Can you close a Bank of America credit card?

Is there a fee to close Bank of America

How much is it to close a Bank of America account It's free to close a Bank of America account. Again, your account cannot have any outstanding balances or unpaid subscription fees and be sure to follow the steps listed in the section above.

Cached

Does canceling a credit card hurt your credit

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Does closing a bank account hurt your credit

Closing a bank account typically won't hurt your credit. Your credit score is based on how you manage borrowed money, and your checking or savings accounts aren't debts. So bank account closures aren't reported to the three major credit bureaus: Experian, TransUnion and Equifax.

Is it hard to close a Bank of America account

The quickest and easiest method to close your account is by calling the bank. This is a nice method in case you want to do everything from the comfort of your own home. Just call their customer support service at 1-800-432-1000 and one of the bank representatives will take care of the situation.

Cached

How much is Bank of America early closure fee

If you close your account within 36 months of opening, you must pay a $450 early closure fee, as well as reimburse any other third-party fees the bank paid on your behalf during the approval process, such as recording fees or taxes.

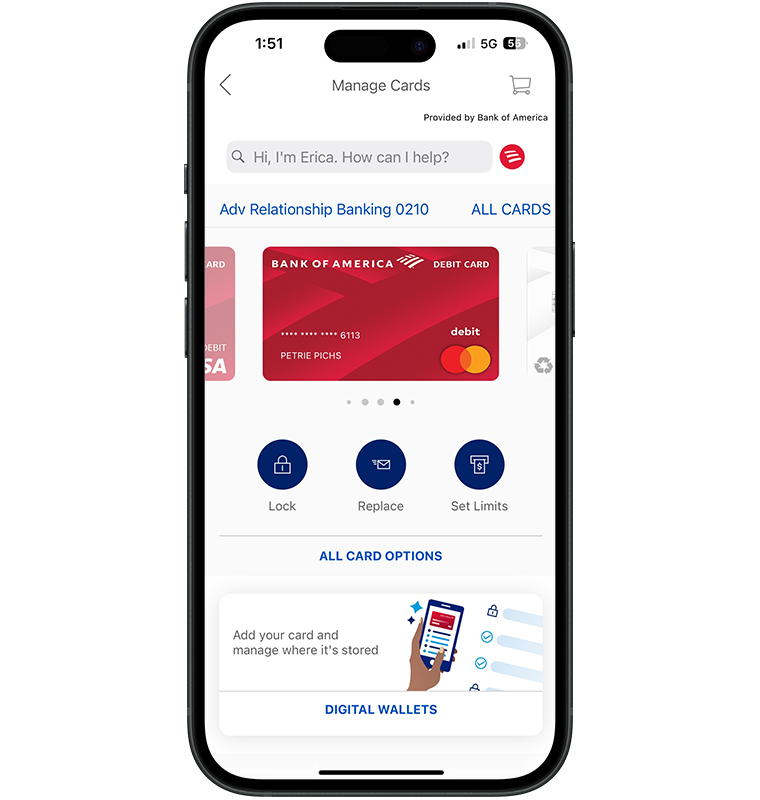

How do I close my Bank of America credit card online

The company doesn't allow customers to close their credit card accounts online. If you contact a customer service representative online, the representative will redirect you to the phone number where you can cancel.

How to cancel a credit card without destroying your credit score

How to cancel credit cards without hurting your creditCheck your outstanding rewards balance. Some cards cancel any cash-back or other rewards you've earned when you close your account.Contact your credit card issuers.Send a follow-up letter.Check your credit report.Destroy your card.

How many points will I lose if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points. Two-thirds of people who open a credit card increase their overall balance within a month of getting that card.

Is it better to close a credit card or leave it open with a zero balance

In general, it's better to leave your credit cards open with a zero balance instead of canceling them. This is true even if they aren't being used as open credit cards allow you to maintain a lower overall credit utilization ratio and will allow your credit history to stay on your report for longer.

How much does my credit score drop if I close an account

Does Closing a Bank Account Affect Your Credit Bank account information is not part of your credit report, so closing a checking or savings account won't have any impact on your credit history.

How long will it take for Bank of America to close my account

How long does it take to close a Bank of America account Once you initiate the closing request, your Bank of America account can be closed right away. However, before that, it could take you some time to cancel subscriptions, complete all pending payments, and transfer funds.

Why is Bank of America charging me $12 dollars a month

Bank of America Advantage Plus Fees

A $12 monthly fee applies to the Advantage Plus account, but it can be waived if you: Maintain a $1,500 minimum daily balance. Have at least one eligible direct deposit of at least $250. Enroll in BofA's Preferred Rewards program.

Will my Bank of America account close at a zero balance

If you have a remaining balance, please transfer it to another account a few days before closing it because this process can take a while to complete. If your account has a negative balance, you'll need to pay it in full or talk to us before we can officially close it.

What if I want to cancel my credit card

Five steps to cancel a credit cardPay off balance. Pay off your entire balance before you close your credit card to avoid accidentally incurring additional fees.Use rewards. Be sure to redeem any rewards that haven't been used on your account.Call issuer.Check your credit report.Destroy card.

How easy is it to cancel a credit card

To cancel your credit card, call your credit card company and ask to close your account. You will also need to bring your balance to zero, but you may be able to close your credit card account first and then continue making the necessary payments.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

How many points will my credit score drop if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

How do I close my credit card without hurting my credit

How to cancel credit cards without hurting your creditCheck your outstanding rewards balance. Some cards cancel any cash-back or other rewards you've earned when you close your account.Contact your credit card issuers.Send a follow-up letter.Check your credit report.Destroy your card.

What is the minimum balance for Bank of America

Checking account fees Advantage Plus Banking

Make at least one qualifying Direct Deposit of $250 or more. Maintain a minimum daily balance of $1,500 or more. Enroll in the Bank of America Preferred Rewards® Program and qualify for the Gold, Platinum or Platinum Honors tier.

How do I avoid Bank of America 12 fees

You might like the Bank of America Advantage Plus Checking Account if you can waive the $12 monthly service fee by completing one of the following each month:Make at least one qualifying direct deposit of $250 or more.Keep at least $1,500 in your account daily.Be enrolled in the bank's Preferred Rewards.