Can you make credit with Netflix?

Can paying for Netflix build credit

Subscriptions that may help build your credit include streaming services (think Netflix® and Hulu®) and other recurring payments to applications on your phone (think Headspace® or Spotify®).

Cached

Does Netflix count as credit

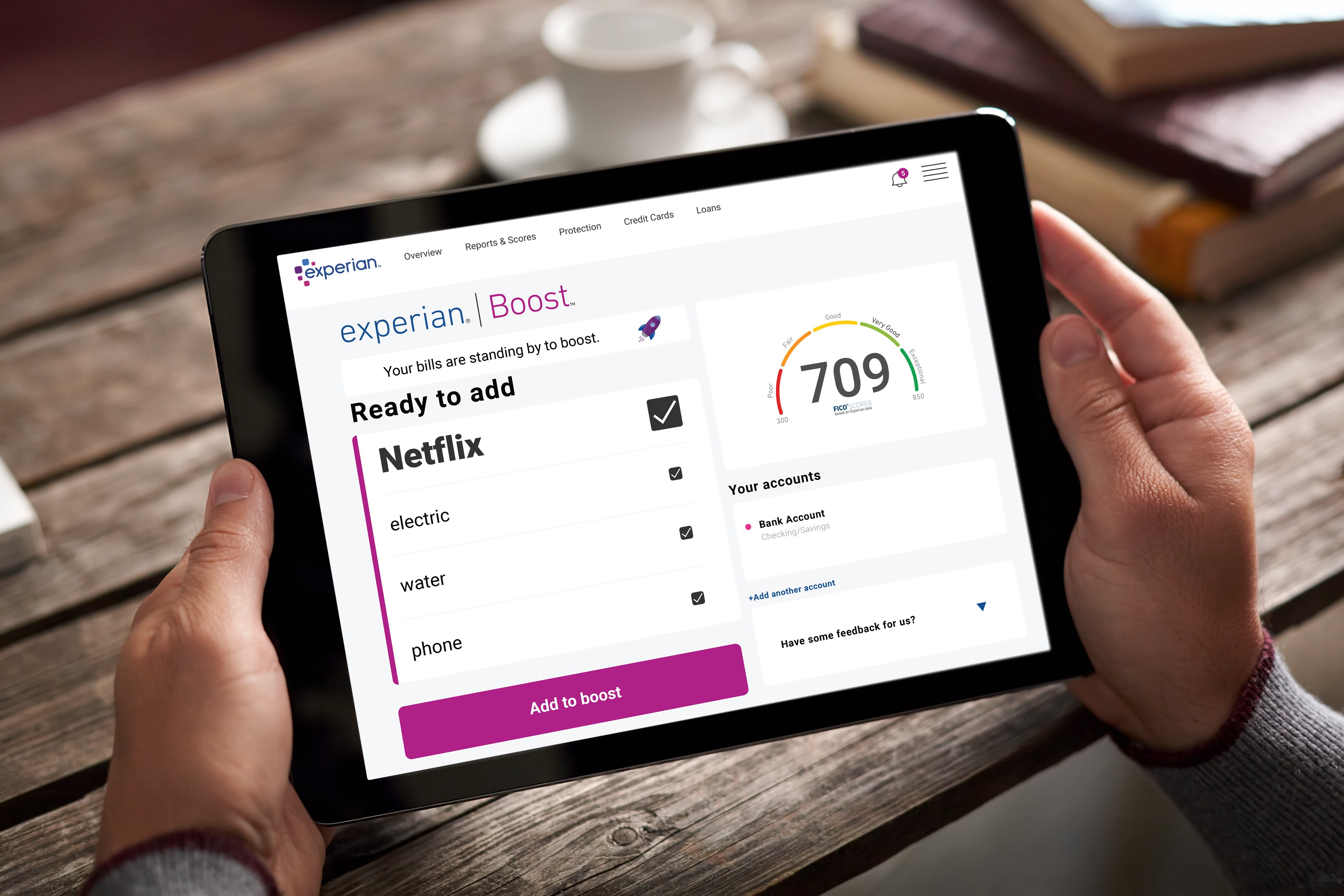

Experian Boost™ Adds Netflix to Your Credit Report

If you're a long-time Netflix user, paying your Netflix account balance every month can count as an on-time payment on your credit report.

Cached

Can you build credit with subscriptions

Subscription services can help you build your credit if your payment activity is reported to the credit bureaus. You can ensure this happens by using your credit card to pay your bills or signing up for a service that reports your payment activity to the credit bureaus.

Should I put Netflix on my credit card

Use a credit card for any recurring payments.

Any recurring payments you have such as subscription services that renew every month or year like Netflix, Amazon Prime, or Spotify are good to put on your credit card, especially an older one that you no longer use as much.

Cached

What bills boost your credit score

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

Can Hulu boost your credit score

You sure can! Video streaming services like Netflix®, Disney+™, HBO™ and Hulu™ are all eligible for Boost. Just make sure the accounts are in your name and the bills have 3 payments in the last 6 months (including 1 payment within the last 3 months).

How can I build my credit by paying bills

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

What payments can build my credit

If you're having difficulty getting approved for a credit card or you're looking for alternative methods, consider these ways to build credit:Make your rent and utility payments count.Take out a personal loan.Take out a car loan.Get a credit builder loan.Make payments on student loans.

What app uses subscriptions to build credit

GROW CREDIT: BEST FOR STREAMING SERVICES

Similar to Experian Boost, Grow Credit works by reporting subscription service payments (like Amazon Prime) to the three major bureaus. The difference is that Grow Credit provides you with a debit card you must use to pay for your subscription services.

Can I run my debit card as credit if I have no money

If you don't have enough funds in your account, the transaction will be declined. When you choose to run your debit card as credit, you sign your name for the transaction instead of entering your PIN. The transaction goes through Visa's payment network and a hold is placed on the funds in your account.

What bills help build credit

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What are 3 things that will raise your credit score

But here are some things to consider that can help almost anyone boost their credit score:Review your credit reports.Pay on time.Keep your credit utilization rate low.Limit applying for new accounts.Keep old accounts open.

How to get 300 credit score fast

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

How to build credit 100 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

What utilities build credit

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to build credit from $500

Ways to start rebuilding from a credit score of 500Pay your bills on time. Payment history is an important factor in calculating your credit scores.Maintain a low credit utilization ration.Consider a secured credit card.Look into credit counseling.

Which app gives you your real credit score

With myFICO, you can view and monitor your FICO Scores and credit reports right from your fingertips. You'll get alerts on your iOS device when changes are detected. Certain features are available only with eligible myFICO subscriptions. Learn more at www.myfico.com.

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.