access your credit score online from Canada's 2 main credit bureaus. Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

What is a good credit score in Canada

between 660 to 724

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

What happens to my credit score if I leave the US

Your credit information and scores are maintained and calculated by CICs (Credit Information Companies) such as Equifax and TransUnion. You will be required to build a new credit history in your new country of residence. Of course, it is never a good idea to leave behind bad credit and unpaid debt.

Does your credit score reset if you move countries

Although your credit history may not follow you when you move abroad, any debts you owe will remain active. It will be difficult for lenders to take legal action against you if you're living in a new country, but it is not impossible for them to try and recoup the debt.

What credit score do you start at Canada

Because you'll have no credit report to base it on, you'll essentially start with no credit score when you first arrive in Canada, Anand says. Aman Anand, senior director, credit risk at TransUnion. Credit scores range from 300 to 900.

Does FICO work in Canada

The majority of Canadian lenders use the FICO Score, including major banks. Consumers aren't able to access their FICO Score without going through a major bank.

What is a good FICO score in Canada

between 660 to 724

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

How hard is it to get a 800 credit score in Canada

However, statistics show that roughly 1 out of every seven Canadians have an 800 credit score, which is about 17% of people. In essence, an 800 credit score is not so easy to come by.

What is FICO called in Canada

'hard' credit check. The score that most Canadian lenders use is called a FICO score, previously known as the Beacon score.

Does your credit start over if you move to Canada

If you're new to Canada, you won't have any credit upon arrival. That's because your credit history from your country of origin — good or bad — won't transfer with you to Canada. Don't stress! There are simple ways to build your Canadian credit score, like applying for a secured credit card or getting a cellphone plan.

Does US debt follow you to another country

There's no law saying you can't move to another country if you have debt—even if it's in collections. But if you've taken on debt in the U.S., you're contractually obligated to pay it, regardless of where you choose to live. Living abroad can make it more difficult for creditors to find you and collect on your debt.

What happens to my credit score if I move to Canada

If you're moving to Canada, you will not have any credit upon arrival. This means that your score won't be low — it will be nonexistent. As previously mentioned, there is no universal credit reporting system. Every country has a unique set of laws governing how credit is regulated.

Does US debt follow you to Canada

Your US credit history does not in fact transfer to Canada, or reflect for Canadian credit bureaus when you move. Both countries have their own systems for credit reporting, each with its own rules. This means that credit information is not shared across the border.

What is a normal credit score in Canada

between 660 to 724

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

What can a 800 credit score get you in Canada

Benefits of a 800 Credit Score

This is because higher credit scores help to prove how financially responsible you are. With a score of 800 you are also likely to get approved for lower interest credit cards and better rewards. A high credit score also helps you get a mortgage or car loan.

Is it possible to get a 900 credit score in Canada

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, that's excellent. If your score is between 700 and 780, that's considered a strong score and you shouldn't have too much trouble getting approved with a great rate.