Can I Zelle someone with my Chase credit card?

Can Zelle receive money from credit card

Payment transfers with Zelle generally happen within minutes and don't incur any fees. Note that Zelle does not work with business debit cards, credit cards, international accounts and gift cards.

Cached

How do I use my Zelle credit card with Chase

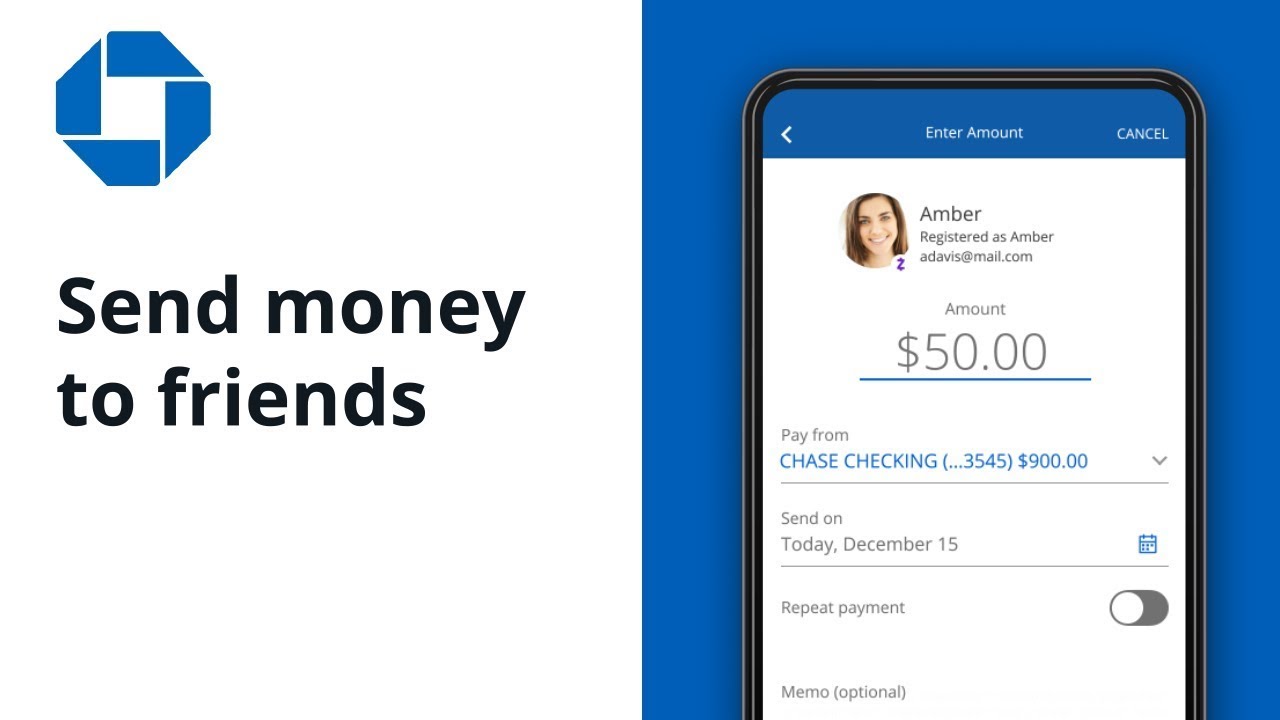

Send moneySign in to the Chase Mobile® app and tap "Pay and Transfer"Tap "Send money with Zelle®"Choose the person you want to pay or add a new one.Enter the amount to send and the account to use.If you want to setup a recurring payment you can enter those details too.Tap "Review & send"

Cached

Can Chase customers use Zelle

Use Zelle® to get paid, or send payments to eligible suppliers and vendors. It's free to Chase customers, users must have a bank account in the U.S. to use Zelle® 1 and it's available 24/7 on your Chase Mobile 2 app or chase.com.

Cached

Can I transfer money from Chase to another bank

You can usually initiate a bank-to-bank wire transfer in person at your bank or financial instruction's local branch or through your online bank account. You'll usually need to provide the recipient's full name, contact information, and bank account details such as routing and transfer numbers.

Why can t Zelle use credit card

Why First, make sure that you are enrolling a Visa® or Mastercard® debit card tied to a bank account in the U.S. You will not be able to enroll business debit cards, credit cards, cards linked to international accounts, gift cards or pre-paid cards from financial institutions outside of the Zelle Network®.

How can I send money to someone with a credit card

Peer-to-peer apps like Venmo, Cash App, and PayPal all allow you to send money with your credit card. Venmo and Cash App are free if you use your debit card, but they charge a 3% fee when you use a credit card. PayPal charges 2.9% plus 30 cents to send money to friends and family with a credit card.

How to send money with a credit card

You can link your credit card to your account in a payment app and use it to transfer money to others, much like you would with a bank account. However, you may be subject to additional fees when your credit card is the funding source.

Can I send $5000 through Zelle

If your bank or credit union offers Zelle®, please contact them directly to learn more about their sending limits through Zelle®. If your bank or credit union does not yet offer Zelle®, your weekly send limit is $500 in the Zelle® app. Please note that you cannot request to increase or decrease your send limit.

Is Zelle through Chase the same as Zelle

Chase QuickPay and Zelle aren't technically the same thing. Chase QuickPay is Chase's name for its easy money-transfer feature, and Zelle is the service that makes it work. Also, Zelle works with most U.S. banks, so it's not a Chase-exclusive service.

How do I transfer money from my credit card to my bank account

How to transfer money from a credit card using Net BankingLog in to your bank's Net Banking website.Visit your credit card section within the website.Now choose the transfer option that seems the most preferable for you.Next, you can proceed to enter the amount that you wish to transfer to your bank account.

How to send money to someone with credit card

Peer-to-peer apps like Venmo, Cash App, and PayPal all allow you to send money with your credit card. Venmo and Cash App are free if you use your debit card, but they charge a 3% fee when you use a credit card. PayPal charges 2.9% plus 30 cents to send money to friends and family with a credit card.

Does Zelle charge a fee for credit card

Zelle® doesn't charge a fee to send or receive money. We recommend confirming with your bank or credit union that there are no fees for Zelle® transactions.

Can I pay someone money from my credit card

It's possible, however, to transfer money straight from your credit card to your or someone else's bank account, although there are a number of things you should be aware of so you don't end up paying too much for your transfer in extra fees.

Can we transfer money from credit card to someone

Can you send someone money with a credit card Yes, sending money to someone using a credit card is possible. Although, the options available to do so may vary depending on the service provider.

What is Chase Zelle limit

From Chase business checking accounts, you can send up to $5,000 in a single transaction, up to $5,000 a day and $40,000 in a calendar month. Keep in mind: Each financial institution that offers Zelle sets its own limits on the amounts their customers may send to others.

What is the highest amount I can send on Zelle

Does Zelle® limit how much I can send or request You can send up to $2,500 per day with Zelle®. There are no limits on how much you can request with Zelle®, but keep in mind that people sending you money may have limits set by their own financial institutions.

Can you Chase QuickPay with a credit card

You'll need to have a Chase checking account or Chase Liquid card to send money using Chase QuickPay with Zelle. You can access the service through the Chase mobile app, Chase.com, and in the Chase Pay app.

How much is Zelle limit Chase

There is no limit to how much money you can receive on your Chase account through Zelle, but limits on how much you can send depend on your type of account. Personal Chase checking account: You can send up to $2,000 per single transaction, up to $2,000 per day and up to $16,000 per month.

How do you pay someone with a credit card

3 ways to pay a friend with a credit cardCash App. Cash App is free to download and accepts credit and debit cards.Venmo. Venmo requires you to sign up for an account through Facebook or your email.PayPal. PayPal is one of the oldest services for electronically sending and requesting money.Apple Pay.Google Pay.Zelle.

Can I transfer funds through credit card

Direct transfer from credit card to a bank account

You can use an online banking app or a smartphone to directly transfer the funds from your credit card to your bank account. However, you should remember that the daily transfer limit of funds can often vary from one bank to another.