Can owing the IRS stop you from buying a house?

Can you get an FHA loan if you owe the IRS

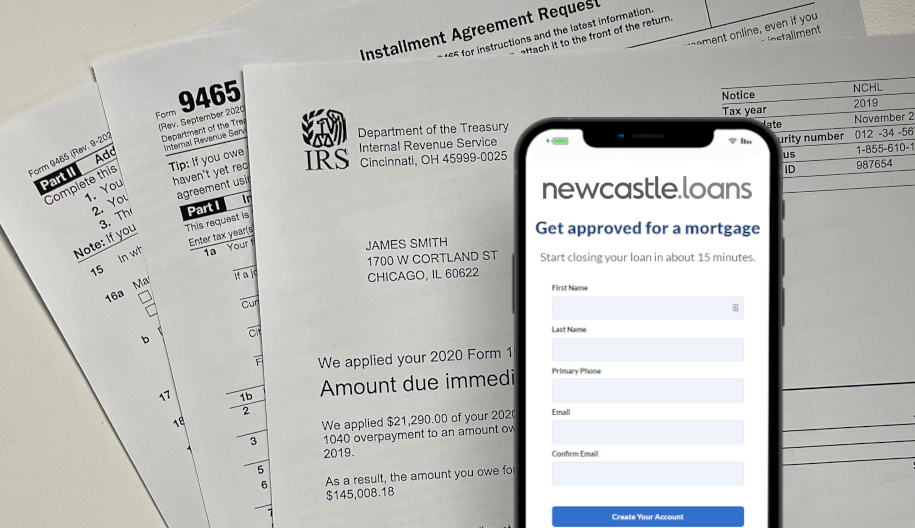

FHA loans allow borrowers to qualify for outstanding tax debts to the IRS as well as borrowers with oustanding tax liens. However, whether you owe the IRS or the IRS has already placed a federal IRS tax lien, you will need a written payment agreement with a three month history of paying the IRS debts on time.

Do mortgage companies check with the IRS

Mortgage companies do verify your tax returns to prevent fraudulent loan applications from sneaking through. Lenders request transcripts directly from the IRS, allowing no possibility for alteration. Transcripts are just one areas lenders need documentation for all income, assets and debts.

Can I buy a house if I owe back taxes and haven t filed in the past

You can still buy a house even if you owe taxes to the government. Tax debt makes the process of applying for a loan more complicated, especially if your debt has transitioned into a tax lien.

Cached

What happens if you owe the IRS money and don’t pay

The failure-to-pay penalty is equal to one half of one percent per month or part of a month, up to a maximum of 25 percent, of the amount still owed. The penalty rate is cut in half — to one quarter of one percent — while a payment plan is in effect. Interest and penalties add to the total amount you owe.

Will an underwriter see if I owe the IRS

Yes, mortgage companies and underwriters verify your tax returns with the IRS. The lenders will request the tax transcript directly from the IRS to ensure that your application is not fraudulent.

What will disqualify you from an FHA loan

The three primary factors that can disqualify you from getting an FHA loan are a high debt-to-income ratio, poor credit, or lack of funds to cover the required down payment, monthly mortgage payments or closing costs.

How far back do underwriters look at tax returns

To help calculate your income, mortgage lenders typically need: 1 to 2 years of personal tax returns. 1 to 2 years of business tax returns (if you own more than 25% of a business)

Is the IRS notified when you buy a house

“For the purchaser, the only thing that reports to the IRS is the deduction of property taxes paid through escrow,” says Watson. “Since the property is bought for cash, there is no debt, therefore no mortgage interest.”

What are my options if I owe the IRS money

You may request a payment plan (including an installment agreement) using the OPA application. Even if the IRS hasn't yet issued you a bill, you may establish a pre-assessed agreement by entering the balance you'll owe from your tax return. OPA is quick and has a lower user fee compared to other application methods.

How long can you owe the IRS

10 years

Internal Revenue Code section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. The collection statute expiration ends the government's right to pursue collection of a liability.

Do underwriters contact IRS

Yes, mortgage companies and underwriters verify your tax returns with the IRS. The lenders will request the tax transcript directly from the IRS to ensure that your application is not fraudulent.

How often do FHA loans get denied

How often are FHA loans denied in underwriting According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), FHA borrowers are more likely to be denied for FHA loans than all other loan types: 14.1% of FHA purchase loans and 22.2% of FHA refinance applications were turned down in 2023.

Can your loan be denied at closing

Can A Loan Be Denied After Final Approval Although rarely, a mortgage loan can be denied after the borrower has signed the closing documents. In addition, borrowers have a 3-day right of rescission, during this period of time, they can withdraw from the loan.

What do the underwriters check for final approval

Participation in the Verified Approval program is based on an underwriter's comprehensive analysis of your credit, income, employment status, debt, property, insurance and appraisal as well as a satisfactory title report/search.

How does IRS find out about house sale

Typically, when a taxpayer sells a house (or any other piece of real property), the title company handling the closing generates a Form 1099 setting forth the sales price received for the house. The 1099 is transmitted to the IRS.

What are 3 options that are available for you to pay the IRS if you owe them taxes at the end of the year

Payment options

The IRS may be able to provide some relief such as a short-term extension to pay (paid in 120 days or less), an installment agreement, an offer in compromise, or by temporarily delaying collection by reporting your account as currently not collectible until you are able to pay.

What happens if you owe the IRS more than $50 000

Owing over $50,000 in tax debt can result in IRS tax liens and levies. Your tax debt can make it hard to meet your other expenses, and you may be worried about all the IRS notices you've been receiving.

What happens when you owe IRS a lot of money

The IRS may levy (seize) assets such as wages, bank accounts, Social Security benefits, and retirement income. The IRS also may seize your property (including your car, boat, or real estate) and sell the property to satisfy the tax debt.

Is IRS debt forgiven after 10 years

Yes, after 10 years, the IRS forgives tax debt.

After this time period, the tax debt is considered "uncollectible". However, it is important to note that there are certain circumstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.

Do underwriters always check with the IRS

Yes, mortgage companies and underwriters verify your tax returns with the IRS. The lenders will request the tax transcript directly from the IRS to ensure that your application is not fraudulent.