Can medical bills go on your credit report 2023?

Are medical bills coming off credit reports

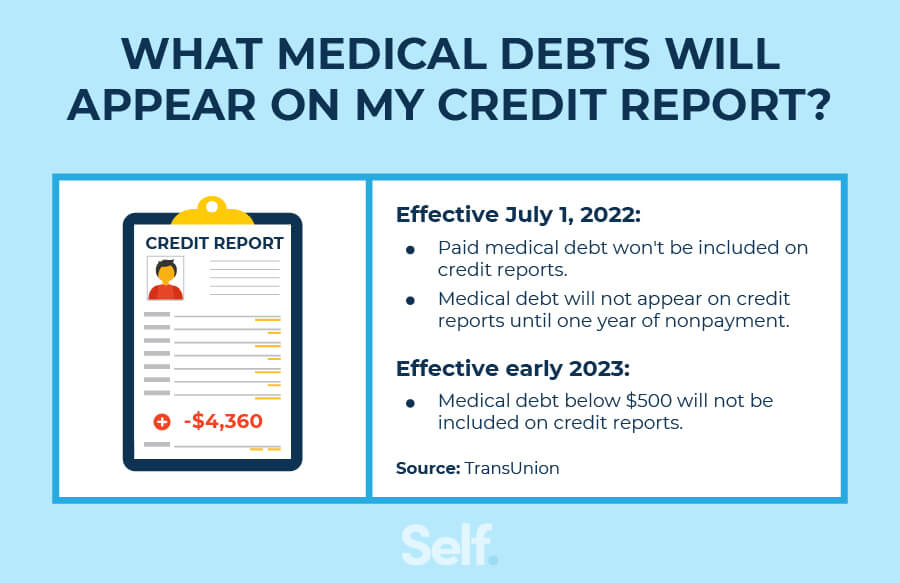

On Tuesday, the three major credit bureaus — Equifax, Experian, and TransUnion — announced that medical collections with balances of $500 or less would no longer appear on consumer credit reports.

Cached

What is the medical debt Relief Act 2023

Starting March 30, 2023, these agencies have also agreed to stop reporting medical debts under a certain dollar threshold (at least $500) on credit reports, even if the alleged medical debt is unpaid and in collection.

Cached

When did medical bills stop affecting credit

While certain unpaid medical debt in collections can negatively impact your credit score, starting March 31, 2023, the credit reporting agencies will no longer include medical collections under $500 on your credit report—so those accounts won't hurt your credit.

Cached

Can medical bills be removed from credit report due to Hipaa

Answer: No. The Privacy Rule's definition of “payment” includes disclosures to consumer reporting agencies. These disclosures, however, are limited to the following protected health information about the individual: name and address; date of birth; social security number; payment history; and account number.

Is medical debt being wiped off credit

Paid medical debts were removed from credit reports in July 2023. Previously, medical bills that went to collections could blemish credit reports even after the debt was paid off.

Will medical debt be forgiven

It's unlikely you'll get your medical debt forgiven, but there are ways to get some financial relief for those who qualify. Consider hospital forgiveness programs, assistance from specialized organizations and government assistance programs.

What happens if you don’t pay medical debt USA

Unpaid medical bills can lead to calls from debt collectors, dings to your credit report, and potentially bankruptcy. If you can't pay your medical debt, you can ask for a payment plan that's affordable for you, find financial assistance programs, or consolidate the debt.

Is medical bills going to collections a violation of HIPAA

HIPAA may protect you when it comes to unpaid medical bills. The HIPAA law protects patient privacy, including third-party debt collectors accessing your information.

Are medical collections against HIPAA

What personal information can healthcare providers legally disclose under HIPAA and the HITECH Act Under both HIPAA and the HITECH Act, health care providers are prohibited from disclosing a U.S. citizen's medical records or PHI when working with medical debt collectors.

What is a 609 dispute letter

A 609 dispute letter is a request to the credit bureaus (TransUnion, Equifax, and Experian) to remove harmful, inaccurate, and not verifiable data from your credit report.

Will I get rid of collections if I pay it

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

Does FHA require medical collections to be paid off

The FHA does not require collections to be paid off entirely in order for a borrower to be approved. However, they do recognize that collections can impact a borrower's ability to repay their loan, which is something they take into consideration.

Is medical debt being erased

Consumer Credit and the Removal of Medical Collections from Credit Reports. The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.

What does the Fair Credit Reporting Act say about medical bills

Starting in 2023, medical collections tradelines less than $500 will no longer be reported on consumer credit reports. Medical bills under $500 are significantly more likely to remain on a credit report for longer than medical bills over $500.

What medical information is not allowed on a credit report

(iii) The creditor does not take the consumer's physical, mental, or behavioral health, condition or history, type of treatment, or prognosis into account as part of any such determination.

How do I remove medical collections from my credit report

How do I remove medical debt from my credit reportDispute an error.Pay off your medical debt.Bring your medical debt below $500.Ask your health insurance company to pay the debt.Ask for a goodwill deletion.Settle your medical debt with pay for delete.Hire a credit repair company.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

Does 609 letter really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Should I pay collections or let it fall off

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.