Can teachers deduct $250?

Do teachers still get $250 deduction

But each of you can only claim up to $300. Why is the deduction higher for the 2023 tax year For nearly twenty years, the annual limit for the educator expense deduction has been $250. But due in part to inflation, the IRS adjusted the educator expense deduction upward by $50 for the 2023 tax year.

Cached

Who qualifies for the 250 educator deduction

You're an eligible educator if you meet the following criteria: You work as a teacher, principal, counselor, instructor or aide. You've worked at least 900 hours during the school year. You teach at a public or private elementary or secondary school (K-12)

Cached

Can teachers claim more than 250

Teachers can claim the Educator Expense Deduction regardless of whether they take the standard deduction or itemize their tax deductions. For the 2023 tax year: A teacher can deduct a maximum of $300. Two married teachers filing a joint return can take a deduction of up to $300 apiece, for a maximum of $600.

Cached

What is the maximum teacher tax deduction

Start and e-File your Education Tax Return Now. For Tax Year 2023, teachers or educators can generally deduct unreimbursed, out-of-pocket, school, trade, or educator business expenses up to $300 on their federal tax returns for single taxpayers using the Educator Expense Deduction.

CachedSimilar

What is the $250 teacher credit

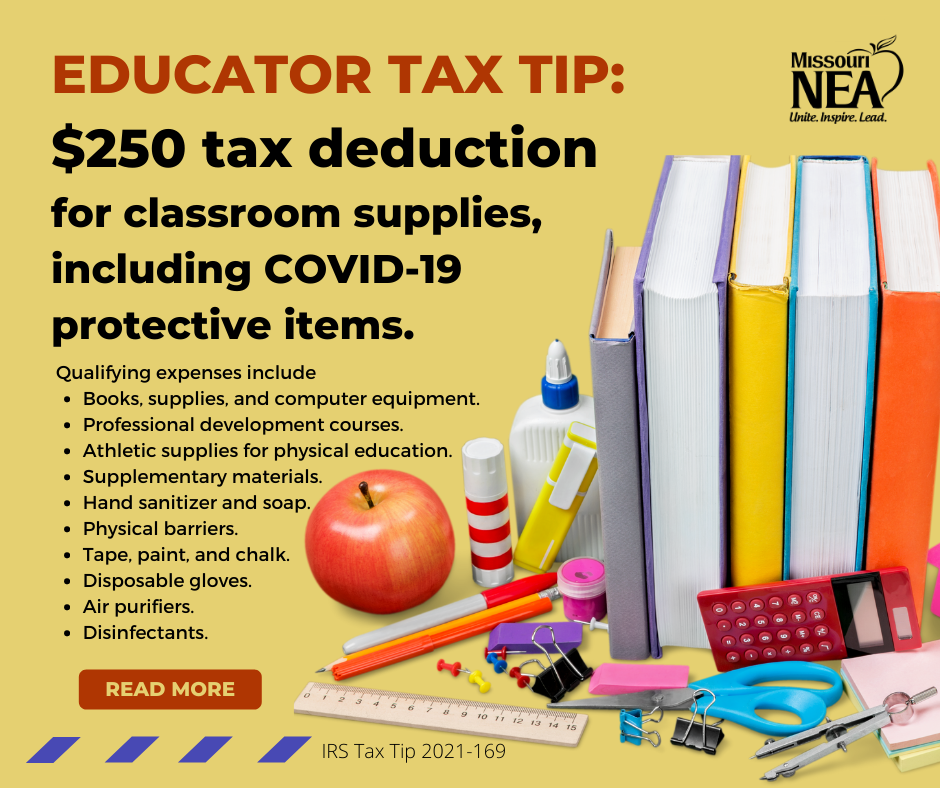

An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom.

What deductions can a teacher claim

Items eligible for the Educator Expense Deduction include:Books.School supplies.Computer equipment.Software.Athletic equipment (for physical education teachers)Any purchased item that is appropriate and helpful for students in your classroom.

What is the $250 teacher tax credit

An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom.

What is 250 educator expense deduction

With the tax deadline just around the corner, the IRS reminds any educator still working on their 2023 return that they can claim any qualifying expenses on Schedule 1, Line 11. For 2023, the deduction limit is $250. If they are married and file a joint return with another eligible educator, the limit rises to $500.

How much can teachers claim without receipts

$300

The IRS allows elementary and secondary school teachers to claim up to $300 of qualified expenses as an above-the-line adjustment to income for the 2023 tax year. You do not need to itemize deductions to take advantage of this deduction.

Why are teachers not allowed to give extra credit

Here are some reasons why extra credit such as this is not allowed: All students have to be graded by the same standards. You can't base one student's final grade on homework and exams, and then base another student's final grade on an "extra credit" project. It is simply not fair.

What is the $2500 education credit

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

Can teachers write off cell phones

Computers, extra monitors, webcams, and microphones needed to teach are write-offs. Turnitin, Copyscape, or other software you use to grade papers or teach can be written off. Part of your actual phone's cost, monthly phone bill, and any accessories you use for work can be written off.

Why did I get $250 from the IRS

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

How much can teachers write off on taxes 2023

$300

The decision of how much teachers can deduct from their income taxes lies with the Internal Revenue Service, and in 2023 the answer is a total of $300 can come off a teacher's taxes for expenses. That's $50 more than teachers were allowed to deduct in 2023.

Can teachers deduct work clothes

Unfortunately, you cannot write off the cost of clothing unless you are required to wear a uniform or clothes that you wouldn't wear anywhere else. Normally, teaching clothes don't fall into this category. To calculate your deduction, add up all of your eligible expenses.

How do you ask a teacher if they offer extra credit

Go to Office Hours

Simply ask if they offer extra credit and accept their answer. If your professor doesn't offer extra credit and you're worried about your grade, ask for advice for any upcoming tests or assignments. Your professor's guidance on how to improve your grade can be worth more than extra credit.

Can extra credit hurt your grade

Extra credit assignments will NOT negatively impact a student's grade. If an assignment is marked Extra Credit, only awarded points are included in the grade calculation. If a student gets a zero for example, the lack of points granted or earned will not count against the student.

Why can’t I claim education tax break

Who cannot claim an education credit You cannot claim an education credit when: Someone else, such as your parents, list you as a dependent on their tax return. Your filing status is married filing separately.

How much education expenses can I claim without receipts

How it works: You can claim 20% of the first $10,000 you paid toward 2023 tuition and fees, for a maximum of $2,000.

What are the $250 stimulus checks for

The American Recovery and Reinvestment Act of 2009 (ARRA) authorized the Social Security Administration to issue a one-time payment of $250 to anyone who gets a Social Security benefit, Railroad Retirement, or Veterans Administration (VA) disability pension and most people who receive Supplemental Security Income (SSI) …