Can you get a car loan with a fair credit score?

Is fair credit good to finance a car

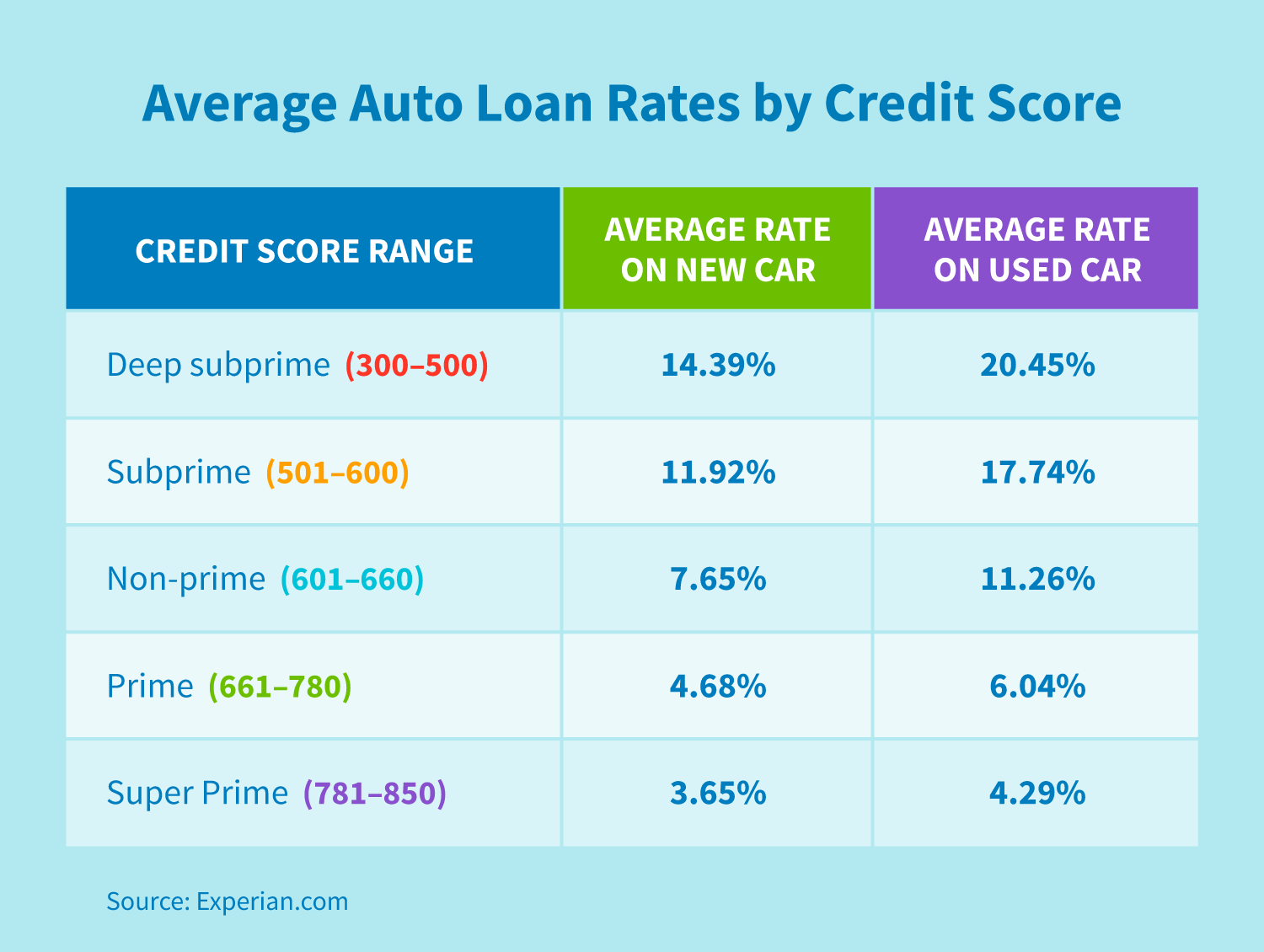

Car loan companies consider applicants with fair credit to be nonprime or subprime borrowers. Those distinctions mean you'll pay much higher interest rates than those with very good or excellent credit. Average rates for those with fair credit can be in the double digits for new and used car loans.

Cached

What is a fair credit score to buy a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

Can a fair credit score get you a new car

Less-than-perfect credit scores may not stop you from getting a car loan, but they can affect the interest rate and other loan terms you get. Generally, the lower your credit scores, the higher your interest rate will be. But there may be ways to get a better rate, like by making a down payment or getting a co-signer.

Cached

Can a 600 credit score get me a car

It's essential to be knowledgeable about how your auto loan process will be different than someone with a higher score. You might not have the same options, but you can still get an auto loan with a 600 credit score.

Cached

What can a fair credit score get you

Fair credit scores typically range from the upper 500s to the mid-600s, depending on the credit-scoring model. While there's room to improve your scores if they're in this range, you'll likely still be able to get a credit card or loan. But you may not qualify for the best rates or terms available.

What will a fair credit score get me

As the name implies, a fair credit score is OK—but not great. If you have a fair score, lenders may consider you to be a subprime borrower and charge you more upfront fees and higher interest rates. You might even have trouble getting approved for certain financial products.

Is a 620 credit score good to buy a car

Can I get an auto loan with an 620 credit score The short answer is yes, but you're likely to get a significantly higher-than-average interest rate. To put it into perspective, as of November 2023, the typical borrower with prime credit (720 or higher FICO score) got an APR of 5.34% on a 60-month new auto loan.

How bad is a credit score of 640

Your score falls within the range of scores, from 580 to 669, considered Fair. A 640 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Can I get a car loan with a credit score of 620

A credit score of 620 is considered fair but nothing too great. You can expect to get a car loan with an APR of about 6% for a new car and 10% for a used car. A lower or subpar credit score will always result in higher interest rates.

How bad is a credit score of 630

Your score falls within the range of scores, from 580 to 669, considered Fair. A 630 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Can I buy a car with a 610 credit score

Can I get an auto loan with an 610 credit score The short answer is yes, but you're likely to get a significantly higher-than-average interest rate. To put it into perspective, as of November 2023, the typical borrower with prime credit (720 or higher FICO score) got an APR of 5.34% on a 60-month new auto loan.

Can I finance a car with a 620 credit score

A credit score of 620 is considered fair but nothing too great. You can expect to get a car loan with an APR of about 6% for a new car and 10% for a used car. A lower or subpar credit score will always result in higher interest rates.

Is it hard to get a loan with a fair credit score

A fair credit score — one between 580 and 669 — doesn't necessarily mean you won't get approved for funding. However, you can expect slightly higher interest rates, shorter loan terms, and in some cases, higher fees.

Is 620 a fair credit score

A FICO® Score of 620 places you within a population of consumers whose credit may be seen as Fair. Your 620 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

What can I qualify for with a 620 credit score

You can borrow anywhere from a few thousand dollars to $100,000+ with a 620 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

What credit score do you need to buy a 50k car

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better, or a used-car loan around 8.75% or lower.

Is 610 credit score ok

A FICO® Score of 610 places you within a population of consumers whose credit may be seen as Fair. Your 610 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Can I get a 20k loan with 640 credit score

You will likely need a credit score of 660 or higher for a $20,000 personal loan. Most lenders that offer personal loans of $20,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

Can I get a 20000 loan with a 620 credit score

You will likely need a credit score of 660 or higher for a $20,000 personal loan. Most lenders that offer personal loans of $20,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

What can a 620 credit score get you

You can borrow anywhere from a few thousand dollars to $100,000+ with a 620 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.