Can TransUnion remove closed accounts?

How do I delete a closed account on TransUnion

Send a letter to the three major credit bureaus—TransUnion®, Experian® and Equifax®—that explains what information you are challenging, why you believe it is inaccurate and that you would like it removed. Similarly, send a letter to the financial institution that provided the information to the bureaus.

Cached

Can I get closed accounts removed from my credit report

You cannot remove a closed accounts from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for 7-10 years if it is accurate.

Do closed accounts get removed

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Cached

What is the best way to remove closed accounts from credit report

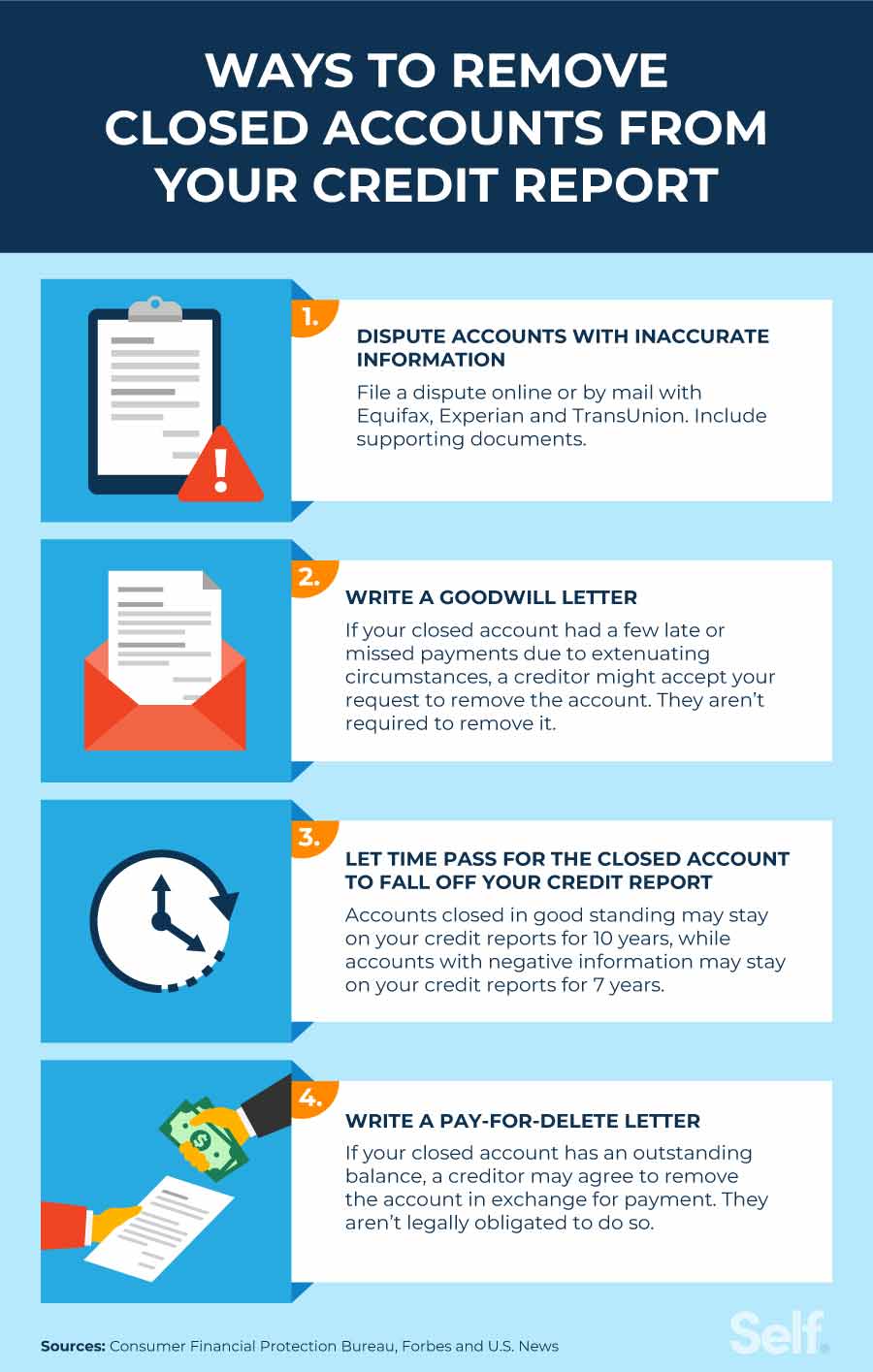

If you want to remove a closed account from your credit report, you have four ways you might consider doing so, depending on your situation.Refute inaccurately reported accounts.Write a pay-for-delete letter.Write a goodwill letter.Let time pass for the closed account to fall off your credit report.

Cached

How do I clean up my TransUnion credit report

You submit an investigation request (dispute).

If you believe that an item contained in your TransUnion credit report is inaccurate or needs updating, send TransUnion a request for investigation or request to change information. You can start your investigation online. You can also submit a dispute by phone or mail.

How long does TransUnion keep records

6 years

negative information about accounts such as credit cards and loans may stay up to 6 years. credit checks by lenders; Equifax keeps this information for 3 years, while TransUnion keeps it for 6 years.

What is a 609 letter to remove closed accounts

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

Should I remove old closed accounts from credit report

You only need to consider removing a closed account if it has an adverse payment history. Otherwise, an account that is in good standing is OK to leave. It shows future lenders you can pay off a loan and make payments on time.

Should you still pay off closed accounts

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time.

Do lenders see closed accounts

If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as “closed” on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

How to remove collections and closed accounts from credit score

Send a written request to remove the account from your credit report directly to the creditor that reported the information to the credit bureau, McClary says. Ask politely if the creditor will remove the account now that it is no longer active.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

Can you wipe your credit history clean

No, technically, you can't wipe your credit history. However, you can change your credit behavior to make improvements that will build better credit going forward. It takes time and better habits to move on from subpar credit.

Can TransUnion remove collections

There are ways to get this removed yourself. The best way to go about this is to file a dispute with the credit bureaus, Equifax and TransUnion. They will look into the entry, and should they find it expired, they will take the steps needed to remove it from your credit report.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

Do 609 letters really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Why are old closed accounts still on my credit report

Closed accounts, whether they were closed by you or closed due to payoff or transfer to another lender, are not automatically removed from the credit report. The status of the account will be updated to show that it is no longer open, but the payment history of the account will remain on your report.

Will my credit score go up if I pay a closed account

Even after an account is closed, a solid history of paying on time can help your credit score. The positive effect will not be the same as an open account, but it can still bolster your credit score, according to the credit bureau Experian.

What happens if you don’t pay closed accounts

Your creditor canceled your account because of delinquencies. If you fall behind on your payments, your lender may close your account. Keep in mind that negative payment history for these accounts may remain on your report for seven years.

Should I pay off closed accounts

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.