Can sales tax be deducted?

Is sales tax a deductible expense

On your tax return, you can deduct the state and local general sales tax you paid during the year, or you can deduct the state and local income tax you paid during the year. You can't do both. Here's how the sales tax deduction works and how you can determine the best route for you.

Cached

How do I deduct sales tax from total

How the Sales Tax Decalculator WorksStep 1: take the total price and divide it by one plus the tax rate.Step 2: multiply the result from step one by the tax rate to get the dollars of tax.Step 3: subtract the dollars of tax from step 2 from the total price.Pre-Tax Price = TP – [(TP / (1 + r) x r]TP = Total Price.

Can I claim sales tax in Texas

Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying.

Does sales tax count as income

Collected sales tax is not part of your small business revenue. When you collect sales tax from customers, you have a sales tax liability. You must remit your sales tax liability to the government. As a result, collected sales tax falls under the liability category.

Cached

Is sales tax capitalized or expensed

Other expenses associated with constructing a fixed asset can also be capitalized. These include materials, sales taxes, labor, transportation, and interest incurred to finance the construction of the asset.

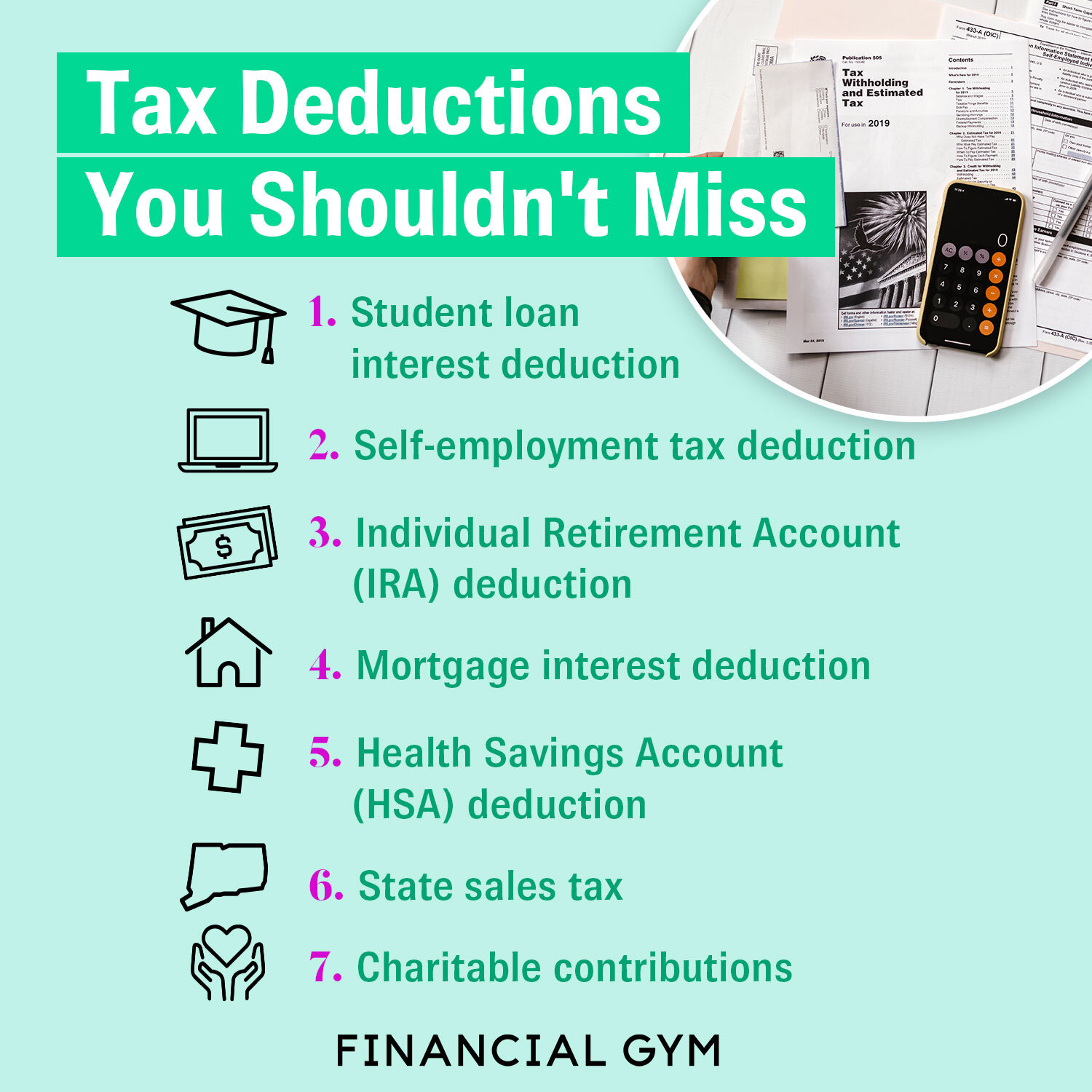

Which items are tax deductible

Which Deductions Can Be ItemizedUnreimbursed Medical and Dental Expenses.Long-Term Care Premiums.Home Mortgage and Home-Equity Loan (or Line of Credit) Interest.Home-Equity Loan or Line of Credit Interest.Taxes Paid.Charitable Donations.Casualty and Theft Losses.

Is sales tax a business expense

You can deduct sales tax on items you purchased as a deductible business expense. If you have any doubts about the validity of a tax-based deduction, speak with a tax professional.

Do you subtract sales tax from gross sales

Gross sales is your total sales before numerous categories of expenses are deducted, such as returned items, taxes, license and business fees, rent, utility bills, payroll, the cost of retail items purchased to be resold, or any other costs that a business can expect to incur.

Can I claim US sales tax back

The US Government does not refund Sales Tax to Visitors

US Customs and Border Protection has clarified on the CBP website that says, “The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government …”.

What qualifies for sales tax exemption in Texas

An individual can give Form 01-339, Texas Sales and Use Tax Exemption Certification (PDF), to the seller instead of paying sales tax when buying items to be directly donated to the following exempt organizations: religious, charitable, educational, nonprofits exempt under IRC Sections 501(c)(3), (4), (8), (10) or (19), …

Is sales tax deductible for small business

In general, businesses can deduct various federal, state, local, and foreign taxes related to your business. You cannot deduct federal income taxes. The IRS allows you to deduct certain payroll taxes. You can deduct sales tax on items you purchased as a deductible business expense.

Should I deduct income taxes or sales taxes

You can't deduct both: You must choose between income tax and sales tax. As a general rule, you should deduct whichever is more. However, because of the annual cap, in some cases it won't make any difference which tax you choose to deduct.

Why is sales tax not an expense

The sales taxes collected by a merchant are not part of the merchant's sales and are not part of the merchant's expenses. Instead, the merchant is merely an agent of the state and will record the sales taxes collected as a current liability.

Where does sales tax go on a profit and loss statement

Sales tax and use tax are usually listed on the balance sheet as current liabilities.

What items are not deductible

What expenses are nondeductibleCapital expenses. Capital expenses are expenses related to launching your business.Travel expenses. Everyday travel expenses, such as commuting costs to and from your office or coworking space, are nondeductible.Meals.Entertainment.Gifts.Political contributions.

What items are no longer tax deductible

Employees can no longer deduct fees related to financial services, including tax preparation, professional membership dues, unreimbursed employment expenses (in most cases), moving expenses (except for members of the military) and alimony payments.

Should sales tax be expense or liability

Sales tax and use tax are usually listed on the balance sheet as current liabilities. They are both paid directly to the government and depend on the amount of product or services sold because the tax is a percentage of total sales.

Is sales tax included in gross sales

Sales tax is, as a rule, calculated on gross sales.

The gross sales price is the unaltered amount, which means that adding your sales tax would get you to the net sales amount.

Does sales tax mean add or subtract

Sales tax is calculated by multiplying the cost of a good or service by the appropriate sales tax rate. For example, if the sales tax in an area is 5 percent and someone makes a purchase of $25, the sales tax on the item is calculated by multiplying 25 × 0.05 = $1.25.

How do I get sales tax exemption in USA

Who is eligible for sales tax exemptionsManufacturer Buying Materials to Use in Manufacturing. Similar to retailers, manufacturers are also eligible to buy goods without paying sales tax.Government Entities. In most US states, sales to government entities are tax exempt.Charitable or other Nonprofit Organizations.