Can judgments be removed from credit report?

Can you pay to delete a Judgement

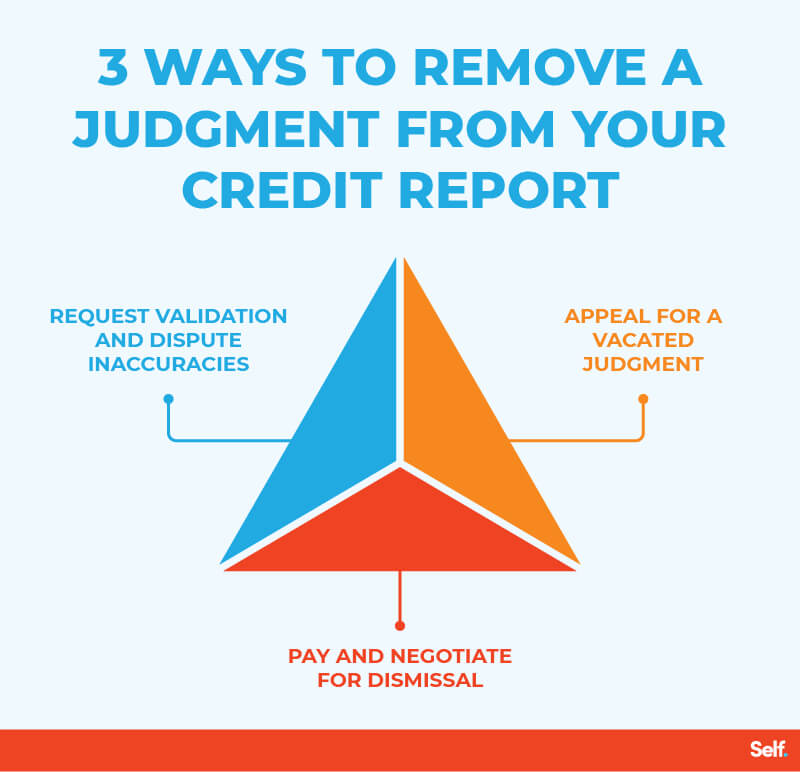

Removing A Judgment from Your Record

There are only three ways in which a judgment can be made to go away: paying the debt, vacating the judgment or discharging the debt through bankruptcy.

Cached

Can credit repair companies remove Judgements

Credit Repair May Remove Incorrectly Reported Judgments

Vacated judgments may also sometimes be mistakenly included on your credit reports. In either of these cases, you can dispute the judgment with the credit bureaus to have it removed from your reports.

Cached

How bad is a Judgement on your credit report

Judgments Don't Affect Your Credit Score, But Can Impact Your Application. Since judgments are not included in credit reports, they won't be factored into credit score calculations.

Cached

How long before a Judgement is removed from credit report

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

Cached

How do I clear my Judgement

Contact the creditor who took the judgment and try to resolve the dispute, either by way of a payment arrangement or by settling the claim in full. Once the debt is paid, a so-called paid-up letter will be provided by the creditor confirming that the specific account in question has been settled.

How do I remove a credit Judgement

If you want to remove the court judgement from your credit report, you will need to take the following five steps.Write to the Credit Provider.Write to the Credit Bureau.Get a Signed Consent Order.Apply to the Court Seeking to Set Aside the Judgement.What if I Dispute the Debt

Will a Judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

Who can remove a judgement from my credit report

Generally, you should contact the three credit agencies – Equifax, Experian, and TransUnion – either by certified mail or by phone, to dispute the judgment. Credit agencies are required by law to investigate any disputes within a thirty day time period.

Will a judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

Does a judgement against you ever go away

A judgment stays on your credit report for seven years, although in some cases — such as bankruptcy — the judgment can stay for as long as 10 years, and it does not matter what type of loan the judgment relates to: a car loan, a student loan, unpaid credit card debt, a personal loan, a cosigned loan, etc.

How do you get around a judgement

How To Resolve A Judgment Against Youpay the balance due in full;work with the creditor to settle the debt or work out an agreeable payment plan;allow the creditor to seize your assets in payment of the debt;repay the debt involuntarily through a wage garnishee;

How do you satisfy a Judgement on your credit report

Pay directly to the creditor

Mail or deliver a check or money order to the Judgment Creditor. Make sure to keep proof of payment, such as your canceled check. Once the Judgment Creditor receives your payment, ask them to file the form Acknowledgment of Satisfaction of Judgment with the court within 14 days.

What is judgment Removal

Judgment removal is the process of removing a judgment from the county land records where you have your house.

Does FHA require judgments to be paid off

FHA does not require that collection accounts be paid off as a condition of mortgage approval. However, court-ordered judgments must be paid off before the mortgage loan is eligible for FHA insurance endorsement.

Can you get a FHA mortgage with a Judgement

The answer is YES. You can qualify for an FHA loan with an outstanding judgment if you settle the judgment with the judgment creditor for a lower amount than the face value or enter into a written payment agreement with the judgment creditor for a fixed monthly payment.

How do you not let judgment get to you

Take these six steps to let go of self-doubt and avoid being paralyzed by the fear of being judged:Don't invite judgment.Stop judging yourself.Don't assume people are judgmental a-holes.Stop chasing people's approval.Be happy.Get a power posse.

What happens after 5 years of judgement

Judgments are valid until satisfied or discharged; however, when a period of five years lapses, the judgment holder must file a motion with the court and prove sufficient cause for failure to obtain a writ of execution.

Does a Judgement against you ever go away

A judgment stays on your credit report for seven years, although in some cases — such as bankruptcy — the judgment can stay for as long as 10 years, and it does not matter what type of loan the judgment relates to: a car loan, a student loan, unpaid credit card debt, a personal loan, a cosigned loan, etc.

How do I remove a credit judgement

If you want to remove the court judgement from your credit report, you will need to take the following five steps.Write to the Credit Provider.Write to the Credit Bureau.Get a Signed Consent Order.Apply to the Court Seeking to Set Aside the Judgement.What if I Dispute the Debt

How does a judgement affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.