Can you claim dental bills on your taxes?

Can dental bills be a tax write off

If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents.

Cached

What medical dental expenses are tax deductible

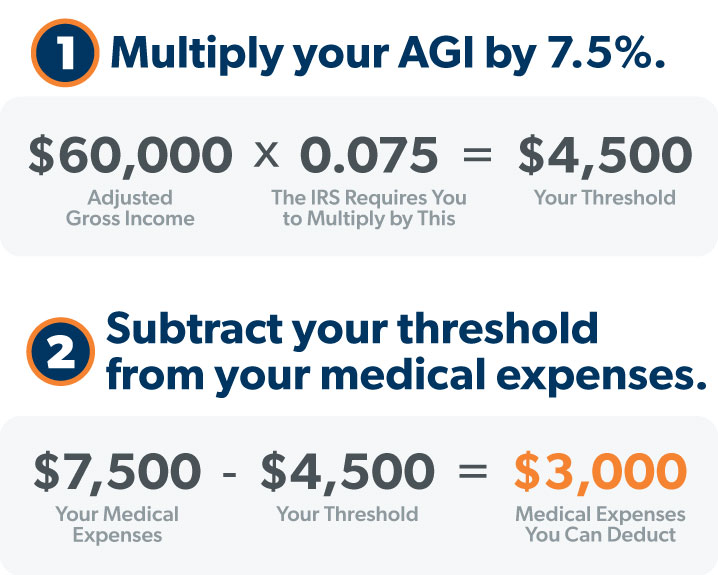

Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI).

Is a root canal tax deductible

Medical Isn't Just 'Medical'

The IRS allows tax deductions for dental care and vision, in addition to medical expenses. This means you can potentially deduct eye exams, contacts, glasses, dental visits, braces, false teeth, and root canals.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

Can I deduct health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

How much medical expenses are deductible 2023

For tax returns filed in 2023, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. So if your adjusted gross income is $40,000, anything beyond the first $3,000 of medical bills — or 7.5% of your AGI — could be deductible.

Can seniors deduct medical expenses

However, out-of-pocket medical costs are a significant expense for older adults, especially for those who have retired. The good news is you can claim some of these expenses on your taxes. The key They must be itemized and exceed 7.5 percent of your adjusted gross income.

Can I write off my dental implants

Dental implants are the closest thing to having a healthy, natural tooth in your mouth again. Your question is also perfect timing for the end of the year! To answer your question, yes, dental implants can be tax deductible under IRS Topic 502: Medical and Dental Expenses.

Can I write off my wisdom teeth removal

Only medically necessary dental treatments are deductible, such as teeth cleanings, sealants, fluoride treatments, X-rays, fillings, braces, extractions, dentures, and dental-related prescription medications.

Does IRS require physical receipts for expenses

You generally must have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses. Additional evidence is required for travel, entertainment, gifts, and auto expenses.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What are IRS qualified medical expenses

These costs include health insurance premiums, hospital stays, doctor appointments, and prescriptions. Other eligible costs that are frequently overlooked include alternative treatments like acupuncture, well-child care for newborns, hotel stays for medical visits, and special diets.

Can seniors deduct health insurance premiums

Yes, your Medicare premiums can be tax deductible as a medical expense if you itemize deductions on your federal income tax return. If you're self-employed, you may be able to deduct your Medicare premiums even if you don't itemize.

What medical expenses are deductible for over 65

Medical Expense Deductions for Self-Employed Seniors

If you're a self-employed senior and have a net profit for the year, health insurance premiums such as Medicare, Medicaid, Medicare Supplement Insurance (Medigap), and qualified long-term care insurance can be claimed as a health insurance deduction.

What is the IRS deduction for seniors over 65

The standard deduction for seniors this year is actually the 2023 amount, filed by April 2023. For the 2023 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.

Are dentures or implants tax deductible

yes

Dental implants are the closest thing to having a healthy, natural tooth in your mouth again. Your question is also perfect timing for the end of the year! To answer your question, yes, dental implants can be tax deductible under IRS Topic 502: Medical and Dental Expenses.

Do dental implants count as medical expenses for taxes

Dental implants are tax-deductible medical expenses under IRS rules, provided the treatment is not cosmetic: enhancing appearance only.

Why experts now say not to remove your wisdom teeth

That exposes the underlying bone and nerves and results in severe pain. More serious risks, which become more common with age, include nerve and blood-vessel damage. As with any surgery, wisdom-tooth removal does carry the very rare risk of death.

What if I don’t have money to remove my wisdom teeth

You have several options if you can't afford the cost of a wisdom tooth removal. Some free dental clinics offer emergency appointments for patients with limited funds and no dental insurance. In addition, most dental offices provide payment plans and dental savings plans through third-party lenders.

Will I get audited if I claim medical expenses

Claiming deductions for things like charitable donations or medical expenses to lower your tax bill doesn't in itself make you prime audit material. But claiming substantial deductions in proportion to your income does.