Can one parent claim child tax credit and the other EITC?

Can one parent claim dependent and the other parent claim EIC

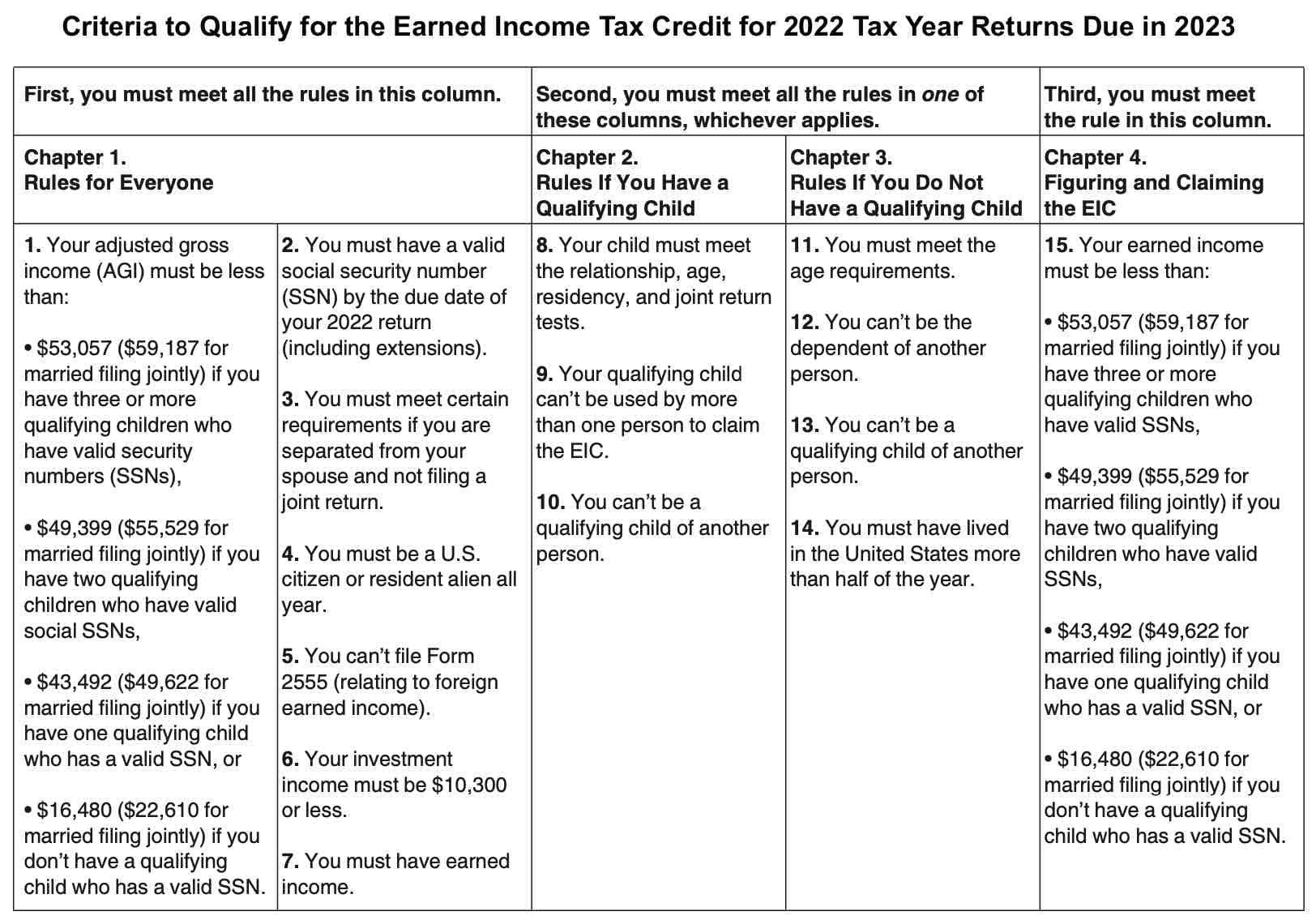

Answer: If they otherwise meet all of the requirements to claim the earned income tax credit (EITC), unmarried parents with a qualifying child may choose which parent will claim the qualifying child for the EITC. If there are two qualifying children, each parent may claim the credit based on one child.

Cached

Do I qualify for EITC and child tax credit

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Which parent gets earned income credit

Only the custodial parent, with whom the child lived with more than half the year, can claim Earned Income Credit, Child and Dependent Care Credit and the Head of Household filing status.

Cached

Can you get earned income credit if someone else claims you

Your qualifying child cannot be used by more than one person to claim the EIC. However, you can claim the EIC even if another person can claim the child as a dependent. You cannot be a qualifying child of another person.

Cached

Should the child tax credit be split between parents

To claim the child tax credit, a parent must have a qualifying dependent child younger than 17 at the end of 2023. However, only one divorced parent is allowed to claim a child as a dependent on their tax return. Parents cannot split or share the tax benefits from a child on their taxes.

What happens if both parents claim child tax credit

When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

How much income do you need for one child with EITC

$43,492

Tax Year 2023 (Current Tax Year)

| Children or Relatives Claimed | Filing as Single, Head of Household, or Widowed | Filing as Married Filing Jointly |

|---|---|---|

| Zero | $16,480 | $22,610 |

| One | $43,492 | $49,622 |

| Two | $49,399 | $55,529 |

| Three | $53,057 | $59,187 |

Mar 8, 2023

Is there a difference between EIC and EITC

The Earned Income Credit (EIC), otherwise known as Earned Income Tax Credit (EITC) is a valuable credit for low-income taxpayers who work and earn an income of a certain amount. This credit is highly valuable and is often missed — allowing you to keep more of your hard-earned money.

Are EIC and EITC the same thing

The Earned Income Credit (EIC), otherwise known as Earned Income Tax Credit (EITC) is a valuable credit for low-income taxpayers who work and earn an income of a certain amount.

How much is the EITC for 2023

Tax Year 2023

| Children or Relatives Claimed | Filing as Single, Head of Household, or Widowed | Filing as Married Filing Jointly |

|---|---|---|

| Zero | $17,640 | $24,210 |

| One | $46,560 | $53,120 |

| Two | $52,918 | $59,478 |

| Three | $56,838 | $63,698 |

Mar 8, 2023

Can a single person with no dependents claim earned income credit

You can claim the credit whether you're single or married, or have children or not. The main requirement is that you must earn money from a job. The credit can get rid of any federal tax you owe at tax time. If the EITC amount is more than what you owe in taxes, you get the money back in your tax refund .

How do parents split Child Tax Credit

If parents are divorced and do not live together, the custodial parent may sign a release which allows the noncustodial parent to claim the child as a dependent and claim the child tax credit/credit for other dependents for the child, and dependency exemption, if the requirements are met.

What happens if both parents claim Child Tax Credit

When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

Which parent has the right to claim child on taxes

the custodial parent

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.

How does the IRS know who the custodial parent is

Determine Who the Custodial Parent Is

Before a parent can claim a child as a tax dependent, the IRS requires you to determine which parent is the custodial parent. According to the IRS, the custodial parent is the parent who the child lived with for a longer period of time during the tax year.

What is the maximum EITC for a single person

Earned income tax credit 2023

| Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers |

|---|---|---|

| 0 | $560 | $16,480 |

| 1 | $3,733 | $43,492 |

| 2 | $6,164 | $49,399 |

| 3 or more | $6,935 | $53,057 |

Mar 15, 2023

What is the max income for EITC

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2023 as a working family or individual earning up to $30,000 per year.

What is the EITC and child tax credit for 2023

Find the maximum AGI, investment income and credit amounts for tax year 2023. The maximum amount of credit: No qualifying children: $600. 1 qualifying child: $3,995.

What is the disadvantage of EITC

Weaknesses of the EITC. Despite its strengths, the EITC has several flaws: it is complicated, has a high error rate, discourages work past a certain income threshold, imposes a marriage penalty, and creates disparity between workers with and without children.

How does the Earned Income Tax Credit EITC work

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low and moderate incomes. It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes.