Can removed collections come back?

What happens when a collection is removed

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

Cached

Do removed collections affect credit score

Will deleting collections improve credit score In most cases, deleting a collections account from your credit report can improve your credit score. In other cases, it may have little-to-no effect on your credit score.

Cached

Can a collection agency reopen a closed account

If your creditor closed it, you can ask if it'll reopen the account, but it's not required to. Either way, you know it wasn't a credit bureau error. File a dispute. If the lender didn't close the account or you don't agree with what it's reporting, you can file a dispute with the credit bureaus.

Do I still have to pay removed collections

If the collection was legitimate, it is unlikely that you will be able to remove it from your credit reports. In this case, you should still pay your collection. This shows future lenders that you take your debts seriously. Then you simply have to wait for the account to be removed from your credit report in due time.

Cached

Is it better to pay off a collection or have it removed

It's better to pay off a debt in full (if you can) than settle. Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

Is it better to have a collection removed or paid in full

A collection account paid in full reflects better on your credit report. Plus, newer versions of the FICO and VantageScore credit scoring models only ding your credit for unpaid collections accounts.

How much will a deleted collection raise my credit score

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

Why didn t my credit score go up after collections were removed

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score.

What happens when something is removed from your credit report

It is true, though, that when an account is removed from your credit reports, all the information associated with that account also disappears. If the account in question was one of your oldest, one possible effect of the removal is a shortened length of credit history and potentially lower score.

Can a debt go to collections twice

For example, if a collector is unable to make satisfactory arrangements with a consumer after a few months, the individual debt may be bundled with many others and sold to another collection agency. That process can be repeated many times over, even beyond the applicable statute of limitations for the consumer's debt.

How many points will my credit score increase if a collection is deleted

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

How much does removing a collection raise your credit score

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

How much will my credit go up if I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

How long does it take for credit score to go up after collection removed

seven years

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

How much will my credit score go up if I get a collection is deleted

Generally, the boost to scores can range from 50 to 100 points or more. However, this does not happen overnight and may take a few months to reflect. To further improve scores over time, it is important to keep up with smart credit habits such as making payments on time and having a low credit utilization ratio.

Can a debt collector pursue you after a debt has been removed from credit report

Yes, creditors can continue to attempt to collect a debt you owe after it has been removed from your credit report, and it can still continue to accrue interest and fees.

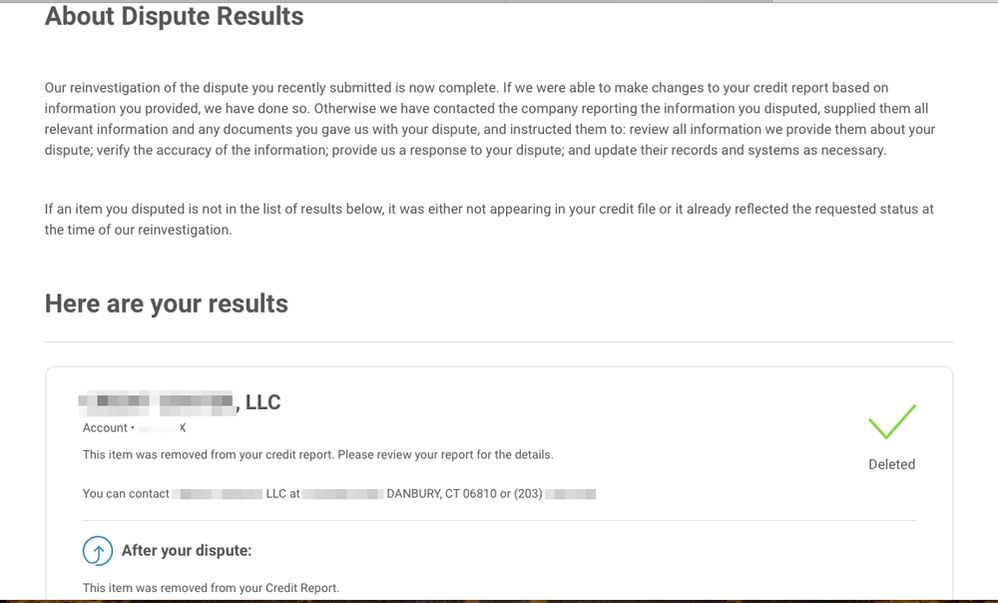

Why was an unpaid collection removed from my credit report

This could happen as a result of a dispute you filed directly with the credit bureau, or because your lender contacted the bureau to correct inaccurate prior reporting.

What is the new debt collection rule

The Debt Collection Rule limits the contact a debt collector can make with consumers. Examples of such limitations include: No calls before 8 a.m. or after 9 p.m. in the consumer's time zone. No subsequent contact with the consumer for seven days following a conversation with them. No more than seven phone calls per …

Should I pay collections after 2 years

With most collection accounts, if you pay them in full, their impact on your credit doesn't go away immediately. You'll usually have to wait until they reach the end of their seven-year reporting window. The good news is that the older the information is, the less impact it should have on your credit.