Can you get an Affirm card?

Does Affirm have a physical card

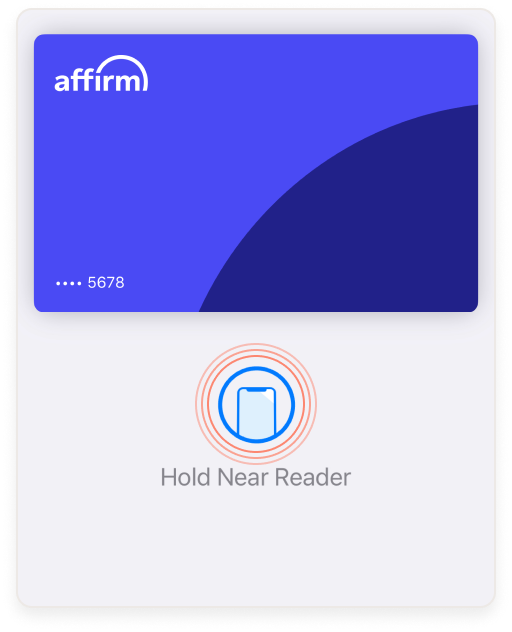

You'll receive a virtual Affirm card that can be added to your mobile wallet (Google Pay/Apple Pay) and a physical card to use in-store. Note that your physical and virtual cards will have different numbers. Simply use your Affirm card to make purchases where Visa is accepted.

Cached

Does Affirm offer credit card

Now in your wallet. Have it all with the Affirm Card—the flexibility to pay now and over time, without any of the fees or compound interest you'd get with a credit card. See how it works.

Cached

Can I get cash from Affirm virtual card

Open the Affirm app. Under Savings, tap See account. Tap Withdraw. Enter the amount you want to withdraw.

Is the Affirm card a Visa

Affirm Card Banking Services are provided by Evolve Bank & Trust, Member FDIC, issuer of the Affirm Card Visa® pursuant to a license from Visa U.S.A. Inc.

Cached

What is the downside of Affirm

Cons Explained

With standard interest rates ranging from 10% to 30%, customers may want to explore other payment options first for retailers that do not offer 0% financing. May require a credit check. Affirm may do a soft credit inquiry to verify a customer's identity and to prequalify them for their spending limit.

Can I use Affirm to pay a bill

Affirm is designed for financing purchases when shopping with partner merchants. Though some platforms that offer short-term installment loans also offer bill payment services or money transfer services, Affirm isn't one of them.

How can I get an Afterpay card

Simply download the Afterpay mobile app to set up Afterpay Card. Visit the In-Store tab and follow the prompts to add Afterpay Card to your digital wallet. When you're ready to pay, tap to pay with Afterpay Card using Apple Pay, Google Pay, or Samsung Pay.

Can you turn Affirm into cash

When you've completed your payment, you'll be transferred to your online banking account. From there, select “Transfer Money” and click “Transfer to a Bank Account.” 4. Next, select the bank account you'd like to transfer funds to and enter the exact amount you'd like to transfer.

Can I borrow money from Afterpay

Loans through the Afterpay Pay Monthly program are underwritten and issued by First Electronic Bank, Member FDIC. A down payment may be required. APRs range from 0% to 35.99%, depending on eligibility.

What is the limit on the Affirm debit card

Keep in mind that Affirm sets a daily limit on the total amount a user can spend. The card has a flexible spending limit based on the available balance in the linked personal bank account – with daily limits reaching a maximum $2,500 daily limit and a maximum $15,000 monthly spending limit.

Is Walmart Affirm a credit card

When you shop at Walmart with Affirm, you'll never pay more than what you see up front. Unlike most credit cards, we charge simple interest, not compound interest. Plus, there are no late fees, hidden fees, or just because fees. Shop at your favorite stores or discover someplace new with the Affirm app.

Will using Affirm build credit

When you borrow with Affirm, your positive payment history and credit use may be reported to the credit bureaus. This can help you build credit with the credit bureaus as long as you make all of your payments on time and do not max out your credit.

Does Affirm hurt your credit

Affirm checks your credit with a soft credit pull, which doesn't hurt your credit score. Though there's no minimum requirement, Affirm considers your credit score as part of your application.

Can Affirm give you cash

Have you ever wished that you could have access to your money without carrying a physical wallet Now, with the help of Affirm virtual cards, you can do just that! With a few easy steps, you can easily access your cash from your virtual card, making it easier than ever to pay for goods and services.

What happens if you don’t pay Affirm back

Affirm never charges late fees, but if you've stopped making payments for more than 120 days, we may charge off your loan. Once a loan has been charged off, it may be sent to a third-party collections agency at any time. Charge-offs may appear on your credit report and must still be repaid.

How do I get an affirm virtual card

You can request a virtual card in your Affirm account. There are three places to access your virtual card: in the Affirm app, in your account on the Affirm website, or via the confirmation email we send you after you request the card. When paying with your virtual card online, it works like a standard credit card.

Does Afterpay offer a physical card

Always interest-free. What is the Afterpay Card Afterpay Card is a contactless digital card stored in a customer's digital wallet on their phone. The customer adds their Afterpay Card to their digital wallet via a one-time setup prompted in their Afterpay app.

How do I transfer money from Afterpay to my bank account

It's not possible to transfer Afterpay to your bank account since it isn't classified as a personal loan or line of credit. When setting up a payment plan on Afterpay you need to either use a credit or debit card and you cannot transfer a balance on Afterpay to another card.

Can you borrow cash from Klarna

If you qualify, you could also use Klarna Financing. This option allows you to borrow money in the form of a line of credit from Klarna. But this option comes with an APR that may be on the higher end compared to some credit card options.

How do I get $3000 on Afterpay

Currently, customers receive an initial $600 credit limit via Afterpay, which can increase to up to $3,000 after payments are made consistently and on-time.