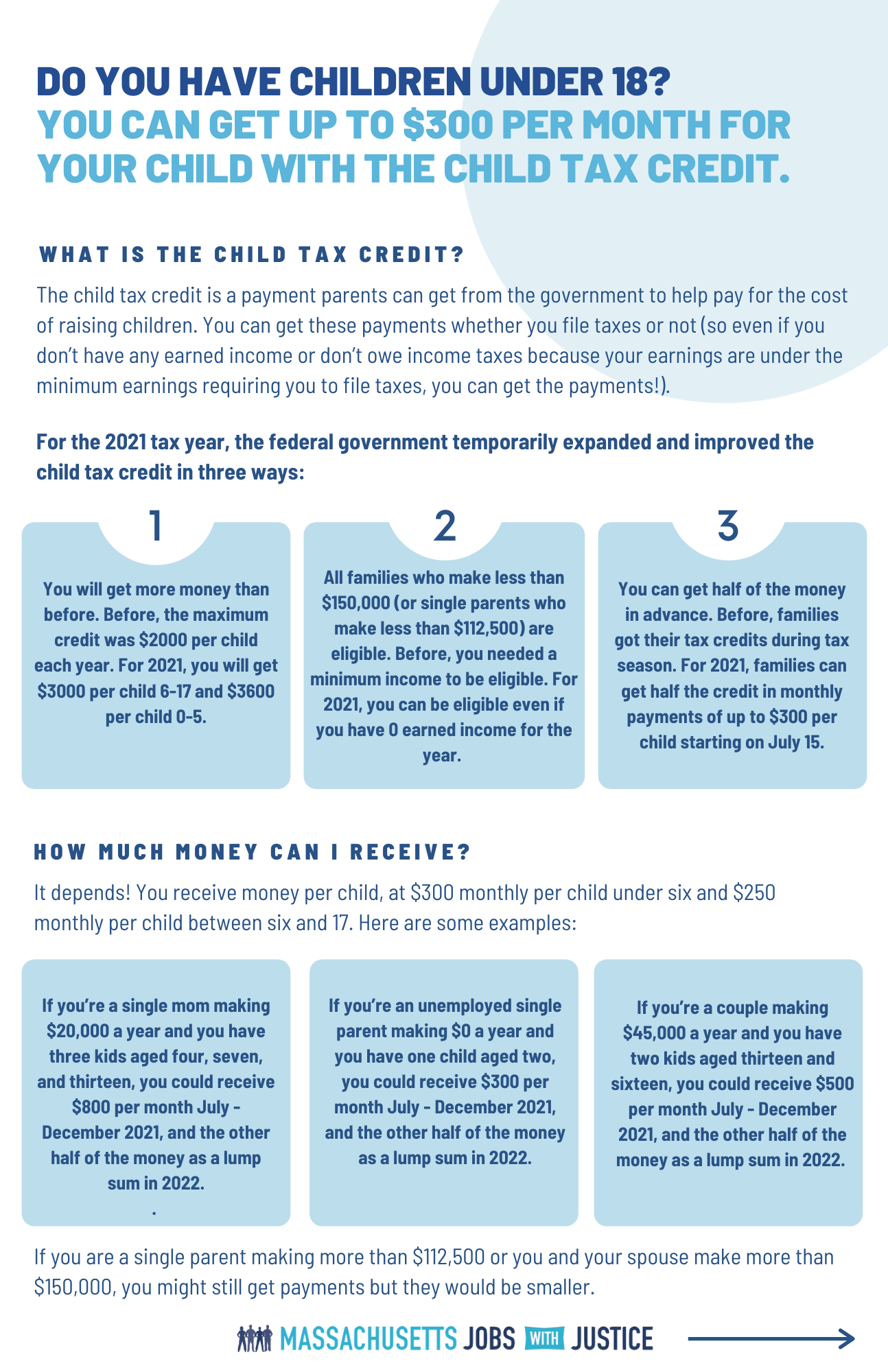

Can you get Child Tax Credit even if you don’t work?

Can I get a tax refund if I have no income

Credits may earn you a tax refund

If you qualify for tax credits, such as the Earned Income Tax Credit or Additional Child Tax Credit, you can receive a refund even if your tax is $0. To claim the credits, you have to file your 1040 and other tax forms.

Can a stay at home mom claim child on taxes

A stay-at-home mom can claim her child as a dependent even if she has no income. To do so, both spouses must agree that they can claim the child before filing. In most cases, it would be more advantageous for the spouse with income to claim the child.

Can you get EIC with no income

You must have at least $1 of earned income (pensions and unemployment don't count). You must not have to file Form 2555, Foreign Earned Income; or Form 2555-EZ, Foreign Earned Income Exclusion. If you're claiming the EITC without any qualifying children, you must be at least 25 years old, but not older than 65.

What happens if you never get Child Tax Credit

If you are eligible for the Child Tax Credit, but did not receive advance Child Tax Credit payments, you can claim the full credit amount when you file your 2023 tax return.

What disqualifies you from earned income credit

For the EITC, we don't accept: Individual taxpayer identification numbers (ITIN) Adoption taxpayer identification numbers (ATIN) Social Security numbers on Social Security cards that have the words, "Not Valid for Employment," on them.

Do you have to file a tax return if you don t make enough money

The minimum income amount depends on your filing status and age. In 2023, for example, the minimum for single filing status if under age 65 is $12,950. If your income is below that threshold, you generally do not need to file a federal tax return.

Can I claim my mother as a dependent if she doesn’t work

To qualify as a dependent, Your parent must not have earned or received more than the gross income test limit for the tax year. This amount is determined by the IRS and may change from year to year. The gross income limit for 2023 is $4,400.

Is a stay-at-home mom considered unemployed

No. Unemployed refers to individuals who are looking for work but have not yet found it. A stay-at-home mom or dad has a job—society doesn't recognize the economic contribution of the work they do. Was this worth your time

How do I claim Child Tax Credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

What are the 6 requirements for claiming a child as a dependent

There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income. If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent.

Can you file taxes if you didn t work but have a child 2023

You can still file your taxes even if you have no income if you choose. Can you file taxes with no income but have a child or dependent If you have no income but have a child/dependent, you can still file your taxes.

Who is eligible for advance Child Tax Credit

The individual is the taxpayer's son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, a grandchild, niece, or nephew). The individual does not provide more than one-half of his or her own support during 2023.

Why would the IRS deny child tax credit

Most errors happen because the child you claim doesn't meet the qualification rules: Relationship: Your child must be related to you. Residency: Your child must live in the same home as you for more than half the tax year. Age: Your child's age and student or disability status will affect if they qualify.

Can you file taxes with no income but have a dependent 2023

You can still file your taxes even if you have no income if you choose. Can you file taxes with no income but have a child or dependent If you have no income but have a child/dependent, you can still file your taxes.

What happens if you don’t make enough money to pay taxes

If you find that you cannot pay the full amount by the filing deadline, you should file your return and pay as much as you can by the due date. To see if you qualify for an installment payment plan, attach a Form 9465, “Installment Agreement Request,” to the front of your tax return.

Can my wife claim me as a dependent if I didn’t work

If you and your spouse are married filing jointly, you can claim one exemption for your spouse and one exemption for yourself. If you're married filing separately, you can claim an exemption for your spouse only if your spouse: Had no gross income. Isn't filing a return.

Do you claim a stay at home mom as a dependent

In certain situations, you can claim your parent as a dependent and file as head of household (HOH). To claim head of household (HOH) filing status, these must apply: You're unmarried on the last day of the year. You paid more than half the cost of keeping up a home for the year.

Can I get paid for being a stay-at-home mom

To answer the main question pressing on everyone's minds – yes, it's possible to earn money from the comfort of your own home during free time or even while you're busy watching the kiddos. We gathered a list of our favorite ways to earn extra cash as a stay-at-home parent.

Can I get benefits for being a stay-at-home mom

Social Security for Stay-at-Home Moms (and Dads): How to Qualify for Benefits. Just because you don't bring home a paycheck doesn't mean you're not working. A stay-at-home parent can get a Social Security check just like any other worker.

Who can claim a child on taxes

You can claim a child as a dependent if he or she is your qualifying child. Generally, the child is the qualifying child of the custodial parent. The custodial parent is the parent with whom the child lived for the longer period of time during the year.