Can my friend transfer money to my credit card?

Can a friend make a payment to my credit card

So, the answer to this question is, Yes. A family member, or a friend, on the behalf of an individual can pay his credit card bill.

Can you put money onto a credit card

Can I put extra money on my credit card Yes, you can, and usually, this will show up as a “CR” next to the balance on your credit card statement.

Can I transfer money from someone else’s credit card to mine

Only you (the person taking on the balance) can request the transfer. The provider will not allow the other person to make the transfer. Taking on someone else's credit card debt is a risk.

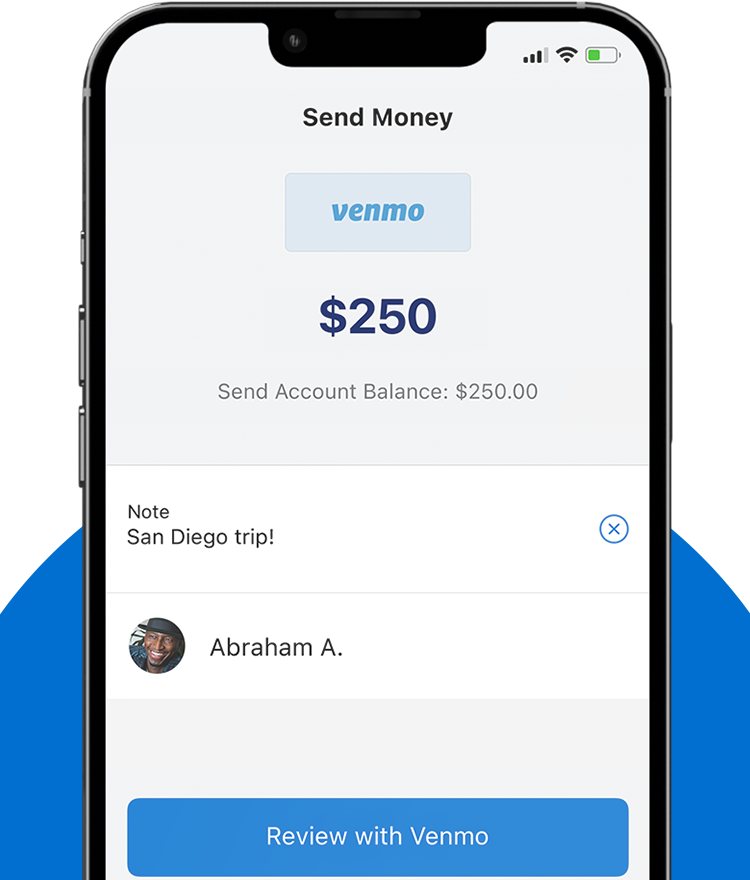

Can you pay someone on Venmo with a credit card

Venmo allows you to make payments using a variety of methods including: Venmo balance, bank account, debit card, and credit card.

How do I deposit money into my credit card

You can visit the nearest bank branch to deposit cash to your credit card account. There are banks such as ICICI that offer cash pick-up services for credit cardholders.

How much money can you put on a credit card

In general, credit limits tend to run around $2,000 to $10,000 per card — although many credit cards for people with bad credit offer lower credit limits in exchange for the opportunity to rebuild your credit score.

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Can you balance transfer to a debit card

Transferring money between a credit card and a debit card is very similar to transferring to a bank account. To transfer funds to a debit card, all you need is the name on the card, card number and expiry date.

Can you use Zelle with a credit card

To enroll with the Zelle® app, enter your basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account. We do not accept debit cards associated with international deposit accounts or any credit cards.

How do I pay someone else’s credit card

How to Pay Someone Else's Credit Card BillPay Online. To pay online, the person paying starts by logging in to their own financial institution.Pay by Phone. Anyone can call the number on the back of your credit card.3. Mail a Payment.Visit a Branch of the Issuing Bank.

How do I deposit money into my credit card online

NEFTLog in to your online banking account.Click on 'Funds Transfer' option.Look out for 'Transfer to other bank' and click on it.Select your credit card account and beneficiary.Enter the required details and accept the 'Terms and Conditions'Re-check all the details and click on 'Confirm' to make the payment.

How do I add money to my Capital One credit card

Just sign into your capital one mobile. App choose the checking account you want to add cash to and tap add cash. Now enter a dollar amount and you'll receive a unique barcode that's available for 30

How much of $1 500 credit card limit should I use

You should aim to use no more than 30% of your credit limit at any given time. Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score.

Is $1,000 on a credit card bad

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

What is the downside of a balance transfer

A balance transfer generally isn't worth the cost or hassle if you can pay off your balance in three months or less. That's because balance transfers typically take at least one billing cycle to go through, and most credit cards charge balance transfer fees of 3% to 5% for moving debt.

Does a balance transfer count as a payment

A balance transfer does count as a payment to the original creditor to which you owed the balance. The issuer of the balance transfer card will submit payment to the old creditor for the amount of the transfer.

How do I transfer a balance to a card

Let's take a look at how the balance transfer process works in four easy steps.Apply for a balance transfer card. You can apply for a balance transfer card online in a matter of minutes.Transfer the balance to the new credit card.Wait for the transfer to go through.Pay off your balance.

How to transfer money into Capital One credit card

Transfer fundsSign in to your account online or with the Capital One Mobile app.Select an account and choose “Transfer” at the top of your account page.Choose the “To” and “From” accounts, pick the date and enter the amount you'd like to transfer.Click or slide the “Transfer” button to confirm.

Can you send money through cash app with a credit card

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported. ATM cards, Paypal, and business debit cards are not supported at this time.

Why can t Zelle use credit card

Why First, make sure that you are enrolling a Visa® or Mastercard® debit card tied to a bank account in the U.S. You will not be able to enroll business debit cards, credit cards, cards linked to international accounts, gift cards or pre-paid cards from financial institutions outside of the Zelle Network®.