Can you claim dental on taxes?

What kind of dental expenses are tax deductible

What dental expenses are tax deductible Generally, you can deduct the costs of routine dental checkups, surgeries, medication, and treatments. Travel and transportation costs to reach your dental facility may also be considered deductible. But all expenses need to be medically necessary to be tax deductible.

Cached

Is health and dental insurance tax deductible

Many people aren't aware that some expenses can be deducted from your federal income taxes. Besides your health insurance premiums, other deductible medical expenses may include the following: Long-term care insurance premiums. Dental insurance premiums.

Cached

Is a root canal a tax deduction

The IRS allows tax deductions for dental care and vision, in addition to medical expenses. This means you can potentially deduct eye exams, contacts, glasses, dental visits, braces, false teeth, and root canals.

Can you claim medical bills on your taxes

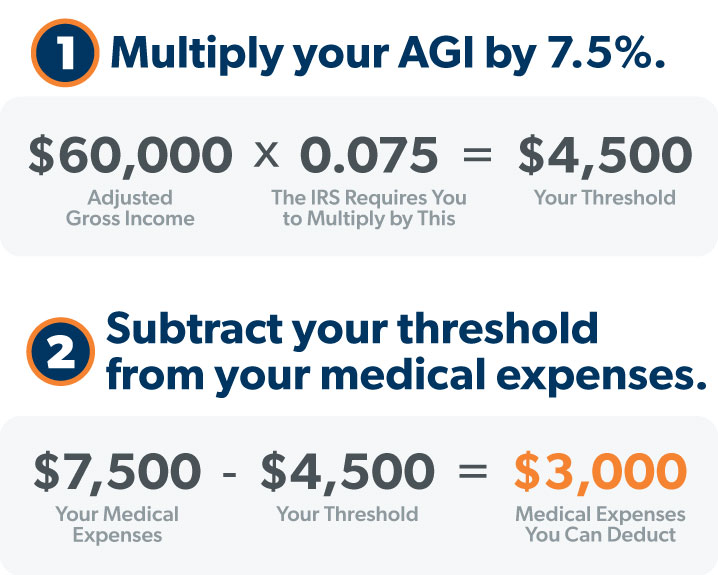

You can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040.

What type of expenses are typically covered by dental insurance

Generally, dental policies cover some portion of the cost of preventive care, fillings, crowns, root canals, and oral surgery, such as tooth extractions. They might also cover orthodontics, periodontics (the structures that support and surround the tooth) and prosthodontics, such as dentures and bridges.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

What type of health insurance is tax deductible

Medical Insurance Premium Deductions: What Can Be Included

Dental insurance. Medicare A insurance (if you're enrolled voluntarily and not as a Social Security recipient or government employee) Medicare B supplemental insurance. Medicare D prescription insurance.

Can I write off my wisdom teeth removal

Only medically necessary dental treatments are deductible, such as teeth cleanings, sealants, fluoride treatments, X-rays, fillings, braces, extractions, dentures, and dental-related prescription medications.

What proof do I need to deduct medical expenses

You should also keep a statement or itemized invoice showing:What medical care was received.Who received the care.The nature and purpose of any medical expenses.The amount of the other medical expenses.

How much do you get back in taxes for medical expenses

Deducting these expenses from your total earnings reduces some of your tax burden. The IRS allows filers to deduct medical expenses that are more than 7.5 percent of their adjusted gross income.

What are three types of expenses covered by health insurance

Health insurance covers most medical expenses, such as hospital visits, doctor visits, prescription drugs, home care, and wellness care.

How much is a cavity filling

On average, the cost for a dental filling without insurance could run from $200 to $600. This is just an average estimate, and the price could be as low as $100 or as high as $4,000. The cost of a dental filling procedure varies based on several factors, including: Cavity size.

How can I get the most money back from my taxes

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What are IRS qualified medical expenses

These costs include health insurance premiums, hospital stays, doctor appointments, and prescriptions. Other eligible costs that are frequently overlooked include alternative treatments like acupuncture, well-child care for newborns, hotel stays for medical visits, and special diets.

Why experts now say not to remove your wisdom teeth

That exposes the underlying bone and nerves and results in severe pain. More serious risks, which become more common with age, include nerve and blood-vessel damage. As with any surgery, wisdom-tooth removal does carry the very rare risk of death.

What if I don’t have money to remove my wisdom teeth

You have several options if you can't afford the cost of a wisdom tooth removal. Some free dental clinics offer emergency appointments for patients with limited funds and no dental insurance. In addition, most dental offices provide payment plans and dental savings plans through third-party lenders.

How much medical and dental expenses are deductible

You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). This publication also explains how to treat impairment-related work expenses and health insurance premiums if you are self-employed.

Does the IRS verify medical expenses

However, the IRS now keeps track of who has medical insurance, and they can easily check this. Of course, if you have a major surgery or hospital stay, you could easily claim legitimate expenses for this deduction, even with insurance.

Can you write off health insurance

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.