Can you dispute an interest charge?

Can I get interest charges refunded

Interest charges are entirely fair and can't be refunded unless something very unusual has occurred, but the other two charges are more murky. Most credit card companies will charge you a fine for missing a payment or going over your card limit.

How do you get out of interest charges

If you'd like to avoid paying interest on your credit card, you have two options. You can pay off your balance before your grace period ends, or you can apply for a credit card that offers a 0 percent intro APR on purchases for up to 21 months.

Can I ask my credit card company to stop charging interest

Whether you're in arrears or struggling to keep on top of your regular payments, asking your creditors to freeze interest and charges can help you clear your debts and get back on track quicker. They may agree to freeze interest for an agreed length of time if you tell them about your financial difficulties.

Can I dispute a credit card charge that I willingly paid for

Disputing a credit card charge

Bad service and service not rendered are also eligible reasons to dispute a charge, even if you willingly made the purchase. For example, if you purchase something online that shows up broken, your credit card issuer can assist with getting your money back.

Why did I get charged interest if I paid in full

This means that if you have been carrying a balance, you will be charged interest – sometimes called “residual interest” – from the time your bill was sent to you until the time your payment is received by your card issuer. Your cardholder agreement should tell you the rules your card issuer applies.

Was charging interest illegal

When Did Usury Become Illegal Usury has a long history. It has primarily become illegal to prevent individuals from predatory loan practices; situations in which people need to borrow money but are charged a high interest rate, often resulting in difficulty paying back the loan with interest and/or financial ruin.

Can I ask my bank to remove interest

You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a reduction.

Does interest charge ruin credit

While they do not have a direct impact on credit scores, rising interest rates can affect several factors that do influence credit scores. Because they can lead to higher cumulative charges on credit card balances and adjustable-rate loans, higher interest rates can affect: Your total amount of outstanding debt.

How do I ask my credit card to remove interest

Most cards have a variable interest rate, meaning it can fluctuate based on several factors, including your card issuer's discretion. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a reduction.

What are grounds for disputing a credit card charge

When to dispute a credit card chargeUnauthorized charges.Charges with an incorrect amount or incorrect date.Charges for undelivered goods and services.Calculation errors.Failure to post payments or credits for returns.Failure to send bills to your current address.

What happens if you dispute a charge that you actually made

Once filed, your dispute is then turned over to the bank or card network for investigation. Your bank will typically give you a provisional refund, which will be in place until your claim can be validated by the bank.

Why do I have an interest charge on my credit card after paying it off

Residual interest, aka trailing interest, occurs when you carry a credit card balance from one month to the next. It builds up daily between the time your new statement is issued and the day your payment posts. Since it accrues after your billing period closes, you won't see it on your current statement.

Do I get charged interest if I pay minimum payment

If you pay the credit card minimum payment, you won't have to pay a late fee. But you'll still have to pay interest on the balance you didn't pay. And credit card interest rates run high: According to March 2023 data from the Federal Reserve, the national average credit card APR was 20.09%.

What is the highest interest rate you can legally charge

There is no federal regulation on the maximum interest rate that your issuer can charge you, though each state has its own approach to limiting interest rates.

How much interest is legal to charge

10%

CALIFORNIA: The legal rate of interest is 10% for consumers; the general usury limit for non-consumers is more than 5% greater than the Federal Reserve Bank of San Francisco's rate.

Can I get my interest lowered

If you maintain good credit and a clean payment history you can often be granted a lower interest rate. Even if you don't, don't give up. Continue to make payments on time, reduce outstanding debt and make a plan to try again in three to six months. Improving your credit health will help you make your case next time.

Why did I get charged interest on my credit card after I paid it off

This means that if you have been carrying a balance, you will be charged interest – sometimes called “residual interest” – from the time your bill was sent to you until the time your payment is received by your card issuer.

Can you ask bank to lower interest rate

If you're unhappy with your credit card's interest rate, also known as an APR, securing a lower one may be as simple as asking your credit card issuer. It may decline your request, but it doesn't hurt to ask.

Can I ask my bank to lower my credit card interest

You may be able to lower your credit card's interest rate simply by asking your card issuer. While card issuers aren't required to lower your rate, they may be willing to, especially if you have a long history of making on-time payments or if your creditworthiness has improved since you opened your account.

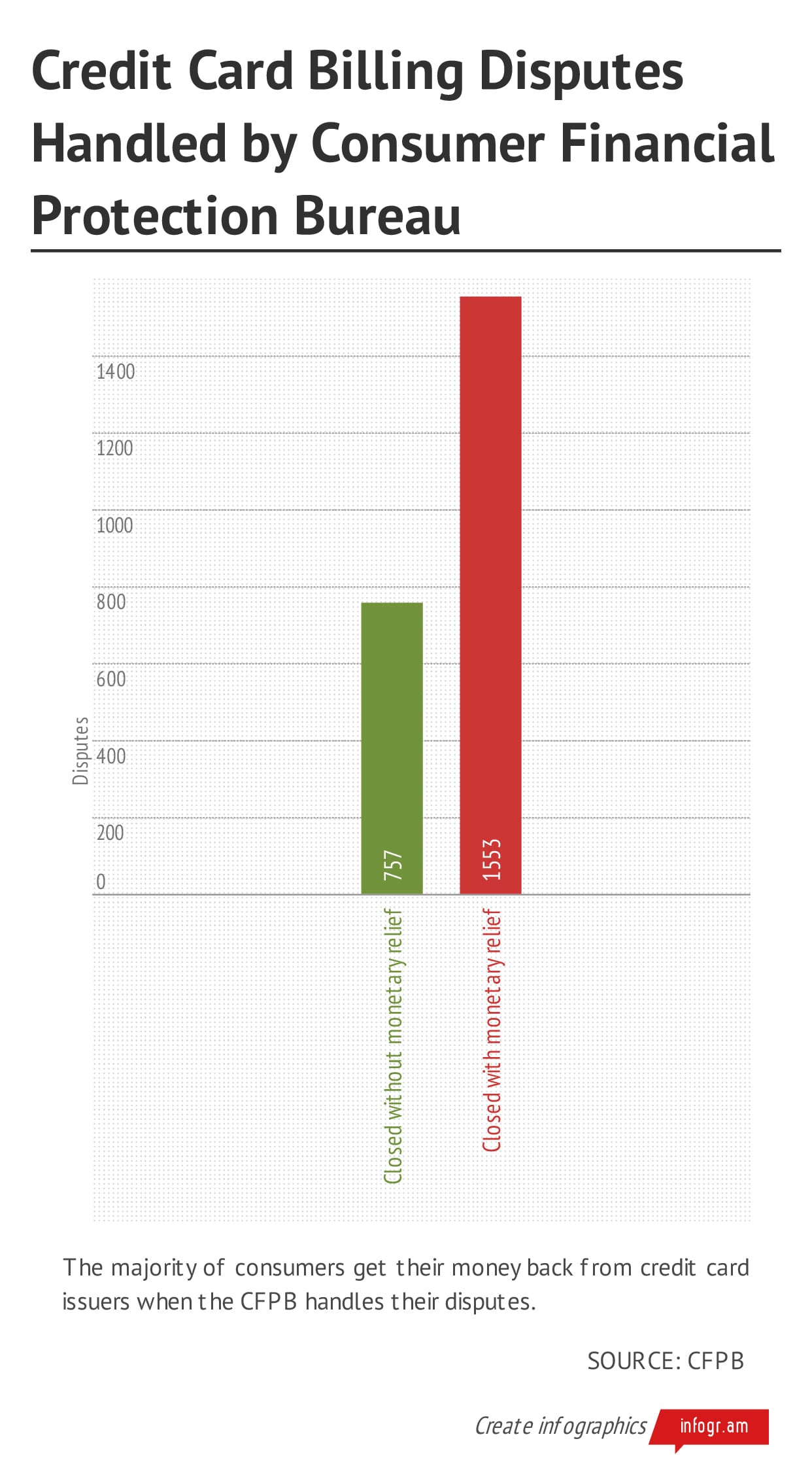

Are credit card disputes usually successful

You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.