Can I use upgrade card to pay off credit card debt?

Can I pay off a credit card with an upgrade card

While the Upgrade Card technically doesn't allow balance transfers, it does have an easy workaround: You can draw money from your account online and deposit it into your bank account. Once that money is in the bank, you can use it to pay off your existing credit card debt.

Cached

Can I use a credit card to pay off credit card debt

Paying off one credit balance using another card isn't generally possible. Banks don't allow you to pay your credit card balance directly using another credit card. Typically payments via check, electronic bank transfer or money order are the only acceptable methods of payment.

Does the upgrade card count as a credit card

The Upgrade Card is neither a credit card nor a traditional personal loan — it is a card with a credit line that offers easy-to-use installment payment terms. Qualifying cardholders are offered a default line of credit, APR and repayment term based on their creditworthiness.

Cached

Can I use my upgrade card like a debit card

1. It's essentially three products in one. The Upgrade OneCard combines the immediate payment of a debit card, the rewards and fraud protection of a credit card, and the fixed monthly payments of a personal loan. You can use the card to make purchases in stores or online, as you would with a debit or credit card.

Is upgrade card a card or loan

An Upgrade card looks like a credit card, and since you can use it in stores, it acts like a credit card. But it's actually considered a “series of closed-end loans,'' according to the terms and conditions.

Do upgrade cards increase credit score

The good news is that upgrading, downgrading or changing your credit card shouldn't have a lasting effect on your credit score. If there's a new account, it will essentially inherit the history of the old one. In some cases, there won't even be a new account.

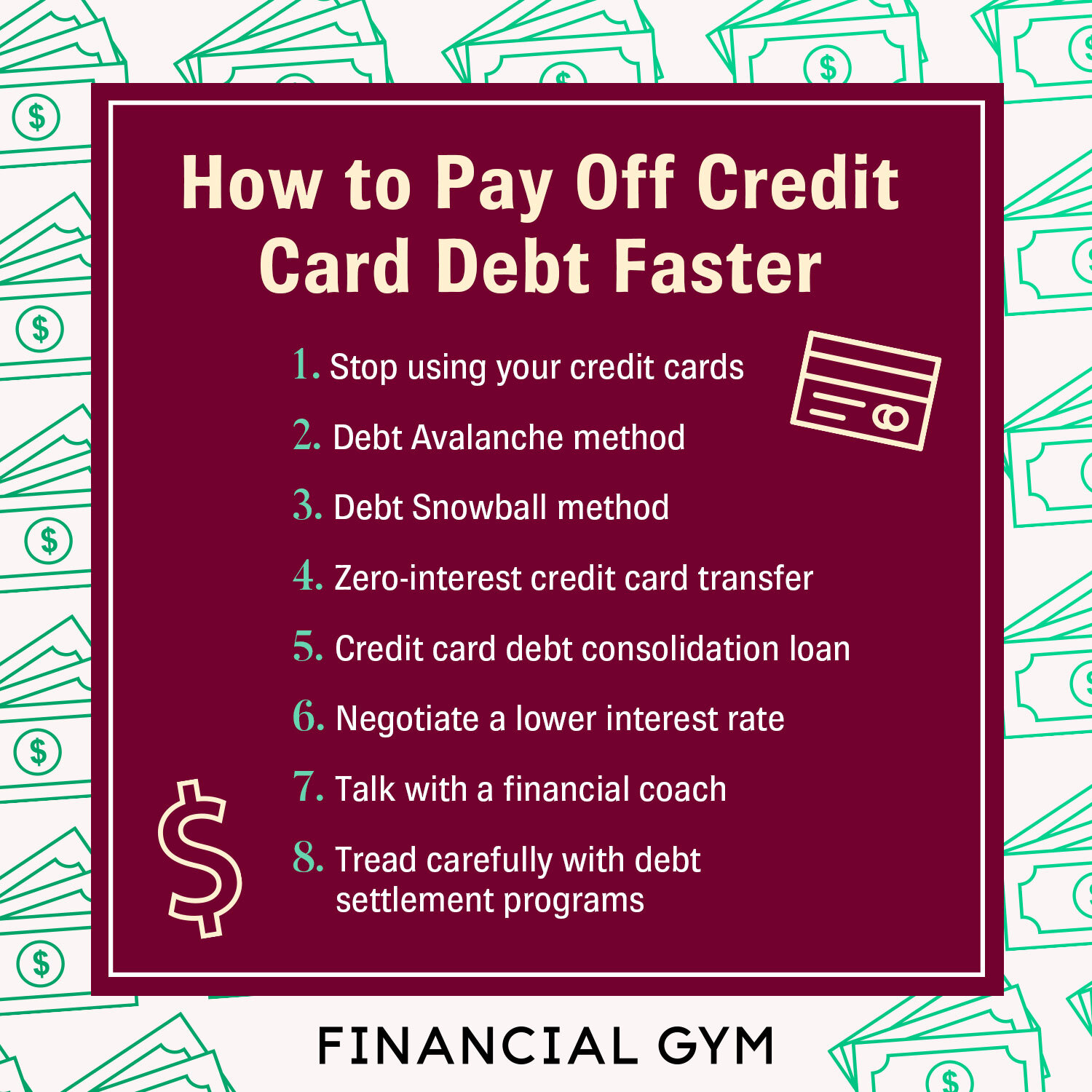

How do I pay off my credit card debt if I am poor

How to pay off debt on a low incomeStep 1: Stop taking on new debt.Step 2: Determine how much you owe.Step 3: Create a budget.Step 4: Pay off the smallest debts first.Step 5: Start tackling larger debts.Step 6: Look for ways to earn extra money.Step 7: Boost your credit scores.

What are the 3 biggest strategies for paying down debt

Tips for paying off debtStick to a budget. Whatever strategy you choose for paying off debt, you'll need a budget.Start an emergency savings account. There's nothing like an unexpected car repair coming to ruin all your plans to get out of debt.Reduce monthly bills.Earn extra cash.Explore debt relief options.

What are the disadvantages of upgrade card

ConsCardholders can't completely avoid interest charges with the Upgrade Cash Rewards Visa payment plan.Depending on your credit history, your Upgrade Cash Rewards Visa APR may not be any better than the rate you'd get on a traditional credit card.

What can I use my upgrade card for

You can use the card to make a purchase or transfer money into your linked bank account. At the end of each billing cycle, the total of your transactions is added together and treated by Upgrade as an installment loan.

How to get out of 30K credit card debt

4 ways to pay off $30K in credit card debtFocus on one debt at a time.Consolidate your debts.Use a balance transfer credit card.Make a budget to prevent future overspending.

Does consolidation hurt your credit

Does debt consolidation hurt your credit Debt consolidation loans can hurt your credit, but it's only temporary. The lender will perform a credit check when you apply for a debt consolidation loan. This will result in a hard inquiry, which could lower your credit score by 10 points.

How to pay off $15,000 fast

How to Pay Off $15,000 in Credit Card DebtCreate a Budget.Debt Management Program.DIY (Do It Yourself) Payment Plans.Debt Consolidation Loan.Consider a Balance Transfer.Debt Settlement.Lifestyle Changes to Pay Off Credit Card Debt.Consider Professional Debt Relief Help.

What is a trick people use to pay off debt

Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put all the extra money you can dedicate to debt payoff toward that account while continuing to pay the minimums on the others.

How to pay off a $5,000 credit card fast

While having $5,000 in credit card debt can seem overwhelming, you can take steps to eliminate your debt fasterHow to tell if you have too much credit card debt.Cut back on spending.Pay off the highest-interest cards first.Use a balance transfer card.Take out a credit card consolidation loan.

Is 5000 a lot of credit card debt

It could lead to credit card debt

That's a situation you never want to be in, because credit cards have high interest rates. In fact, the average credit card interest rate recently surpassed 20%. That means a $5,000 balance could cost you over $1,000 per year in credit card interest.

How long does a debt consolidation stay on your credit

seven years

If you take out a debt consolidation loan, it will stay on your credit report for as long as the loan is open. If you make payments on your loan and keep it in good standing, this can be a good thing. However, if you miss a payment, later payments can stay on your credit report for up to seven years.

How long is your credit bad after consolidation

Information related to debt consolidation will stay on your credit report for 7 – 10+ years depending on how you handle repaying the debt. Negative information, like from late payments, will stay on your report for seven years, while accounts closed in good standing will stay for ten years.

What is the 15 3 payment trick

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

How to make $200 dollars fast in one day

8 Ways To Make $200 in Just a DayFreelancing. Many skills can make you money as a freelancer.Drive for Uber or Lyft.Deliver Food.Complete Tasks on TaskRabbit.Pet Sitting or Dog Walking.Sell Items Online.Participate in Paid Focus Groups or Surveys.Rent Your Space.