Can the IRS verify EIN?

Can an EIN number be verified

EIN verification is a process of validating the Employer Identification Number along with the legal name of the entity per the official records of the IRS. You can verify the EIN with the IRS TIN Match system or use Tax1099's super fast real-time TIN match program (more on this as you scroll).

Cached

Can you check an EIN online

Can I look up an EIN number The IRS doesn't provide a public database you can use to look up EIN numbers for your own company or others. However, you can look at your EIN confirmation letter or other places your number may be recorded, including previously filed tax returns or old financing documents.

Cached

What makes an EIN invalid

An EIN is 9 digits in length with the format of XX-XXXXXXX. An invalid employer identification number usually results when the number you entered in the federal EIN section of your TaxAct® W-2: was taken from the state section of your physical W2, doesn't match the federal EIN on your physical W2, or.

What is the IRS form to verify EIN number

Initial Form 8871 EIN Verification.

Is there a database for EIN numbers

It is also possible to use the EDGAR Online Forms and Filings database to search for an EIN. Searching the EDGAR database is completely free of charge, and can be used to find a business EIN that is not listed in the online SEC filings.

Is an EIN number public information

No, EINs are not kept confidential and are a matter of public record. Therefore, it is important that you keep your EIN safe and secure to ensure that no one attempts to commit fraud by using your EIN.

Why would the IRS decline an EIN number

What is an EIN Application rejection If your entity name is not unique and the IRS finds one that is similar, you may be denied an EIN. Limited Liability Companies and corporations can't file articles of organization or incorporation until there is a unique entity name for that specific state.

Why is the IRS rejecting my EIN

The number you entered in the federal EIN section of your TaxAct® W-2: was taken from the state section of your physical W2, does not match the federal EIN on your physical W2, or. matches the federal EIN on your physical W2, but is incorrect (i.e. the number provided on your W-2 is wrong).

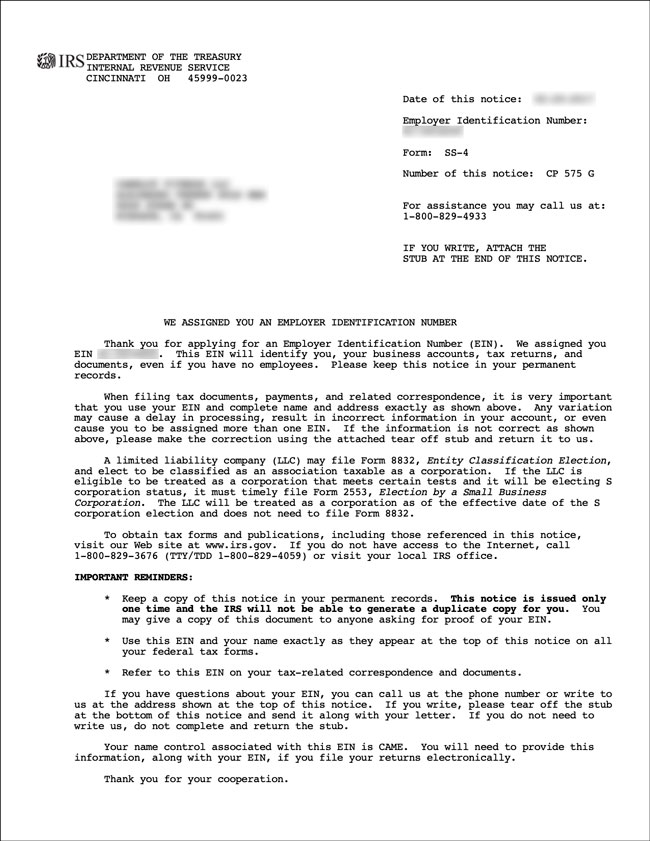

Does the IRS send EIN confirmation letter

The IRS sends out an EIN confirmation letter for every EIN application it processes. This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.

What is an EIN verification

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website.

How do I verify a company’s EIN

You can look up another business's EIN using the SEC's Edgar system, as long as the business is a public company. To verify a charitable organization's EIN, you could check the IRS Tax Exempt Organization Search tool. You may also be able to hire an online company to do the research on your behalf.

Are all EIN numbers public

No, EINs are not kept confidential and are a matter of public record. Therefore, it is important that you keep your EIN safe and secure to ensure that no one attempts to commit fraud by using your EIN.

Can I see who owns a EIN

The IRS publishes a database of companies called EDGAR Online. You can access this database by going to www.edgaronline.com. Once there, click on the link labeled "Search Companies." Enter the EIN number and press enter. A list of companies will appear.

Is your EIN linked to my SSN

An EIN is not linked or associated with your SSN. As such, it provides additional personal privacy protection by using a different number than your SSN for reporting purposes. You can easily apply online for the EIN through the IRS. In addition to privacy, there are other advantages to obtain an EIN.

Why would an EIN be invalid

If the INVALID status appears, this means the IRS did not recognize the combination you provided. To resolve an INVALID tax ID status, make sure the Legal Name and TIN you provide is the same Legal Name/TIN as shown on your W-9 form.

How do I get proof of my EIN number

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) two ways: by mail.

How long does it take to get EIN verification

If you do not include a return fax number, it will take about two weeks. If you apply by mail, send your completed Form SS-4PDF at least four to five weeks before you need your EIN to file a return or make a deposit.

What IRS form do I use to verify my EIN

Initial Form 8871 EIN Verification.

How do I verify a business name with the IRS

Contact your county clerk's office or the office that handles business registrations, and ask them to check their records for the business name you want to use.

Can someone do anything with your EIN

Once someone gets your EIN number, he can establish corporate credit card accounts, business banking accounts and even establish personal credit without your knowing it. The theft of your EIN can be combined with thieves accessing your mail.