Can LLC borrow money from the person?

Can I put personal money into my LLC

One of the most common ways to fund your LLC is with personal funds. This can include your savings, retirement accounts, and personal loans. While this option may not be ideal for everyone, it's a good way to get started if you don't have a lot of capital.

Cached

Can I personally loan money to my business

Many small businesses need help with financing, particularly when they're starting out, and entrepreneurs and small business owners often use their own money to found a business or help keep their businesses afloat. Under most state laws, it is legal to lend money to your own LLC.

Cached

Can my business loan money to a friend

Yes, it is. It is legal to lend money, and when you do, the debt becomes the borrower's legal obligation to repay. For smaller loans, you can take legal action against your borrower if they do not pay by taking them to small claims court. This may seem harsh, but it's important to understand up front.

Cached

Is a loan to an LLC treated as income to the business

Is a business loan considered income Most of the time, no, they're not. Loans aren't earnings, so it's usually not necessary to claim the loans you receive on your taxes. There is an exception to this rule, which is when the lender forgives your loan.

What is it called when you put money into your own business

When the corporation forms, the owner or owners will have to put money and assets into the business in order for the business to start to operate. This is called investment.

How do I give equity to an LLC

There are four common methods of granting equity or equity incentives in an LLC: (1) outright membership interest or membership unit grants, (2) LLC incentive units (aka “profit interests”), (3) a phantom or parallel unit plan (aka. synthetic equity), and (4) options to acquire LLC capital interests.

How do I record owner loan to business

To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.

Do business loans run on personal credit

Are you applying for a business loan Commercial lenders may look at both your business and personal credit scores before they approve your application. If you have poor personal credit and you're wondering if it will affect your approval or the terms of your commercial loan, the answer is yes, it can.

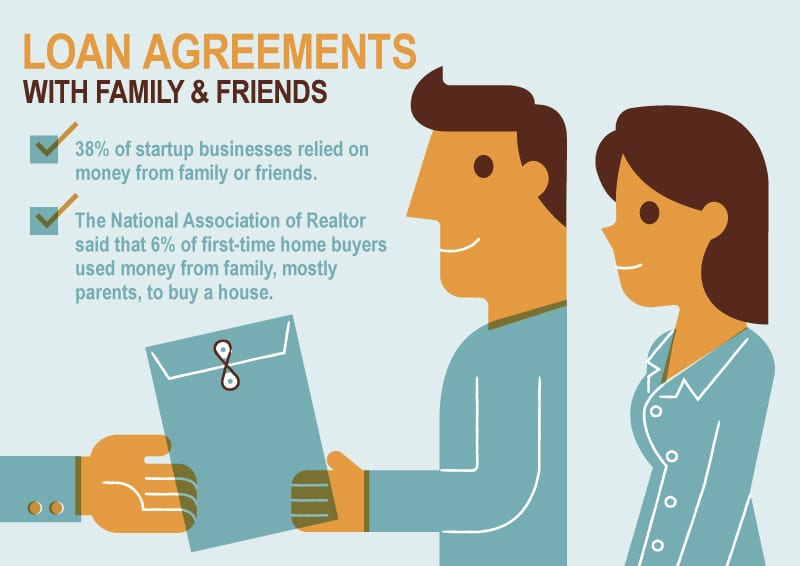

What is the legal document when lending money to a friend

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

Do I have to pay taxes on a loan from a friend

On the borrower's side, there are typically no tax implications. The borrower doesn't typically need to report the loan and won't pay any income tax on it. In some cases, the borrower may get a tax perk from borrowing money from family. This is only the case if the borrowed money is used to purchase a home.

Does money from the LLC count as income

If you earn a profit from your LLC, that money is added to any other income that you've earned. This includes interest income or your spouse's income if you're married and filing jointly. The total amount earned is then taxed.

How much cash can I deposit into my business account

$10,000

Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

What is it called when you withdraw money from a business account for personal use

An owner's draw, also called a draw, is when a business owner takes funds out of their business for personal use. Business owners might use a draw for compensation versus paying themselves a salary. Owner's draws are usually taken from your owner's equity account.

How do I pay myself from my LLC profits

To get paid, LLC members take a draw from their capital account. Payment is usually made by a business check. They can also receive non-salary payments or “guaranteed payments” — basically a payment that is made regardless of whether the LLC has generated any net income that month or quarter.

Can a single member LLC give equity

Whatever may be your rationale, you want to know if it is something you can do with your Limited Liability Company; and the answer is yes. Therefore, you can give away your LLC's equity.

Will loans from owners be classified as liabilities

Your shareholder loan balance will appear on your balance sheet as either an asset or a liability. It is considered to be a liability (payable) of the business when the company owes the shareholder.

How do you record business expenses paid by owner personal cash

Account you'll see why in a bit choose a category that reflects what the owner spent the money on then describe what the owner paid for and enter the amount of money spent. If the owner made multiple

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

What credit score is needed for business loan

640 to 700: Business loan providers generally consider a credit score that falls somewhere between 640 and 700 to be good but not excellent. Generally, the minimum credit score for SBA and term loans is around 680.

How do I write a legal contract for lending money

What should be in a personal loan contractNames and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.