Can you check credit score without permission?

Can someone check my credit score without my permission

Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

Cached

Can I sue for unauthorized credit check

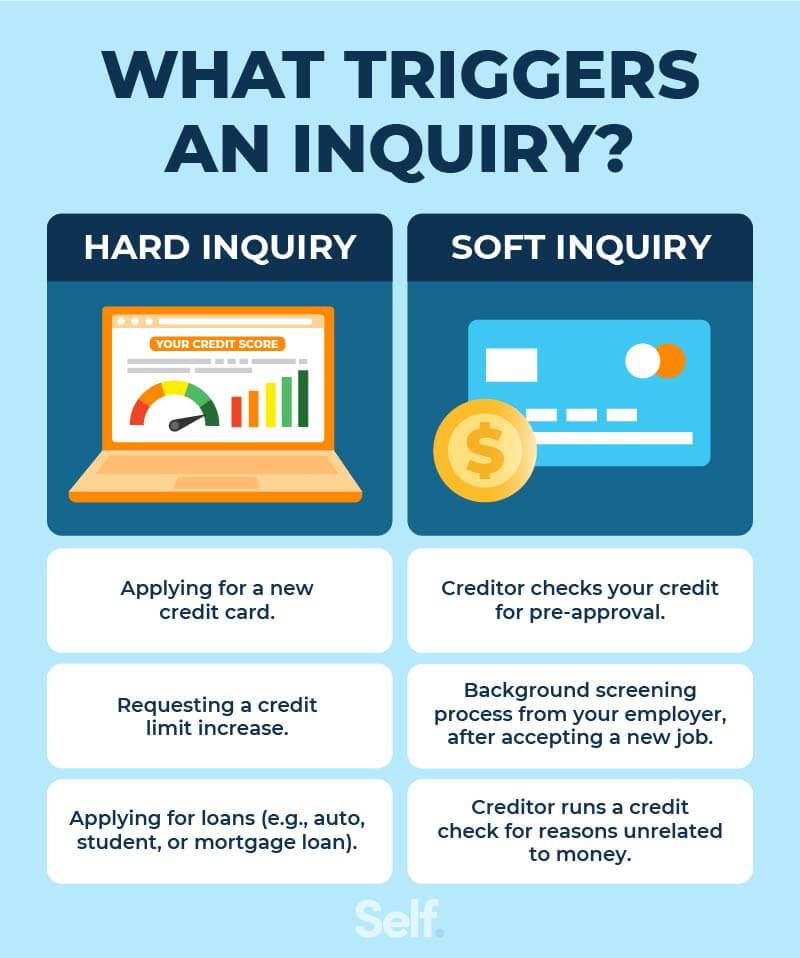

If you notice hard pulls on your credit that you did not consent to, you can demand the creditor remove the inquiry. If they do not do this, you can sue under the Fair Credit Reporting Act (FCRA).

Cached

Can you look up someone’s credit score

You can access someone else's credit report by directly contacting one of the credit bureaus (TransUnion, Equifax, and Experian). Each of these bureaus technically gives their ratings independently, but all three of the scores should be quite similar for the same person.

Can anyone see your credit score as it is publicly available

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

How do I know if someone checked my credit score

When you request a copy of your credit report, you will see a list of anyone who has requested your credit report within the past year, including any employers or prospective employers who have requested your report within the past two years for employment purposes.

Can I check my boyfriend’s credit

With the proper authority, anyone can obtain a copy of another person's credit report. The key here, though, is having what the Fair Credit Reporting Act refers to as “permissible purpose” to access the report.

How do I get rid of unauthorized credit inquiry

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

How do I report a false credit inquiry

The credit bureaus also accept disputes online or by phone:Experian (888) 397-3742.Transunion (800) 916-8800.Equifax (866) 349-5191.

Are credit scores public information

Unless you're posting pictures of your credit reports on social media, your credit information shouldn't be available to the public. It won't show up as a search engine result, and your loved ones can't request it, regardless of your relationship.

Who can look at your credit score besides banks

Who can access your credit report or scoreBanks.Creditors.Student loan providers.Utility companies.Collection agencies.Government agencies.Any entity with a court order.

Is my credit score confidential

The good news The average person is not privy to your credit information. For the most part, your score and report remain confidential, and only select parties and companies can see it. Here's who can access your credit report, who can't, and why.

What can people see when they check your credit

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

What information do I need to run a credit check on someone

You will need to provide your name, address, Social Security number, and date of birth.

Can my husband get a credit card without me knowing

Many assume it's acceptable to apply for a credit card in a spouse's name, especially if you know their Social Security number, but it's not. If your spouse doesn't give permission, they should not be on the credit card application.

Is it illegal to check someone else’s credit report

The Fair Credit Reporting Act (FCRA) is a federal statute that defines and limits who can receive credit-related information. The act lists legal reasons why someone's credit can be checked; therefore, it is illegal for an individual or organization to check someone's credit report for any other purpose.

Can someone run your credit without your social

The short answer is No. The credit bureaus do not require a Social Security Number to access the potential borrower's credit file. The main criteria are name and address.

Is it illegal to report false information to credit bureaus

Credit Reporting

However, debt collectors cannot report false information about your debt. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you dispute the debt.

Are credit scores private

Although you aren't the only person who can see your credit scores and reports, you can feel secure in knowing that this financial information is given only to those who legitimately need it.

Is your credit history private

The average person is not privy to your credit information. For the most part, your score and report remain confidential, and only select parties and companies can see it. Here's who can access your credit report, who can't, and why.

What can someone see on a credit check

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.