Can I write off gas on my taxes for DoorDash?

Is it better to write off gas or mileage for DoorDash

One of the best tax deductions for Doordash drivers—or any self-employed individuals—is deducting your non-commuting business mileage.

Cached

What expenses can I write off for DoorDash

Dashers can lower their taxable income by deducting business expenses, such as mileage, parking, tolls, cell phone usage, insulated courier bags, inspections, repairs, health insurance, and retirement contributions.

Cached

Can you deduct mileage and gas on taxes for DoorDash

Because Doordash is considered self-employment, Dashers can deduct their non-commuting business mileage. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day.

Cached

Can I write off food expenses for DoorDash

Business Meal Deduction 2023: How To Get a 100% Deduction

Whether your preference is Uber Eats, Grubhub, DoorDash, or a local delivery company, you can still deduct 100% of the meal's cost. It's exciting enough to make you want to high-five the delivery driver, though we don't recommend that due to COVID.

Is DoorDash worth it after expenses

Some will say yes, driving with DoorDash is definitely worth it. Others will say it's a lot of sitting in your car for a not-so-big payoff. However, they all seem to agree that while it's a great way to earn extra cash, you probably shouldn't quit your day job to do it.

How to save money on gas while doordashing

Driving more slowly, easing into accelerations, using less AC, breaking slowly, and reducing idling can save you more than you might expect. For instance, AAA states that gradual accelerations can increase your fuel efficiency by 10-40%. To save even more, you can decrease the weight of your car.

Can you write off gas

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted." Just make sure to keep a detailed log and all receipts, he advises, and keep track of your yearly mileage and then deduct the …

Does DoorDash keep track of your miles

Everlance makes tracking your mileage and expenses as easy as possible. If you have not used Everlance to track your mileage, DoorDash will send mileage information during tax season only. Please click here to learn more on how mileage was sent to Dashers for the 2023 tax year.

Is DoorDash worth it when it comes to taxes

Since Drivers submit claims as self-employed, DoorDash doesn't withhold any taxable income. This leads to a higher bill from the IRS. Consider sales tax in your area as well. To summarize, a DoorDash driver pays roughly 15.3% of taxes.

What happens if you didn t track your mileage DoorDash

You can expect an auditor to disallow your deduction if you claim miles without any record. When that happens, you may not claim ANY miles OR actual car expenses. You HAVE to have documentation of your miles. Statement from IRS Publication 463 related to incomplete records for your business expenses.

Does DoorDash keep track of mileage

Everlance makes tracking your mileage and expenses as easy as possible. If you have not used Everlance to track your mileage, DoorDash will send mileage information during tax season only. Please click here to learn more on how mileage was sent to Dashers for the 2023 tax year.

How much can you make with DoorDash in 3 hours

The average income for most DoorDash drivers ranges between $15 and $25 per hour. You may also earn more than this if you get plenty of additional income from tips for your orders.

How to make $500 a week with DoorDash

4 Tips To Make $500 a Week With DoorDash. DoorDash drivers are essentially independent contractors that work by delivering food or other products from the company to the customer through the DoorDash app.Frequent Busy Areas During Peak Hours.Use Multiple Apps.Treat It Like a Business.Build a Delivery Strategy.

Do I need gas receipts for taxes

3 If you want to claim gas, you must keep all your receipts. You can also claim other vehicle-related expenses, such as insurance, depreciation, lease payments, parking, toll, and repairs.

How much gas can I claim on my taxes

You can usually deduct unreimbursed vehicle expenses using one of these methods: Standard mileage rate — $0.63 per mile in 2023. If you use the standard mileage rate, you will not qualify for the IRS gas reimbursement and therefore cannot deduct the gas separately.

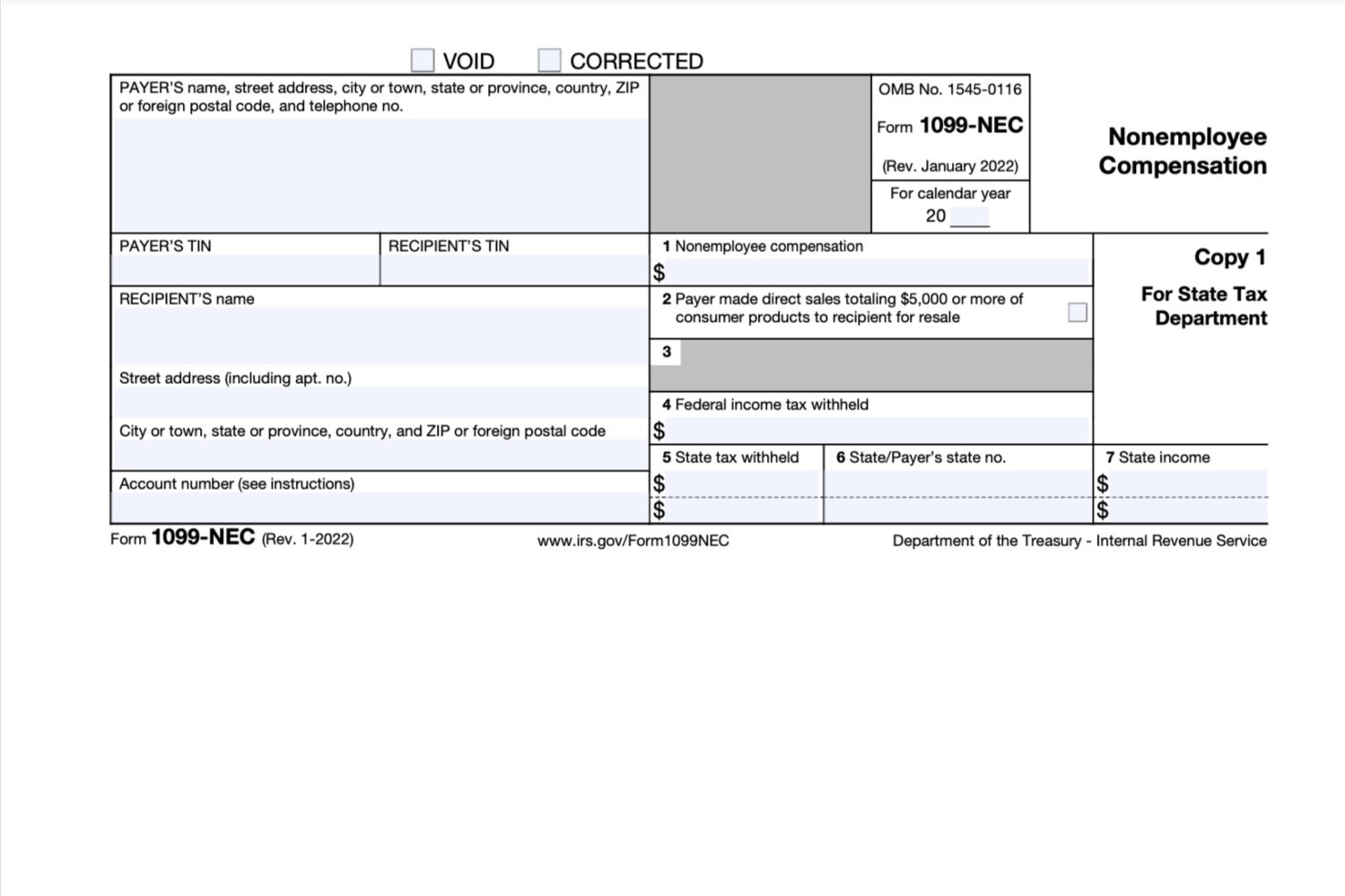

Do I have to file taxes for DoorDash if I made less than $600

Yes. You have to file taxes and report all income you receive as an independent contractor, even if it's less than $600 and you don't get a 1099 form. Does DoorDash report to the IRS DoorDash will report the income of all its DoorDashers who earn more than $600 to the IRS.

How much can you make on DoorDash without paying taxes 2023

Yes – Just like everyone else, you'll need to pay taxes. If you earned more than $600 while working for DoorDash, you are required to pay taxes. It doesn't apply only to DoorDash employees. To compensate for lost income, you may have taken on some side jobs.

How much taxes should I take out of my DoorDash pay

It's a straight 15.3% on every dollar you earn. Self-employment tax covers your Social Security and Medicare taxes. There are no tax deductions, tiers, or tax brackets. The only real exception is that the Social Security part of your taxes stops once you earn more than $147,000 (2023 tax year).

Does the IRS ask for proof of mileage DoorDash

The IRS wants more detail about your driving and your car. They will ask you when you first used your car for business. They'll also ask how many miles you drove for business, commuting, and other purposes. In the end, you'll be asked if you have evidence of your deduction and if it's written.

What happens if you don’t pay DoorDash taxes

If you cannot pay the full amount, you will face penalties and owe interest. Another option is to pay quarterly estimated payments direct to the IRS. This could help you avoid a surprise tax bill and possibly keep you from paying any penalties.