Can you pay Self credit builder off early?

What happens if I close my self credit builder account early

If you decide to close your account before it's paid off, you can access the money in the CD, minus fees and interest, and the amount you still owe. Self offers two-year terms for four different monthly payment options. The lowest payment is $25 a month; you can also choose payments of $35, $48 or $150 per month.

Cached

Can you make a payment early on self credit builder

Yes, you can make an early payment on Self, but there are a few things to be aware of before you do. Paying a few days early won't hurt your credit score. You can pay up to one month in advance with no negative affect on your credit.

What happens when you finish paying self credit builder

Once your loan term is complete, provided you made all your payments on time, you'll receive the full amount of the loan, plus any interest the CD accumulated throughout its term.

Cached

Can you end self credit early

You have the option to pay off or close the account early — but you'll incur a maximum fee of $5 if you do that. Self will also report the loan as paid off early to the credit bureaus, which helps you avoid a delinquent account if you can no longer afford payments.

Cached

What is the downside to self credit builder

Self credit builder pros include flexible payment options, nationwide availability, and access to the Self Visa secured credit card. Cons include relatively high APRs and non-refundable fees.

Will canceling self hurt credit

If you have no other credit accounts, or have other negative items on your credit, your credit score may drop when your Self account closes. Learn more about how credit reporting works at Self.

Will closing my self credit builder account hurt my credit

If you close your Credit Builder Account in good standing, then it will no longer report payment history to the credit bureaus monthly. While we can't speculate on the exact impact of closing a Credit Builder Account on your credit score, payment history is the most important factor in determining your credit score.

Do you build credit if you pay it off immediately

You may have heard carrying a balance is beneficial to your credit score, so wouldn't it be better to pay off your debt slowly The answer in almost all cases is no. Paying off credit card debt as quickly as possible will save you money in interest but also help keep your credit in good shape.

Will closing my self credit card hurt my credit

Although secured cards typically have low credit limits, closing one will still decrease the amount of credit you have available. This will cause your credit utilization rate to slightly decrease and ding your credit score but only temporarily.

How much will credit score increase with self

Self, an Austin, Texas-based startup founded in 2014, is an online lender that offers credit-builder loans to help customers with little or no credit build up their payment history. They claim the average Self customer raises their credit score by 49 points.

How long does it take to see results from self credit builder

Then, once your account is open and you're making payments, Self will report your payment history to the three major credit bureaus (Experian, Equifax and TransUnion). It should take about one to two months for your Credit Builder Account to show up on your credit report.

What happens when you pay off self lender

Once you finish your first Self loan, you close your account and get your principal back. That means you get back the money you paid into your loan (minus interest). While some people use that savings to set up an emergency fund, or apply it as a down payment on a car loan or secured credit card, the choice is yours.

What will my credit score be after a credit builder loan

However, if you make your monthly payments on time, the lender will report positive information to the credit bureaus, which improves your score. For example, if you're establishing credit from scratch with a credit-builder loan, you should expect to have a score around 630 – 650 by the end of your loan term.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score go down with self

You don't keep building your credit.

Credit isn't a one-and-done thing, so if you finish your Self account and don't keep building credit after, your credit score may take a hit.

How many points will my credit score drop if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

Can your credit score go up 100 points in 2 months

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

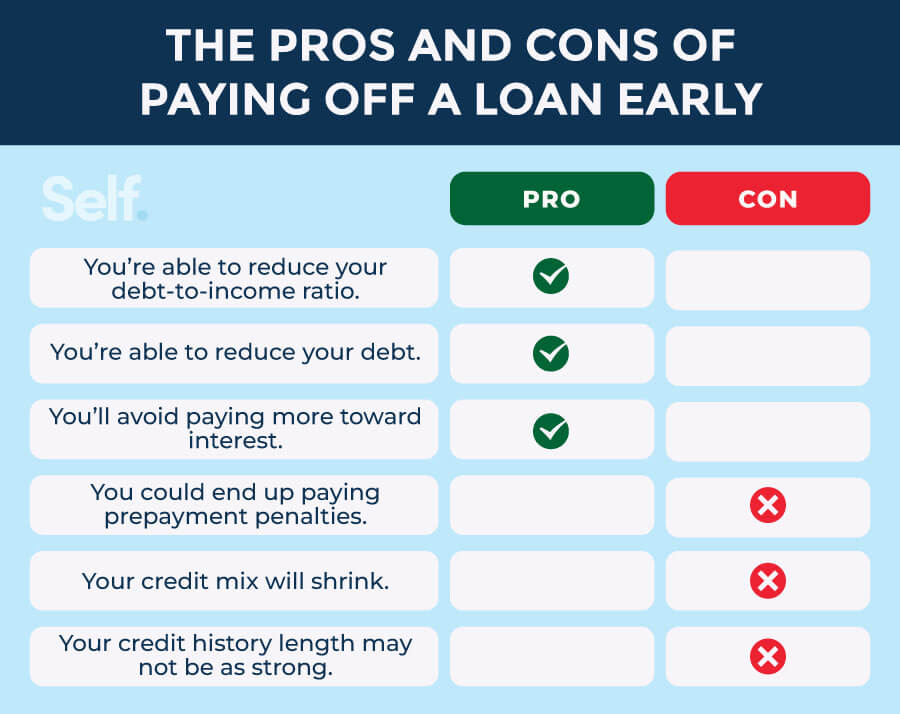

Should I pay my self account off early

Some people believe that paying off your Self Credit Builder Account faster, or paying a higher dollar amount each month, helps you build credit faster. But that's not necessarily true. Sometimes, paying off your Self account early could potentially hurt your credit.