Can I withdraw money from my today card?

What bank is today card

Capital Community Bank

1Who is Today Card Today Card™ Mastercard® is issued by Capital Community Bank, a Utah Chartered bank, located in Provo Utah, Member FDIC, pursuant to a license by Mastercard International Incorporated.

Is today card a credit card

The Today Card™ Mastercard® is an unsecured credit card for bad credit. The card features one of the highest purchase APRs on the market and a steep annual fee of $120, billed as $10 per month.

How can I withdraw money from my credit card without a card

To use NFC at a cardless ATM, open the app on your mobile device, choose the linked bank account you want to withdraw from and tap your phone against the designated reader. To complete the transaction, the ATM will prompt you to type in your PIN (just as if you had inserted your card).

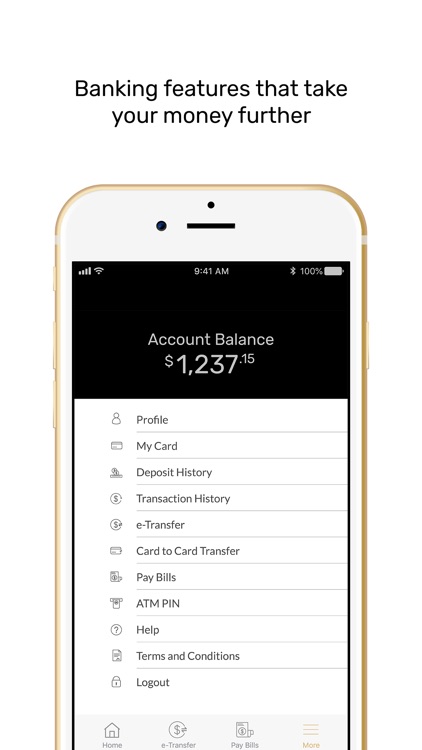

How do I set up my today card

Once you receive your invitation from your employer, enter your mobile or email, enter the verification code, create your password, activate your card by scanning its QR code, and you're ready to go!

Who owns my Today card

Part of the XTM Inc. family of products.

Is a now card a debit card

The Regions Now Card is a reloadable prepaid Visa card that is often used in lieu of a checking account. You can use it virtually anywhere Visa® Debit Cards are accepted.

Is everyday card a debit or credit card

POSB Everyday Card is an all-rounded cash rebates credit card with no minimum spend, annual fee waiver, EZ-Link and ATM card functions, and flat cash rebate rates with Sheng Siong, Watsons, SPC and selected Utilities and telecommunications merchants.

Can I use my phone to withdraw cash from ATM

Withdrawing money using a cardless ATM

But withdrawing cash from a cardless ATM can generally be done in a few easy steps: Open your bank's app and choose the account you want to withdraw from. Tap your phone to the reader—or scan the QR code on the ATM. Verify the transaction for the ATM withdrawal.

Can I withdraw money from ATM without credit card

The Reserve Bank of India (RBI) has asked all the banks to make cardless cash withdrawal available in all the Automated Teller Machines (ATMs) via Unified Payments Interface (UPI). Under this system, the customers no longer have to use their debit cards or credit cards while withdrawing cash from the ATM.

How do I use my virtual current card at the store

A virtual debit card can be used just like you would use a physical bank card. In addition to online purchases, you can use a virtual card for contactless payments in stores by adding it to Apple Pay or Google Pay. Some even allow you to withdraw money from ATMs.

How can I use my virtual current card

You can add your virtual card to Apple Pay™, Google Pay™, or use it online anywhere that Visa® is accepted. However, please note that virtual cards can't be used to withdraw funds from an ATM or to transfer funds to other P2P apps (e.g Venmo, Cash App).

Which bank owns one card

Federal Bank has partnered with OneCard, a co-branded Credit Card, that aims to provide a seamless digital experience to the young, tech-savvy population across the country.

What is difference between mycard and debit card

An ATM card is a PIN-based card, used to transact in ATMs only. While a Debit Card, on the other hand, is a much more multi-functional card. They are accepted for transacting at a lot of places like stores, restaurants, online in addition to ATM.

Is a now card a prepaid card

The Regions Now Card is a reloadable prepaid Visa card that is often used in lieu of a checking account. You can use it virtually anywhere Visa® Debit Cards are accepted.

What is everyday debit card

Everyday MasterCard is an international Debit and ATM MasterCard that you may use for ATM withdrawals, point of sale and online purchases both locally and abroad.

How do I use my daily$ everyday card

Log in to digibank Online with your User ID & PIN.Complete the Authentication Process.Under Cards, select Redeem Daily$ or SAFRA$.Select the Card you wish to check your available Daily$.You will be able to see your Available Daily$.

How do I withdraw cardless cash from ATM

For cardless cash withdrawals customers need to have any UPI application installed on their smartphone and the UPI PIN. Without the UPI PIN customers won't be able to complete the process of cash withdrawal without an ATM card.

Can you tap with your phone to withdraw money

Yes, you can get cash out using Tap & Pay.

What is the limit of cardless withdrawal

It is a simple and convenient way to withdraw cash without using a debit card. The 'Cardless Cash Withdrawal' service can be used for self-withdrawal when customers do not wish to carry the debit card. The daily transaction limit as well as per transaction limit is set at Rs. 20,000.

How can I withdraw money from ATM with no money in account

If you choose to opt in to debit card and ATM overdraft, you are usually allowed to make ATM withdrawals and debit card purchases even if you do not have enough funds at the time of the transaction. However, you will generally incur fees on transactions that settle against a negative balance later.