Can the IRS see crypto com?

Will crypto com report to IRS

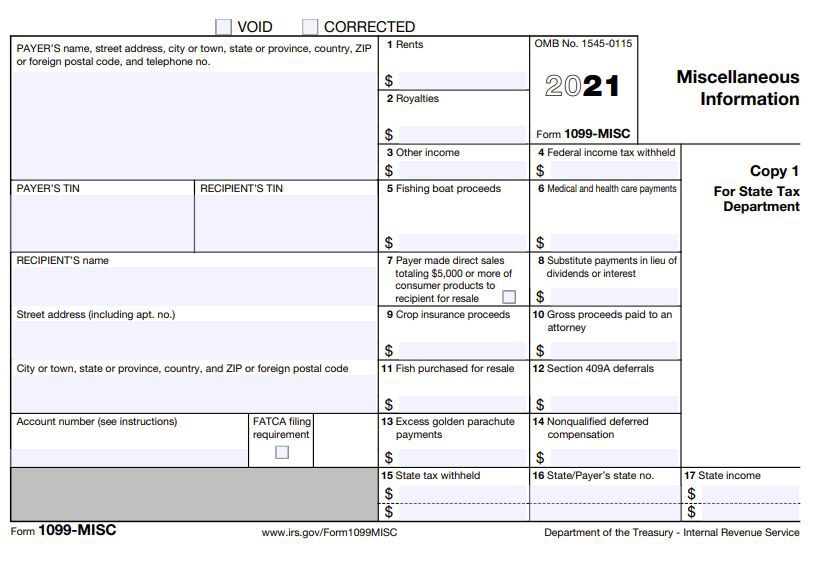

Yes, Crypto.com does report certain transaction information to the IRS. Because it is a centralized exchange based in the U.S., it is required by law to report users' activity with a Form 1099.

Cached

Is crypto com tracked by the IRS

Does Crypto.com report to the IRS Crypto.com provides American customers with a Form 1099-MISC when they earn more than $600 in ordinary income from Crypto.com. In the past, Crypto.com issued Form 1099-K to users and the IRS. Crypto.com no longer sends this tax form as of the 2023 tax year.

Cached

Do I have to pay taxes on Crypto com

Anytime someone disposes of crypto in the US, a capital gains tax applies. This refers to selling, trading, or buying goods and services with cryptocurrency. The tax only needs to be paid on the gains made since buying the crypto.

How does the IRS know I made money on crypto

Your crypto activity isn't completely invisible to the IRS

If you trade on centralized exchanges like Coinbase or Gemini, those exchanges have to report to the IRS. Typically, they'll send you a 1099 miscellaneous form detailing any income you've earned while trading crypto on their platform, Chandrasekera says.

Will the IRS know if I don’t report crypto

If, after the deadline to report and any extensions have passed, you still have not properly reported your crypto gains on Form 8938, you can face additional fines and penalties. After an initial failure to file, the IRS will notify any taxpayer who hasn't completed their annual return or reports.

Will I get a 1099 from Crypto com

Crypto.com may be required to issue to you a Form 1099-MISC, Miscellaneous Income, if you are a U.S. person who has earned USD $600 or more in rewards from Crypto.com during the previous calendar year from Lockup, Earn, Referrals, or certain other activities.

Can you get away with not reporting crypto

The IRS has made it clear that they expect people to report their cryptocurrency holdings on their taxes along with all capital assets. Failing to do so could result in a number of penalties, including fines and even jail time.

Do I have to report crypto less than $600

Even if you earned staking or rewards income below the $600 threshold, you'll still have to report the amount on your tax return. If you've earned less than $600 in crypto income, you won't be receiving any IRS 1099 forms from us. Visit Qualifications for Coinbase tax form 1099-MISC to learn more.

Will the IRS know if I don’t report my crypto

Investors must report crypto gains, losses and income in their annual tax return on Form 8940 & Schedule D. Evading crypto taxes is a federal offence. Penalties for tax evasion are up to 75% of the tax due (maximum $100,000) and 5 years in jail. The IRS knows about your crypto already.

Will I get caught not reporting crypto

The IRS has made it clear that they expect people to report their cryptocurrency holdings on their taxes along with all capital assets. Failing to do so could result in a number of penalties, including fines and even jail time.

Will I get audited if I don’t report crypto

What happens if you don't report taxable activity. If you don't report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges.

What happens if you don t report cryptocurrency on taxes

If you don't report a crypto-taxable event, you could incur interest, penalties, or even criminal charges if the IRS audits you. You may also even receive a letter from the IRS if you failed to report income and pay taxes on crypto, or do not report your transactions properly.

What happens if you don’t get a 1099 for crypto

TurboTax Tip: Cryptocurrency exchanges won't be required to send 1099-B forms until tax year 2023. If you don't receive a Form 1099-B from your crypto exchange, you must still report all crypto sales or exchanges on your taxes.

How do I avoid paying taxes on crypto

9 Ways to Legally Avoid Paying Crypto TaxesBuy Items on Crypto Emporium.Invest Using an IRA.Have a Long-Term Investment Horizon.Gift Crypto to Family Members.Relocate to a Different Country.Donate Crypto to Charity.Offset Gains with Appropriate Losses.Sell Crypto During Low-Income Periods.

What is the penalty for not filing crypto

Failure-to-File Penalties

If you don't report your crypto gains and losses on a tax return, you could incur a penalty of 5% of the unpaid tax for each month the tax return is late, up to a maximum of 25%. If your return was over 60 days delinquent, the minimum penalty is $435 or 100% of the required tax.

What happens if I don’t report crypto on my taxes

Taxpayers are required to report all cryptocurrency transactions, including buying, selling, and trading, on their tax returns. Failure to report these transactions can result in penalties and interest.

Do you have to report all crypto to IRS

You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the transaction, regardless of the amount or whether you receive a payee statement or information return.

How can I avoid IRS with crypto

9 Ways to Legally Avoid Paying Crypto TaxesBuy Items on Crypto Emporium.Invest Using an IRA.Have a Long-Term Investment Horizon.Gift Crypto to Family Members.Relocate to a Different Country.Donate Crypto to Charity.Offset Gains with Appropriate Losses.Sell Crypto During Low-Income Periods.

Do I report crypto to taxes if I never sold

No, you do not need to report crypto if you don't sell. Because cryptocurrency and other digital assets are treated as property, taxable events only occur when you realize capital gains or losses through events such as swapping, trading, selling for fiat, or other methods of disposal.

How do I avoid crypto tax audit

To avoid a crypto tax audit, you should report your capital gains and losses on IRS Form 8949. Included in your report will be i) a description of the “property” or asset you sold, ii) the date of original acquisition and date of disposal, iii) earnings from the sale, iv) your cost basis, and v) your gain or loss.