Can you open a bank account without a credit report?

Can I open a checking account without a credit check

Opening a checking and savings account requires that you have proof of a few things: your age (you must be 18 or share the account with a legal guardian), your identification (you must be a legal U.S. resident) and your current address. But you don't have to worry about where your credit score stands.

What proof do you need to open a bank account

ID and verification.Personal Details.Address Details.Contact Details.Income & Expenditure Details.Overdraft requests (optional)Packaged Accounts (accounts where you pay a monthly fee and receive insurance benefits)Switching.

Can you be denied a checking account because of bad credit

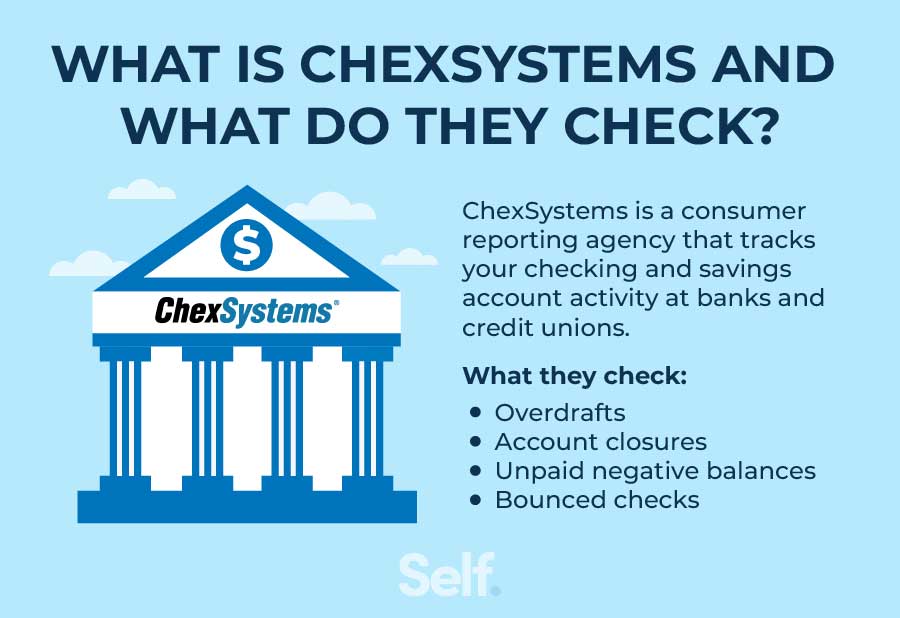

Opening a bank account is easier than applying for a credit card, but consumers should be aware that they can still be denied — likely because of negative actions found on their ChexSystems or Early Warning Services report.

What’s the easiest bank account to open

15 Easiest Bank Accounts to Open OnlineUFB Direct.Varo.Albert.Discover.Marcus.Chime.Chase Bank.Ally Bank.

Do all banks require credit checks

Do banks check your credit report While most banks and credit unions don't check credit reports, they do technically have a right to do so. Negative account information, such as unpaid overdrafts or fraud, will likely affect your credit score as well.

What bank does not run your credit

Best Online Banks with no Credit Check

| Bank Name | Minimum opening deposit | Link |

|---|---|---|

| 👍 Chime | None | Learn More |

| NorthOne | None | Learn More |

| Extra | None | Learn More |

| Wise Business | $10 | Learn More |

What are 5 things you need to open a bank account

Acceptable Forms of ID for BanksDriver's license.REAL ID card.DoD ID card (also known as Department of Defense ID Card)Passport/Passport card.Social security card.Birth certificate.

Can you open a bank account without proof of income

However, most banks will require the following documents for an individual to open an account: Valid government-issued ID (driver's license, passport, etc.) Social Security number or Individual Taxpayer Identification Number (ITIN) Proof of address (utility bill, lease agreement, etc.)

Can I open a bank account with bad credit history

Let's start with the good news. Having a poor credit score will not prevent you from opening a bank account. Your credit score is taken from information on your credit reports, documents that track your history as a borrower, and are compiled by the three major credit bureaus: Experian TransUnion and Equifax.

How do I get a bank account with bad credit

The first step to take is to consider opening a second chance bank account. This type of account is offered by many institutions with lower minimum payments. Associating positive activity with this account, like making regular payments and avoiding overdrafts, can help improve your ChexSystems score.

What bank gives you $200 to open an account

Chase Bank: $200 or $100 bonus

To earn $200, open a new Total Checking account and have a direct deposit.

Why won t banks accept me

Reasons You Can Be Denied a Checking Account

Excessive overdrafts or nonsufficient funds incidents. Unpaid fees or negative account balances, whether from an active or closed account. Suspected fraud or identity theft. Applying for too many bank accounts over a short period of time.

Does Bank of America require a credit check

While Bank of America may pull credit reports from any of the major credit bureaus: Experian, Equifax and TransUnion, consumer-reported data suggests the bank relies heavily on Experian to source many credit reports, followed by Equifax and TransUnion.

Do all banks do credit checks

Banks and credit unions do not perform a credit check when opening a new account. It's not that they don't have a right to do so, they just typically do not, though there can be a correlation between credit history and banking history when it comes to outstanding items such as unpaid overdraft fees or fraud.

What 3 things do you need to open a bank account

You'll need basic information like your home address, email address and phone number, as well as identification documents such as a driver's license, Social Security Number, and a minimum opening deposit amount. Most checking accounts come with checks, some don't – choose which you'll need.

Does Chase give you $200 for opening an account

How does the Chase $200 bonus work The $200 bonus offer simply requires you to open an eligible new Chase checking account and set up qualifying direct deposits. No Chase promotion code is needed to activate or claim the $200 bonus offer. You do, however, have to be a new customer to get the bonus.

How do banks verify proof of income

Bank statements are among the most common documents used for income verification. Bank statements show the movement of funds into and out of an account and provide insight into the borrower's income, spending, and debt repayment history. Retired and self-employed borrowers often use bank statements as proof of income.

What will the bank accept as proof of income

Paystubs and Other Documents to Prove Income

Employment Verification Letter: An employment verification letter verifies income or salary and dates of employment. Bank statements: Your bank statements document all of your incoming deposits, including payroll deposits, and the checks and debits coming out of your account …

How to get a bank account with really bad credit

Open a second chance checking account.

Many banks offer “second chance” checking accounts that give people with lousy banking history the chance to make good. You should also check out your local credit union, as many of them offer second chance checking as well.

Why would I be denied a bank account

Reasons You Can Be Denied a Checking Account

Excessive overdrafts or nonsufficient funds incidents. Unpaid fees or negative account balances, whether from an active or closed account. Suspected fraud or identity theft. Applying for too many bank accounts over a short period of time.