Can you ask a tenant for a credit report?

Is it normal for landlords to ask for a credit report

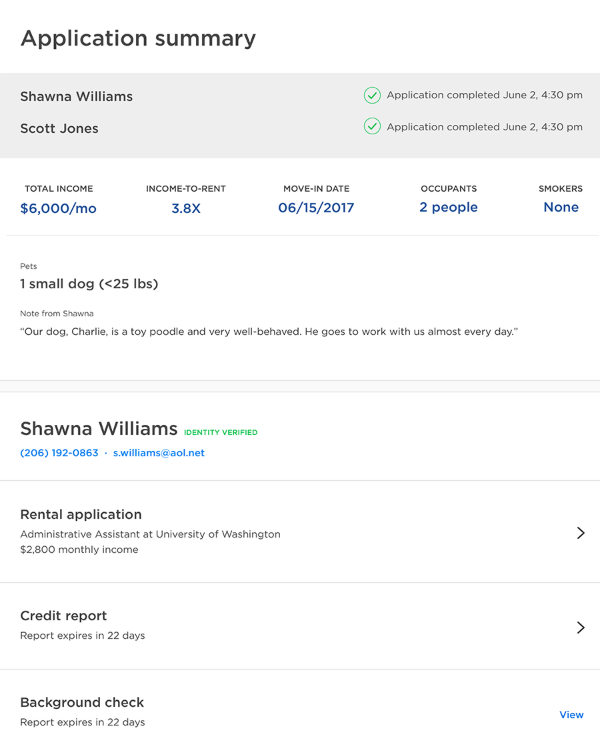

Landlords use a credit check for tenants to make sure the person they're considering renting to has a solid financial history and is considered trustworthy. In a credit check, a landlord is looking for a good credit history and on-time payments.

Can you share credit report with landlord

Credit bureaus

Personal information, including Social Security and account numbers, are not shared with prospective landlords. TransUnion offers a similar service where landlords can pay to view the prospective tenant's credit report or pass on the cost to applicants. The applicant has to allow access.

Cached

How do I get a credit check on someone

Contact one of three credit reporting agencies.

They are Equifax, Experian and TransUnion. Going through one of these agencies is the only legitimate way to obtain someone's credit report. The credit report lists detailed information about employment, credit history, previous tenancies and current debts.

How do I get a credit score for a potential tenant

Where to Get a Tenant's Credit Report. The most common ways of getting a tenant's credit report are directly through one of the three major credit reporting bureaus (Equifax, Experian, and TransUnion) or through a property management software platform like Avail.

Cached

What credit report do most landlords use

Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment.

Why are credit reports important to landlords

With 84% of landlords citing payment problems as their top concern, according to TransUnion, running a credit report on your applicants will reveal the financial responsibility you can expect from renters. Frequent late payments can also impact your financial situation as a landlord.

Is it illegal to share a credit report with someone else

Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

Is it okay to share credit report

It is always a stupid idea to tell people your credit score, how much you earn, how much you paid for your house, in fact any financial information. Some might view that information as showing you are well off and will try to borrow money from you or try to sell you things you don't want.

Who is legally allowed to check a person’s credit report

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

Can someone run a credit check without my permission

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

Do you get a credit score from renting

If you regularly pay your rent on time and in full, you can have your good payment history reported to credit bureaus to help raise your credit score through a rent-reporting service.

How much does it cost to run a credit check on someone

While the average credit check will cost you between $15 and $40 in most cases, it is vital to have a deeper understanding of credit checks than just cost if you want to screen tenants successfully.

What credit report is used to rent an apartment

Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment.

How to check someones credit score for free

You can access someone else's credit report by directly contacting one of the credit bureaus (TransUnion, Equifax, and Experian). Each of these bureaus technically gives their ratings independently, but all three of the scores should be quite similar for the same person.

Are credit reports confidential

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Is it illegal to request someone else’s credit report

The Fair Credit Reporting Act (FCRA) is a federal statute that defines and limits who can receive credit-related information. The act lists legal reasons why someone's credit can be checked; therefore, it is illegal for an individual or organization to check someone's credit report for any other purpose.

Can I request a credit report for someone else

The short answer is yes. With the proper authority, anyone can obtain a copy of another person's credit report. The key here, though, is having what the Fair Credit Reporting Act refers to as “permissible purpose” to access the report.

Can a private party report to credit bureau

Since you can't report your own financial activity to the credit bureaus, you must contract with a third-party service that can independently verify your account and payment information.

What is an OK credit score to rent

Most individuals or companies renting an apartment want credit scores from applicants to be 620 or higher. People with credit scores lower than 620 may indicate a high risk of default on rent owed.

Do people need permission to run a credit check

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.