Can you pay off OneMain Financial loan early?

Is it OK to pay off a loan early

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.

Cached

How do I get out of a loan with OneMain Financial

To cancel your loan, please contact the branch listed on your loan agreement or call (800) 961-5577.

Does OneMain auto loan let you pay off early

Yes, you can pay off OneMain Financial loans early, which is a smart idea because it will save you money on interest. OneMain Financial does not charge a prepayment penalty, meaning that you will not be charged extra if you pay off the loan sooner than you're required to.

Cached

What is the highest loan amount from OneMain Financial

OneMain makes personal and auto loans from $1,500 – $20,000. Not all applicants will qualify for larger loan amounts or most favorable loan terms.

What happens if you pay off a loan too quickly

Paying off the loan early can put you in a situation where you must pay a prepayment penalty, potentially undoing any money you'd save on interest, and it can also impact your credit history.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Do you pay less interest if you pay off a loan early

If I pay off a personal loan early, will I pay less interest Yes. By paying off your personal loans early you're bringing an end to monthly payments, which means no more interest charges. Less interest equals money saved.

Does a OneMain loan help your credit

A OneMain Financial personal loan loan does help you build credit, as long as you make the monthly payments on time. If you do make payments on time, OneMain Financial will relay positive information to all three major credit bureaus each month, which will improve your credit score.

What happens if I pay an extra $100 a month on my car loan

Your car payment won't go down if you pay extra, but you'll pay the loan off faster. Paying extra can also save you money on interest depending on how soon you pay the loan off and how high your interest rate is.

Can you pay off a 72 month car loan early

Some lenders make it difficult to pay off car loans early because they'll receive less payment in interest. If your lender does allow early payoff, ask whether there's a prepayment penalty, since a penalty could reduce any interest savings you'd gain.

How much would a 5000 loan cost per month

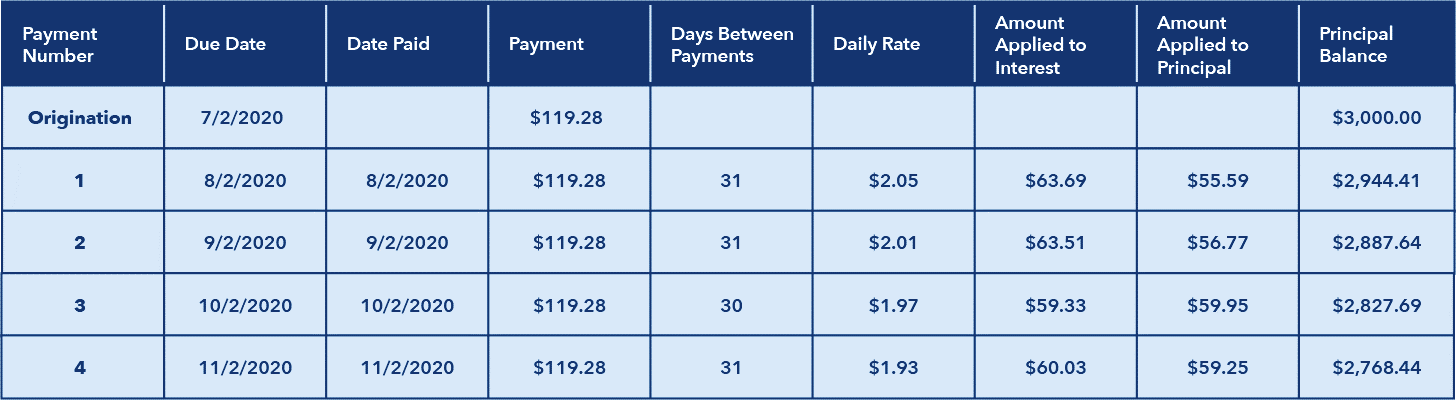

Based on the OneMain personal loan calculator, a $5,000 loan with a 25% APR and a 60-month term length would be $147 per month. The loan terms you receive will depend on your credit profile, including credit history, income, debts and if you secure it with collateral like a car or truck.

What is the minimum income for a OneMain Financial loan

Minimum income: None; OneMain requires borrowers to have enough income to support their own expenses, plus the new loan's monthly payment. This lender accepts income from employment, a partner, alimony, retirement, child support, Social Security payments, investments and public assistance.

Is it smart to get a loan and pay it off right away

In short, yes—paying off a personal loan early could temporarily have a negative impact on your credit scores. You might be thinking, “Isn't paying off debt a good thing” And generally, it is. But credit reporting agencies look at several factors when determining your scores.

Does your credit score drop when you pay off a loan

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How fast does your credit score go up after paying debt

30 to 45 days

How long after paying off debt will my credit scores change The three nationwide CRAs generally receive new information from your creditors and lenders every 30 to 45 days. If you've recently paid off a debt, it may take more than a month to see any changes in your credit scores.

Why do you get penalized for paying off a loan early

A mortgage prepayment penalty is a fee that some lenders charge when you pay all or part of your mortgage loan off early. The penalty fee is an incentive for borrowers to pay back their principal slowly over a longer term, allowing mortgage lenders to collect interest.

Is it better to pay off loans fast or slow

In most cases, paying off a loan early can save money, but check first to make sure prepayment penalties, precomputed interest or tax issues don't neutralize this advantage. Paying off credit cards and high-interest personal loans should come first. This will save money and will almost always improve your credit score.

What is the lowest credit score for OneMain

No minimum credit score for approval.

Most personal loan lenders require credit scores above 660 to apply, but OneMain Financial doesn't have a minimum.

Does OneMain Financial give you a loan the same day

Myth 6: You have to wait a long time to get your funds

Here at OneMain, you could get your money the same day if your application is approved before noon. ** On average, OneMain customers who choose to receive their funds through direct deposit can expect their money in 1-2 business days.