Can Social Security be taken away?

Can Social Security be taken away by the government

Section 459 of the Social Security Act (42 U.S.C. 659) permits Social Security to withhold current and continuing Social Security payments to enforce your legal obligation to pay child support, alimony, or restitution.

Cached

What can cause you to lose your SSI

Going Above the SSI Income or Asset Limits. If you're receiving SSI and, for any reason, your income or assets rise above the SSI eligibility limit, Social Security will stop your benefits. In 2023, the individual income limit for SSI is $914 per month, and the asset limit is $2,000.

Cached

Can you lose your Social Security retirement benefits

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

What is the Social Security 5 year rule

The Social Security disability five-year rule allows people to skip a required waiting period for receiving disability benefits if they had previously received disability benefits, stopped collecting those benefits and then became unable to work again within five years.

Which president started borrowing from Social Security

President Jimmy Carter

| 1. | SOCIAL SECURITY SYSTEM–May 9, 1977 |

|---|---|

| 2. | REMARKS ON SIGNING H.R. 3 INTO LAW– October 25, 1977 |

| 3. | SOCIAL SECURITY FINANCING BILL — October 27, 1977 |

| 4. | SOCIAL SECURITY FINANCING LEGISLATION — December 1, 1977 |

| 5. | SOCIAL SECURITY AMENDMENTS OF 1977 –December 20, 1977 |

What are the four ways you can lose your Social Security

Keep reading to learn about how you could lose some or all of your Social Security benefits.You Forfeit Up To 30% of Your Benefits by Claiming Early.You'll Get Less If You Claim Early and Earn Too Much Money.The SSA Suspends Payments If You Go to Jail or Prison.You Can Lose Some of Your Benefits to Taxes.

Can SSI cut you off without notice

Social Security must tell you in writing before it reduces or stops (terminates) your benefits. You can fight their decision to reduce or terminate your benefits by asking for (requesting) reconsideration.

At what age does Social Security stop paying retirement benefits

Your benefits last as long as you live. Taking benefits before your full retirement age (as early as age 62) lowers the amount you get each month. Delaying benefits past full retirement age (up to age 70) increases the monthly amount for the rest of your life.

Can you get Social Security if you never worked

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

How much Social Security will I get if I make $60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income. The year you were born and the age you decide to start taking money

Has Congress ever taken money from the Social Security fund

The belief among some folks is that Congress has stolen trillions of dollars from Social Security, and that if this money were simply returned to the program, it wouldn't be in such dire financial shape. But the real surprise, upon digging deeper, is that Congress hasn't stolen a dime from Social Security.

When did the US government start borrowing from Social Security

As a stop-gap measure, Congress passed legislation in 1981 to permit inter-fund borrowing among the three Trust Funds (the Old-Age and Survivors Trust Fund; the Disability Trust Fund; and the Medicare Trust Fund).

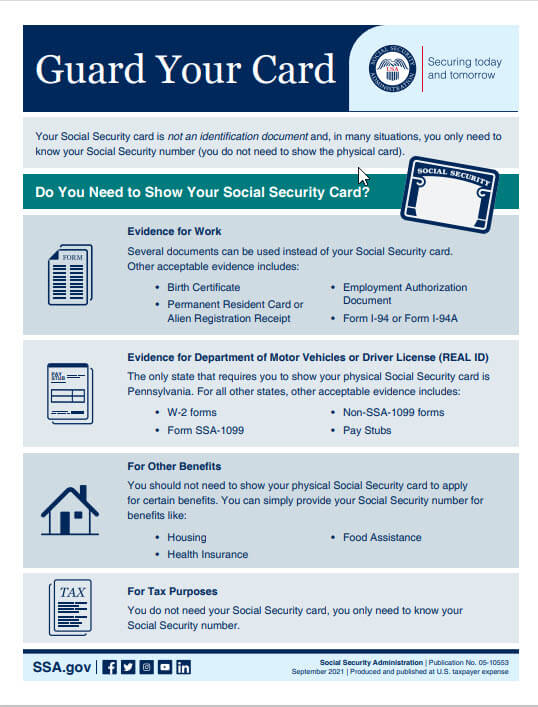

What happens if I lose my Social Security

If you lost your card, you may not need a replacement. In most cases, simply knowing your Social Security number (SSN) is enough. But, if you do need a replacement, you can complete your application online or in-person.

Do you get Social Security if you never worked

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

Do you lose Social Security if you don’t work

If you stop work before you start receiving benefits and you have less than 35 years of earnings, your benefit amount is affected. We use a zero for each year without earnings when we calculate the amount of retirement benefits you are due. Years with no earnings reduces your retirement benefit amount.

Do stay at home moms get Social Security

Just because you don't bring home a paycheck doesn't mean you're not working. A stay-at-home parent can get a Social Security check just like any other worker.

Is $1,500 a month enough to retire on

That means that many will need to rely on Social Security payments—which, in 2023, averages $1,544 a month. That's not a lot, but don't worry. There are plenty of places in the United States—and abroad—where you can live comfortably on $1,500 a month or less.

How much Social Security will I get if I make $100000.00 a year

If your highest 35 years of indexed earnings averaged out to $100,000, your AIME would be roughly $8,333. If you add all three of these numbers together, you would arrive at a PIA of $2,893.11, which equates to about $34,717.32 of Social Security benefits per year at full retirement age.

Which president took the money from Social Security

A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983. These amendments passed the Congress in 1983 on an overwhelmingly bi-partisan vote.

What did Ronald Reagan do to Social Security

In 1981, Reagan ordered the Social Security Administration (SSA) to tighten up enforcement of the Disability Amendments Act of 1980 created by then President Jimmy Carter https://www.ssa.gov/policy/docs/ssb/v44n4/v44n4p14.pdf , which resulted in more than a million disability beneficiaries having their benefits stopped …