Can you buy a house without a pre approval?

Can you put an offer in on a house without a pre-approval

There is no law that states you cannot put in an offer without a pre-approval. So, while you can always try submitting the offer without the pre-approval letter, note that sellers prefer offers with pre-approval letters over those without.

Cached

How long before buying a house should I get pre-approved

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase. As a home buyer, pre-approvals are for your benefit, so it's never too early to get one. Getting pre-approved early is an advantage because one-third of mortgage applications contain an error.

Why do realtors ask for a pre-approval

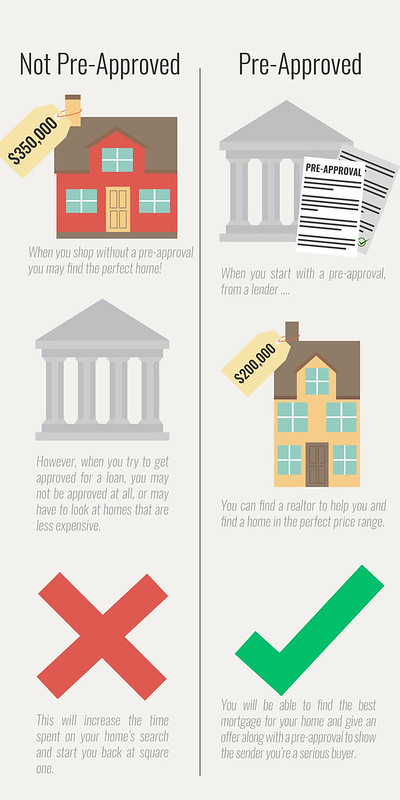

A preapproval helps you and agents narrow down your search to only properties that will fit into your price range. Initial expectations of how much you can afford may be different than reality (especially if you're buying your very first home).

Does pre-approval mean you are approved for a house

A preapproval is helpful when you're shopping for a home, but you'll need to get a full approval once you find your home, and simply getting a preapproval before you start looking at properties doesn't guarantee you'll get approved. For your lender, this process includes making sure the property details check out.

Should I accept an offer without pre-approval

Do you need a pre-approval letter to see a house Real estate agents prefer showing homes to buyers with a pre-approval letter, because it shows the buyer is financially capable of purchasing. Agents “need to know if you can really buy a home,” Shur says. That said, a pre-approval letter isn't mandatory to tour a home.

Does a pre-approval hurt your credit

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

What credit score do you need to get pre-approved for a house

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How quickly can I get a preapproval letter

On average, it takes 7-10 days to get a pre-approval, although in some cases it may take less time. To speed up the home loan pre-approval time, you should gather your financial documents that the lender will require (e.g., W2s, proof of income, tax returns, etc.).

Do you really need pre approval

Absolutely – a mortgage preapproval is helpful to have in your pocket when you're shopping around for a home, but not a prerequisite. That said, while you certainly can look at a house without preapproval, it's only recommended if you're in the earliest stages of planning to buy a home.

Why is it important to get pre-approved

Here are the benefits of being a pre-approved buyer

You know the details of your financing before you pick out a house. You not only know how much house you can afford, you also know the terms of your loan. You know how much you can spend and won't waste time looking at homes you can't afford.

What credit score is needed for pre-approval

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What does my credit score need to be to buy a 250 000 House

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

How can I speed up my pre-approval

Five tips to help you get pre-approved for a home loan fasterHave your documents prepared beforehand.Sign and return any forms as quickly as possible.Research how much you can borrow.Know your credit score.Look for a lender with fast pre-approval times.

Can I get a preapproval letter in one day

Once you've submitted all of the documentation that your lender needs, it can take as little as one business day to be preapproved for a mortgage. But gathering the documents and information that the lender requires can take a few days, depending on your employment status, credit history, and how organized you are.

Does a pre approval matter

Because your lender is verifying your income and assets along with your credit history, a mortgage preapproval is a more accurate estimate of what you can afford. It also carries more weight with a real estate agent and the seller, because they'll know your lender verified that you can afford the home you wish to buy.

What is the lowest credit score to buy a house

Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. That's the minimum credit score requirement most lenders have for a conventional loan. With that said, it's still possible to get a loan with a lower credit score, including a score in the 500s.

Can I afford a 300K house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

Can I buy a 300K house with 60k salary

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

What credit score is needed for a $350 000 house

Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.