Can you deposit convenience checks?

Can I deposit a convenience check

If you need cash quickly, using a convenience check can put cash in your account, often faster than a personal loan would. You can write the check to yourself and deposit it into your bank account without going through the loan application process.

Cached

How long does it take for a convenience check to clear

Credit card convenience checks usually clear within 3 days. But make sure your cash-advance limit is high enough before using one. Convenience checks count as cash advances, which means you'll only have a portion of your overall spending limit available. You'll also have to pay expensive fees and interest.

Is a convenience check the same as a personal check

A convenience check can be used as a personal check—but when you write a convenience check, the money comes out of the line of credit associated with your credit card. If you want to make a purchase with a convenience check, you simply make the check out to the merchant for the amount of your purchase and sign it.

Cached

What are convenience checks used for

Convenience checks are blank checks provided by lenders that borrowers can use to access credit lines. Convenience checks are typically used for purchases, balance transfers, or cash advances. Each lender writes their own terms for convenience check usage, which influences their advantages and risks.

Cached

How do I deposit a check that isn’t mine

Having Someone Endorse a Check So You Can Deposit It In Your Account. The exact process whereby someone endorses a check so that you can deposit it into your own account may vary from bank to bank or credit union to credit union. In general, this involves the person writing your name on the back and signing the check.

What type of check says for deposit only

If you write “for deposit only” on the back of a check made out to you and then sign your name, the check can only be deposited in your account. This is called a “restrictive indorsement,” and it should prevent you or any other person from cashing the check.

Where can I cash a $20000 check without a bank account

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

Do cashier checks clear instantly

When you deposit a check, you might see the money in your account, but you can't withdraw all of that money until the bank "clears" the deposit. Personal checks might take several days or weeks, but cashier's checks typically make the funds available within one business day.

Does Wells Fargo accept convenience checks

Convenience checks at Wells Fargo are called “Superchecks,” and according to the standard card agreement on the Wells Fargo site, anything a Supercheck is used for other than a balance transfer is considered a cash advance.

How can I cash a personal check that is not in my name

Check with your bank or the bank that issued the check to see if you have a document that they'll accept as ID. As a last resort, you can sign the check over to someone you trust and ask them to cash it for you. This creates a third-party check.

What convenience checks may not be written for

Convenience checks must not be used for employee reimbursements, cash advances, cash awards, travel-related transportation payments, or meals. Purchases made with the check must not require detailed specifications or an inspection report. Convenience checks should not be used for recurring payments.

Can I deposit a check thats not written to me

Can I Deposit a Check for Someone Else The answer is yes, generally speaking. It's possible to deposit checks on behalf of another person into their bank account or in some cases, your own bank account. Banks and credit unions may allow you to deposit checks for someone else when certain conditions are met.

Can you deposit a check that’s not in your name in your account

Having Someone Endorse a Check So You Can Deposit It In Your Account. The exact process whereby someone endorses a check so that you can deposit it into your own account may vary from bank to bank or credit union to credit union. In general, this involves the person writing your name on the back and signing the check.

What kind of checks Cannot be mobile deposited

The following are not eligible for Mobile Deposit: international checks, U.S. savings bonds, U.S. postal money orders, remotely created checks (whether in paper form or electronically created), convenience checks (checks drawn against a line of credit), non-American Express traveler's checks, cash, checks that are …

Can I deposit a check that says for mobile deposit only

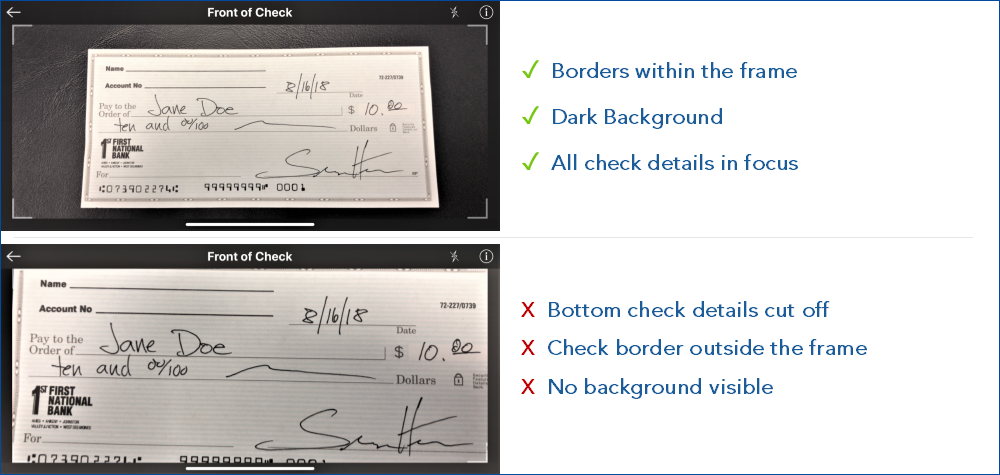

“For Mobile Deposit Only” must be written legibly below your signature. Unfortunately, if you deposit a check through our mobile app without a signature or this endorsement, the check may be rejected and the deposit will be removed from your account.

Where can I cash a $50000 check without a bank account

If you want to cash a large check without a bank account, you'll need to visit the bank or credit union that issued the check to you. If you're not an account holder, you may also be charged a fee for the service.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.

Do banks put a hold on cashier checks

Do banks put a hold on cashier's checks A bank can place a hold on a cashier's check if it has reasonable cause to believe that the check is uncollectible from the paying bank. Banks can also place a hold on cashier's check funds if the total amount of cashier's checks deposited in a single day exceeds $5,525.

Do cashiers checks ever bounce

Cashier's checks are NOT the same as cash!

Just because the money appears to be available in your account doesn't mean that the check has cleared and is legitimate. Counterfeit cashier's checks can look very authentic. The bank may still bounce the check if it's a forgery!

What is a Wells Fargo convenience check

Convenience checks at Wells Fargo are called “Superchecks,” and according to the standard card agreement on the Wells Fargo site, anything a Supercheck is used for other than a balance transfer is considered a cash advance.