Can I write off my family vacation?

Can you deduct family vacation as a business expense

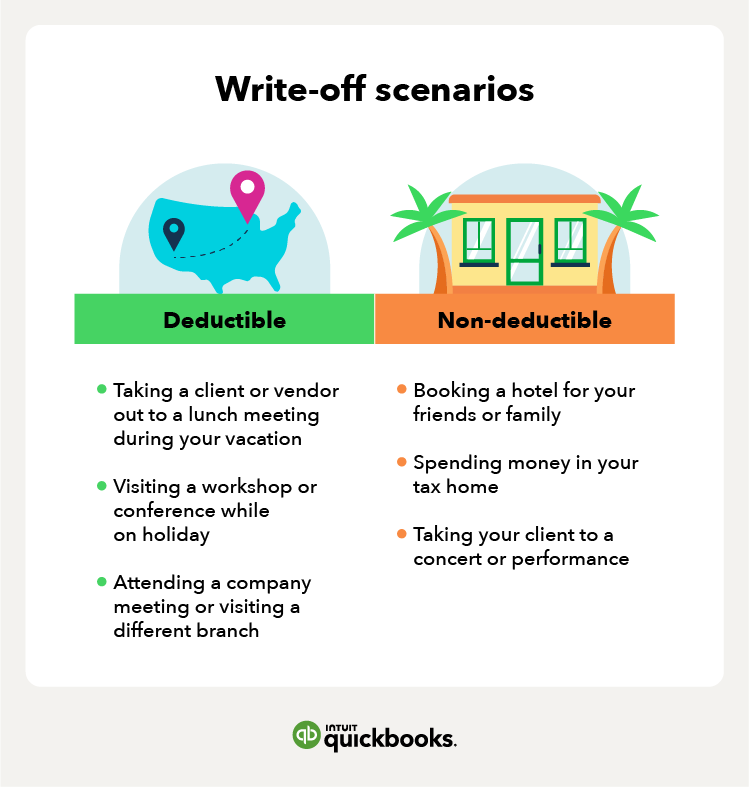

The IRS states that travel expenses are 100% deductible as long as your trip is business related, you are traveling away from your regular place of business longer than an ordinary day's work, and you need to sleep or rest to meet the demands of your work while away from home.

Cached

Can you write off a vacation on your taxes

To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes. Here's how to make sure your travel qualifies as a business trip. Your tax home is the locale where your business is based.

Cached

What kind of travel expenses are tax-deductible

Deductible travel expenses include:

Travel by airplane, train, bus or car between your home and your business destination. Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

Can you write off personal travel

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

Cached

Can I write off Disney tickets

Vacation

You can deduct your own travel expenses and the cost of the room. You won't get to deduct Disney tickets for your family members, but you can probably deduct your own ticket if you take a business associate to the Magic Kingdom.

What Cannot be written off as a business expense

As mentioned above, ordinary expenses related to personal or family expenses aren't deductible. Things like personal motor vehicle expenses outside of business hours or your personal cell phone.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

Can you write off groceries as a business expense

While most groceries are considered personal expenses and are not tax-deductible, there are certain situations where some types of groceries can qualify for deductions. It is important to note that these deductions are generally applicable to businesses or specific scenarios.

What are the three requirements for a traveling expense deduction

Expenses must be ordinary, necessary and reasonable.

You can't deduct travel expenses to the extent that they are lavish or extravagant—the expenses must be reasonable considering the facts and circumstances.

How do I prove travel expenses for taxes

The best way to prove business travel expenses (including hotels, flights, rental cars, meals, and entertainment) is to use a credit card slip (using your business card, of course) with additional notes on the business purpose. Make the note at the time you incur the expense.

What are personal Travelling expenses

Personal Travel Expenses means expenses of a personal nature incurred by the traveller when on approved travel. Expenses such as personal entertainment, including use of the hotel mini-bars and in-house videos, laundry and personal travel are examples that fall into this category.

Can a Disney trip be a business expense

However, the most important consideration is the length of time spent at each location. Travel expenses paid or incurred in connection with a temporary work assignment away from home are deductible. However, travel expenses paid in connection with an indefinite work assignment are not deductible.

Can I write off groceries as a business expense

While most groceries are considered personal expenses and are not tax-deductible, there are certain situations where some types of groceries can qualify for deductions. It is important to note that these deductions are generally applicable to businesses or specific scenarios.

Do you need proof to write off business expenses

You generally must have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses. Additional evidence is required for travel, entertainment, gifts, and auto expenses.

How can I get the most money back from my taxes

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Can I use credit card statements as receipts for taxes

As long as the information is visible and legible, your scanned receipts and statements are acceptable as a proof records for the IRS purposes.

What expenses are 100% tax-deductible

You can deduct 100% of your business and travel expenses. These can include air travel, business lodging, meals, entertainment, parking fees, car rentals, and gas.

Can you write off hotel stays on your taxes

You can deduct any of your business-related lodgings as an expense so long as it's reasonable and necessary to your business (e.g. hotel/resort stay during a travel conference).

Does IRS require receipts for travel expenses

You generally must have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses. Additional evidence is required for travel, entertainment, gifts, and auto expenses.

What are four examples of personal expenses

Personal expenses include necessities like laundry, cell phone service, clothing, personal care products, prescriptions, car insurance and registration, recreation, and more.