Can SSN check credit score?

Can Social Security check your credit

As a result, you may see an entry called a “soft inquiry” on your Experian credit report. This will show an inquiry by the Social Security Administration and the date of the request. Soft inquiries do not affect your credit score, and you do not incur any charges related to them.

Cached

Do you need SSN to check credit score

While it's possible to have a credit report and credit score even if you don't have an SSN, providing your full identification information is key to ensuring that the report you receive is accurate and complete.

Cached

How do I check my credit score

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Does Credit Karma ask for SSN

In most cases, the last 4 digits of your SSN, along with the other personal information you enter, will be enough to match your identity with your Equifax and TransUnion credit files. In some cases, though, we may need your full SSN to ensure a correct match.

Who looks at your credit report

Current or potential creditors — like credit card issuers, auto lenders and mortgage lenders — can pull your credit score and report to determine creditworthiness as well. Credit history is a major factor in determining (a) whether to give you a loan or credit card, and (b) the terms of that loan or credit card.

How can I check my credit score without hitting it

Best ways to get a free credit score without hurting itAnnual Credit Report.com or call (877) 322-8228.Equifax: Credit Report Assistance.TransUnion: Free Credit Report.Experian: Free Credit Report | Free Credit Score.

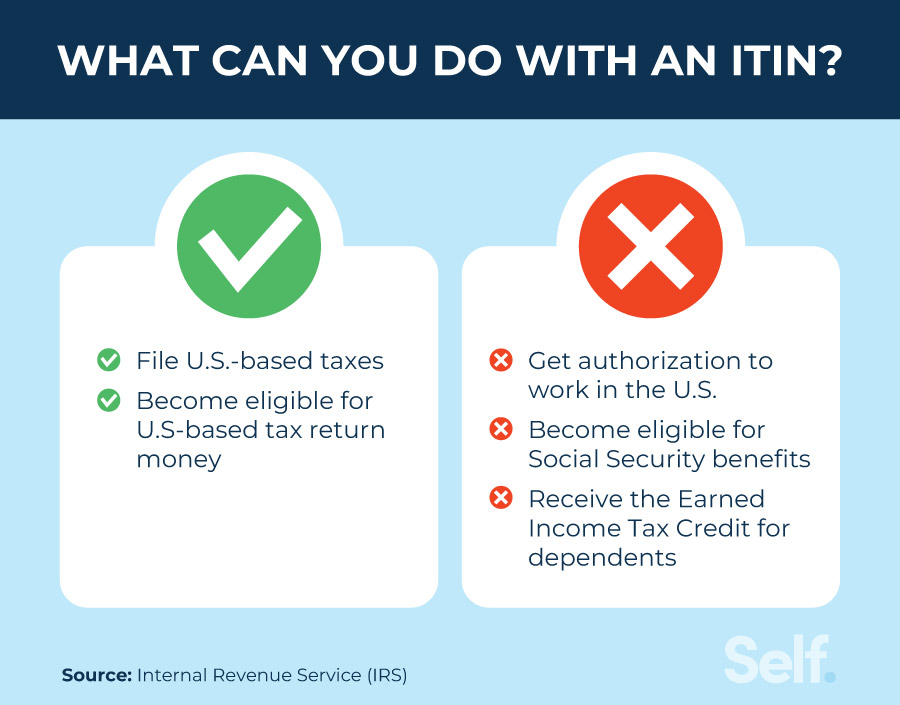

How can I get credit without SSN

Apply for an individual taxpayer identification number, or ITIN. If you're unable to get a Social Security number, you may still be able to apply for a credit card by using an individual taxpayer identification number, a tax-processing ID number assigned to individuals by the Internal Revenue Service.

Does Equifax ask for SSN

We ask for personal information, such as your Social Security number, during the order process to verify your identity and to locate your Equifax credit report.

Can anyone search your credit score

Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

Can someone check my credit history

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

How do I officially check my credit score

How to get a copy of your credit reportOnline by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Is A 650 A good credit score

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

What banks don’t require SSN

Here are some banks and credit unions that don't require you to have an SSN to open an account:Bank of America.Chase.Wells Fargo.Marcus by Goldman Sachs.Self-Help Federal Credit Union.Latino Credit Union.

Can I add a non US citizen to my credit card

Foreigners in the U.S. theoretically can be approved for a credit card as long as they have a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN) or know someone willing to add them as an authorized user.

Does Experian do SSN traces

Social Search is easy to use. As an authorized subscriber, you can input up to 20 Social Security numbers on an inquiry into Experian's consumer credit database. Our comprehensive system then searches for and retrieves identifying information on up to 10 consumers associated with the same Social Security number.

What gets reported to Equifax

Credit account information: This information is reported to Equifax by your creditors and includes the types of accounts (for example, a credit card, mortgage, student loan or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances and your payment history.

Who can view your credit report without permission

Potential investors or servicers, and current insurers, can access your credit report to gauge any credit risk that your loan poses, or to determine whether you will prepay (pay off a loan before it is due).

Can anyone check your credit report without your knowledge

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

Who can see your credit score

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

Who looks at your credit history

Creditors and potential creditors (including credit card issuers and car loan lenders). These people and businesses can review your report when you apply for credit or to monitor your credit once they have given you a loan or credit.