Can you file animals on your taxes?

Can I put my pets on my taxes

Unfortunately, you can't claim pets as dependents, but you may be able to write off some expenses depending on the role they play in your life.

Cached

What animals can you write off on taxes

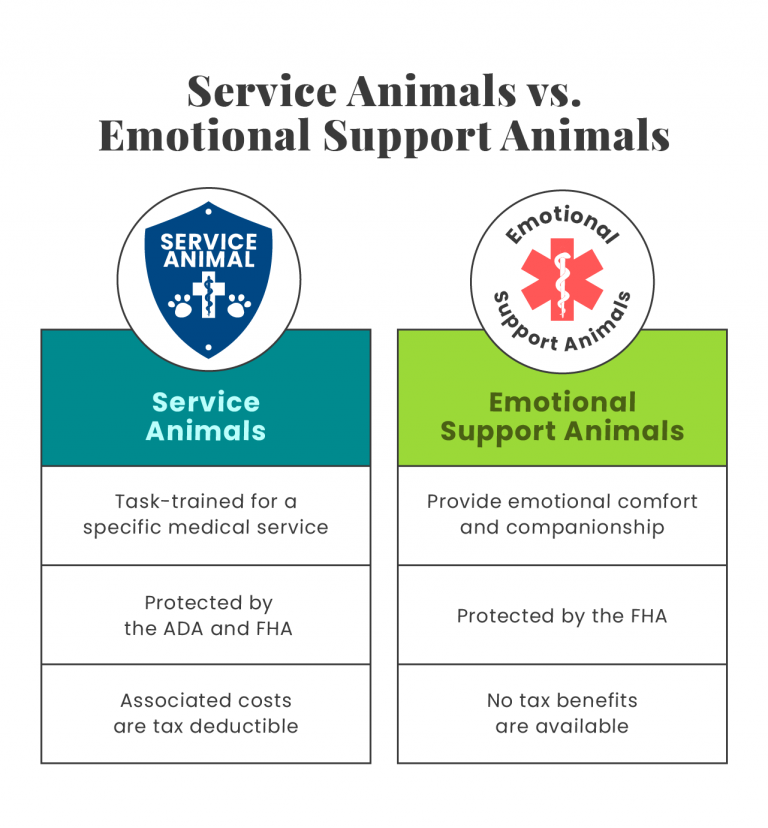

While you cannot claim pet medical costs for your pet, the costs associated with service animals – such as guide dogs for hearing or visual impairments, and certified service dogs for certain other health conditions, such as seizure dogs for those with epilepsy – may be deductible.

Cached

Can I fill my dog on my taxes

Tax Deductions for Pets

A pet cannot be claimed as a dependent on their owner's U.S. taxes. However, the IRS does grant certain tax deductions for dogs and other pets. These deductions include but are not limited to: Business animals.

Cached

What livestock can you claim on taxes

The cost of livestock, like cows, horses, and pigs, can be deducted on your taxes. Food to feed livestock on the farm is considered tax-deductible. Write off seeds and plants you purchase to grow and harvest.

Cached

Is a pet a tax credit

How can pet owners get a Tax Credit Pet medical expenses are generally not deductible on tax returns, although some may do so by using Schedule A for medical expenses paid during the tax year that exceed 7.5 percent of their adjusted gross income (Form 1040).

Can I get my dog a Social Security number

Wait – what Think of it this way: a microchip is like a social security card. Pets don't have wallets, so they carry their social security card under their skin. Your social security card contains a unique number assigned only to you, and your pet's microchip contains a unique number assigned only to them.

Can I claim my girlfriend as a dependent

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets certain Internal Revenue Service requirements. To qualify as a dependent, your partner must have lived with you for the entire calendar year and listed your home as their official residence for the full year.

Can you write-off a farm dog on taxes

You can't claim farm animals, pets or animals of any kind as dependents. You can, however, claim certain farm animals as farm tax deductions or business expenses. Was this topic helpful

Are chickens a tax write-off

(However, you can't ever deduct the costs of chickens and plants used as food for your own family.) Capital Expenses – While capital expenses related to improvement of your property or business are not usually deductible (the depreciate instead), you can possibly deduct costs related to: Fertilizer, lime, etc.

What qualifies as a pet

A pet is a companion animal which is an animal that lives with you in your home like a dog or cat. Companion animals are a result of domestication. They live with us because they fulfill our needs as well. They can provide us comfort, friendship and responsibility.

Can animals get a Social Security number

Think of it this way: a microchip is like a social security card. Pets don't have wallets, so they carry their social security card under their skin. Your social security card contains a unique number assigned only to you, and your pet's microchip contains a unique number assigned only to them.

What is a k9 tax form

The form, officially called Form W-9, Request for Taxpayer Identification Number and Certification, is typically used when a person or entity is required to report certain types of income. The form helps businesses obtain important information from payees to prepare information returns for the IRS.

What is the penalty for falsely claiming dependents

Because you are technically filing your taxes under penalty of perjury, everything you claim has to be true, or you can be charged with penalty of perjury. Failing to be honest by claiming a false dependent could result in 3 years of prison and fines up to $250,000.

Can I claim my girlfriend who doesn’t work as a dependent

Under no circumstance can a spouse be claimed as a dependent, even if they have no income. Furthermore, the Tax Cuts and Jobs Act of 2023 eliminated personal exemptions for tax years 2023 through 2025. However, tax credits for dependents were increased along with standard deductions based on filing status.

Are goats a tax write off

Like other forms of agricultural production, goat raising can be a tax write-off. Expenses from the goat enterprise may be deducted from your tax return to offset ordinary income.

Are dogs considered livestock by IRS

'Livestock' is defined as the horses, cattle, sheep, and other useful animals kept or raised on a farm or ranch. See THE AMERICAN COLLEGE DICTIONARY 713 (1970). Since the dogs are not used as farm animals, they cannot be considered livestock.

What does the IRS consider a hobby farm

According to the IRS, a farmer needs to show a profit 3 out of 5 years, even if the profits are not large. Always showing a loss on your Schedule F, can alert the IRS that the operation may be a hobby and not a for-profit business. You can expect future profits in your farming activities.

Can a hobby farm be a tax write off

Tax Benefits of Turning Your Hobby Into a Business

You can deduct your farm-related expenses, even if they go above your farm income. So if your farm operates at a loss, that loss can be used to offset your tax burden on your overall income.

Can you have a pet as a dependent

Can I Claim My Dog As a Dependent No, pets aren't dependents and the IRS considers their care costs as personal expenses.

Can you legally identify as an animal

Contrary to Stockton's claims, identifying as an animal is not a protected characteristic in U.S. law.