Can you lose money with a fiduciary?

Can fiduciary lose your money

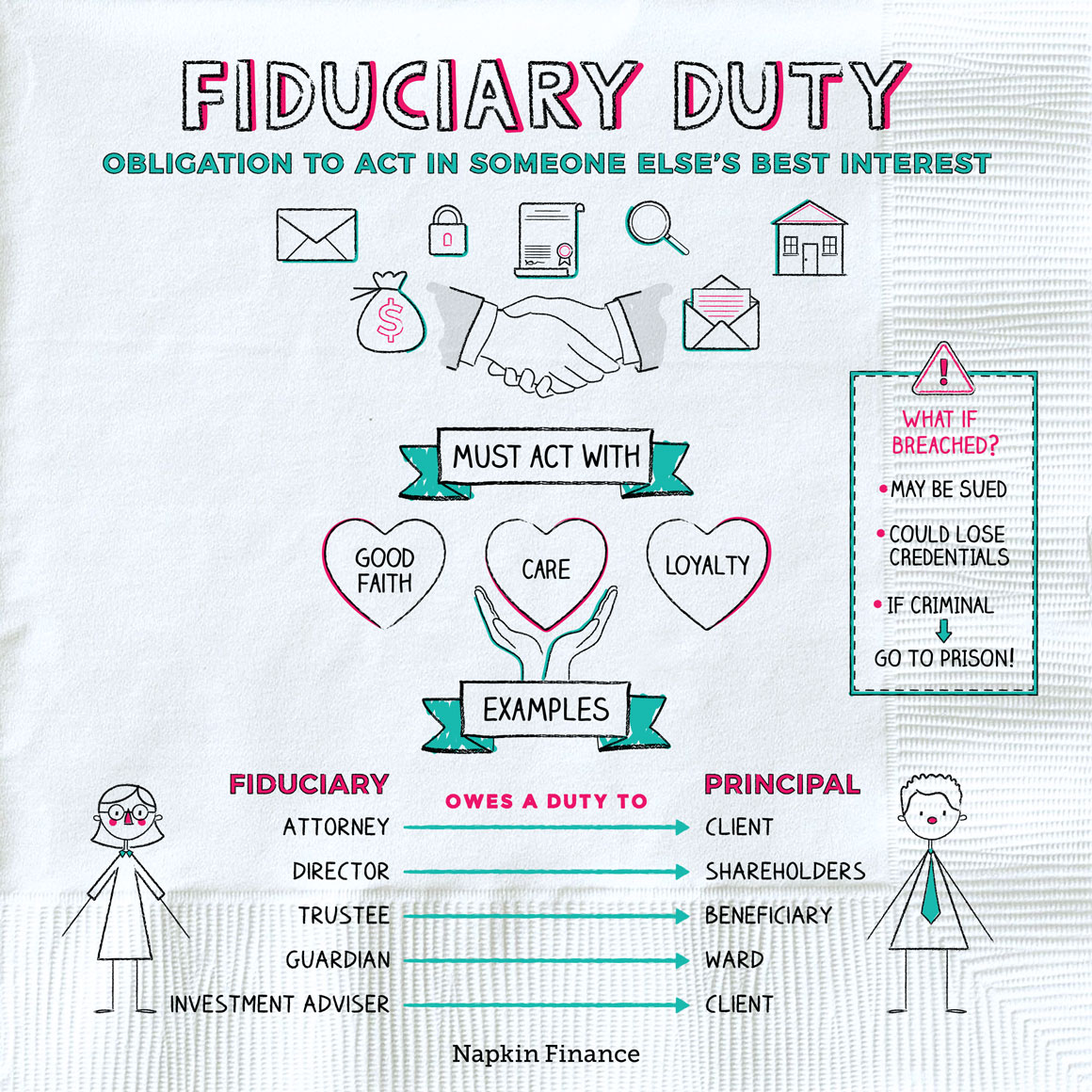

Fiduciaries who breach their duty may face tough civil and criminal penalties. It can be difficult, however, to prove a breach of duty in court. Moreover, they can do their duty towards their clients and still lose money for the client.

Cached

What are the risks of being a fiduciary

Fiduciaries are required to act prudently, follow the terms of plan documents and avoid conflicts of interest. And if they don't Fiduciaries who don't follow these principles of conduct could be held personally liable to restore losses to the plan or to restore any profits made through improper use of plan assets.

Is it a good idea to get a fiduciary financial advisor

A fiduciary is someone who has an obligation to act in your best interest. A financial advisor is a job title that anyone advising about your finances can use. If you're in the market for a financial advisor, you should strongly consider a financial advisor who is a fiduciary or a fiduciary financial advisor.

Should I trust a fiduciary

It's recommended that you use a fiduciary financial advisor in most scenarios. Not only are they usually more affordable, they are legally and federally held to high ethical standards. Their role, by nature, is designed to serve your best interest and maximize your financial benefit and not their own.

What is a typical fiduciary fee

401(k) Financial Advisor Fees – A Study of 860 Plans

| Plan Asset Range | $0-$500k (416 plans) | $1M-$5M (286 plans) |

|---|---|---|

| Range | 0.02% – 9.36% | 0.05% – 1.00% |

| Average | 0.70% | 0.56% |

| Median | 0.50% | 0.50% |

| Formulas Used |

How do I get out of a fiduciary

To remove a fiduciary, you will need to file a Petition with the Surrogate's Court. The Petition should be filed in the County where the Fiduciary was issued their Letters. The petition should set forth the facts and circumstances that you believe warrant the removal.

Why would someone hire a fiduciary

Courts may appoint a Professional Fiduciary as a neutral third party to protect vulnerable and incapacited people from abuse, neglect and exploitation. Professional Fiduciaries may also become members of the Professional Fiduciary Association of California (PFAC).

Why is the fiduciary rule bad

The problem with DOL's fiduciary rule is not the requirement to act in a client's best interest, but the dissuasion of commission-based accounts and the imposition of the Best Interest Contract (BIC) Exemption, which opens up financial advisors to the risk of a litigious clientele.

Is a fiduciary better than a broker

In contrast to an investment broker's role to facilitate the transactions you ask them to carry out, a fiduciary financial advisor will work on your behalf and make decisions they believe are right for you based on their expertise.

How much money do you need to get a fiduciary

Trust. The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100.

What can a fiduciary spend money on

Additional, responsibilities of the fiduciary include, but are not limited to the following: Utilizing the funds for the daily needs (e.g., food, clothing, housing, medical expenses, and personal items) of the beneficiary and his/her recognized dependents.

How long does a fiduciary duty last

The fiduciary duties continue until the asset or liability has been divided between the parties. As such, even if an asset is divided years after the end of the family law case, the parties continue to have the duty to fulfill their fiduciary duties with respect to each undivided or non-awarded asset or debt.

What terminates a fiduciary relationship

The fiduciary relationship between the principal and agent dissolves when the parties cease to intend to maintain a fiduciary relationship, either formally or informally.

How do you tell if an advisor is a fiduciary

A good starting point for determining whether someone is a fiduciary advisor is by looking them up through the SEC's adviser search tool. If their firm (and by extension they themselves) acts as a Registered Investment Adviser, they will have what is called a Form ADV Part 2A filing available to be viewed online.

What percentage do fiduciaries charge

401(k) Financial Advisor Fees – A Study of 860 Plans

| Plan Asset Range | $0-$500k (416 plans) | $1M-$5M (286 plans) |

|---|---|---|

| Range | 0.02% – 9.36% | 0.05% – 1.00% |

| Average | 0.70% | 0.56% |

| Median | 0.50% | 0.50% |

| Formulas Used |

What is abuse of fiduciary responsibility

A breach of fiduciary duty in California happens when an individual or entity is in a position of trust and fails to act in their client's best interests. In California, the responsibility for proving a breach of fiduciary duty falls on the plaintiff (i.e. beneficiary, ward, advisee, client).

What is the best fiduciary company

Find a Fiduciary Financial Advisor

| Rank | Financial Advisor | Assets Managed |

|---|---|---|

| 1 | CAPTRUST Find an Advisor Read Review | $714,587,898,072 |

| 2 | Fisher Investments Find an Advisor Read Review | $173,418,270,044 |

| 3 | GW&K Investment Management, LLC Find an Advisor Read Review | $46,803,858,104 |

What is a typical fee for a fee-only fiduciary

The latter is typically around 1% of a client's portfolio's value each year. Their fee-only pay structure means they do not receive commissions or other payments from the providers of financial products they recommend to clients.

What are the rules that a fiduciary must follow

Fiduciaries must act prudently and must diversify the plan's investments in order to minimize the risk of large losses. In addition, they must follow the terms of plan documents to the extent that the plan terms are consistent with ERISA. They also must avoid conflicts of interest.

What is the current fiduciary rule

The current DOL fiduciary rule says that a broker-dealer and its registered representatives (advisors) are fiduciaries to a plan under ERISA if a functional 5-part test is satisfied. This same 5-part test applies to determining whether an advisor is a fiduciary to an IRA under the Internal Revenue Code (the Code).