Can paying Netflix build credit?

Can my credit build from subscription

Subscription services can help you build your credit if your payment activity is reported to the credit bureaus. You can ensure this happens by using your credit card to pay your bills or signing up for a service that reports your payment activity to the credit bureaus.

What bills can increase my credit score

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

Cached

Should I put Netflix on my credit card

Use a credit card for any recurring payments.

Any recurring payments you have such as subscription services that renew every month or year like Netflix, Amazon Prime, or Spotify are good to put on your credit card, especially an older one that you no longer use as much.

Cached

Does paying bills increase credit score

Of course, paying your bills on time will help your credit, insofar as the absence of "negative" items does not ding your score. If you want to improve a credit score, simply paying gas, electric, or water bills on time will not help much in many cases.

Which payments build credit

If you're having difficulty getting approved for a credit card or you're looking for alternative methods, consider these ways to build credit:Make your rent and utility payments count.Take out a personal loan.Take out a car loan.Get a credit builder loan.Make payments on student loans.

How to build credit 100 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What is the quickest way to raise your credit score

4 tips to boost your credit score fastPay down your revolving credit balances. If you have the funds to pay more than your minimum payment each month, you should do so.Increase your credit limit.Check your credit report for errors.Ask to have negative entries that are paid off removed from your credit report.

How can I build my credit by paying bills

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

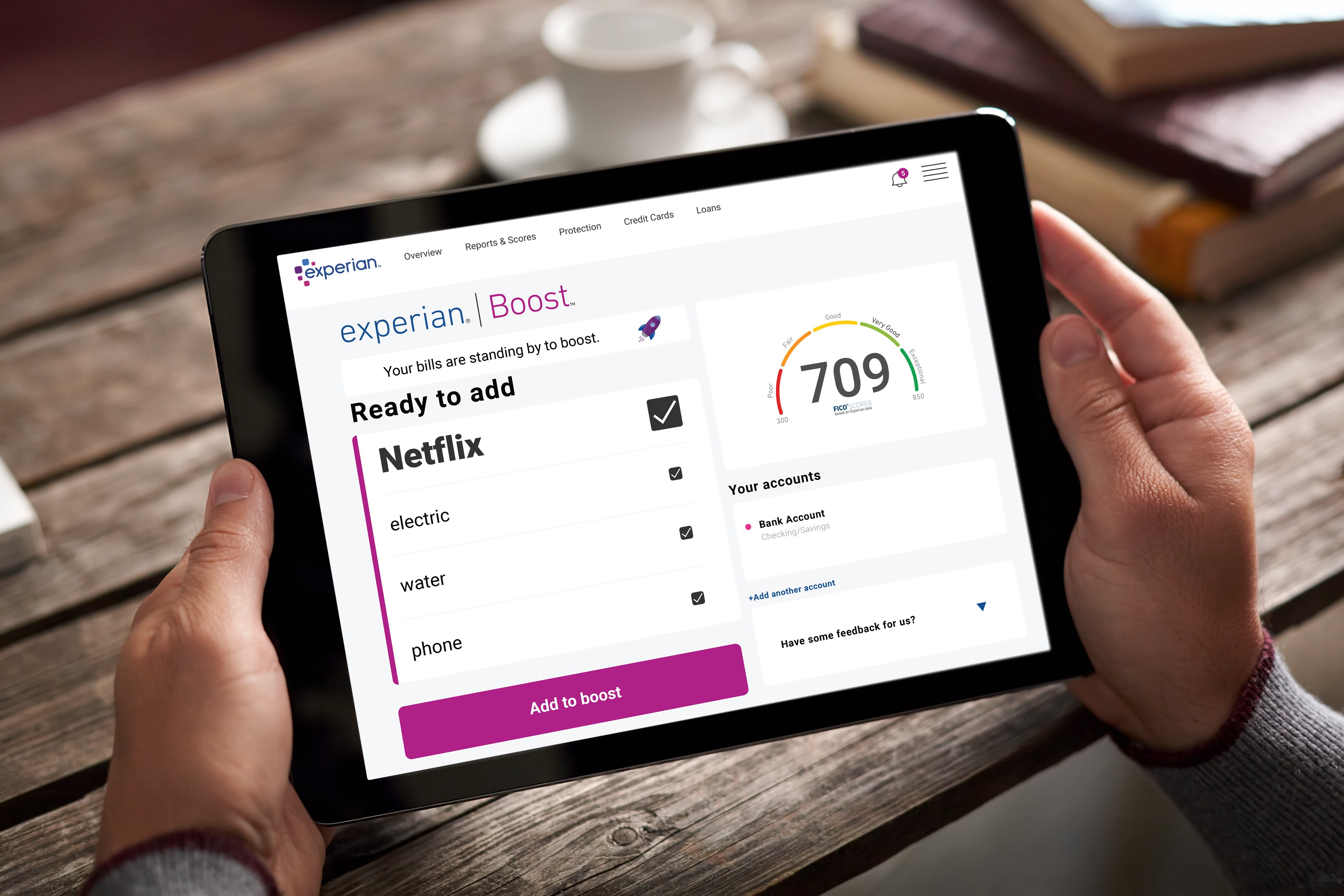

Can Hulu boost your credit score

You sure can! Video streaming services like Netflix®, Disney+™, HBO™ and Hulu™ are all eligible for Boost. Just make sure the accounts are in your name and the bills have 3 payments in the last 6 months (including 1 payment within the last 3 months).

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.

What is the fastest way to raise a credit score

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get a 700 credit score in 2 months

Here's what you need to do.Make every payment on time.Keep your credit utilization low.Don't close old accounts.Pay off credit card balances.Ask your card issuer to increase your limit.Use the authorized user strategy.Put your bill payments to work.Use a rent reporting company.

How to get a credit score of 700 fast

Take the following steps to aim for a credit score of 700 or above.Lower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get 300 credit score fast

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How to get 850 credit score fast

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.