Can you pay snap finance off early?

Can I pay off my snap finance loan early

Paying out your loan early with SNAP is easy, and unlike other institutions, there are no penalty fees. To make a lump sum payment, you can use our online banking options, send us a cheque, or contact us directly at 1.866. 475.9184.

What is early buyout option on snap finance

Early Buyout Option

For maximum flexibility, customers can acquire ownership at any point between the end of the 100-day period and their final scheduled payment. By paying all maximum-term lease payments before their due date, customers can save 30% or more in their leasing cost. Visit snapfinance.com.

Cached

How do I pay off my snap finance account

How Do I Pay Off My AccountSign in to your account at customer.snapfinance.com.Click on the “Schedule Payment” button on the main dashboard.Continue to “Select a Payment Method.”Select a stored payment method.Select the default payoff amount displayed.Verify the information is correct and click “Submit Payment.”

Cached

How long does snap finance give you to pay

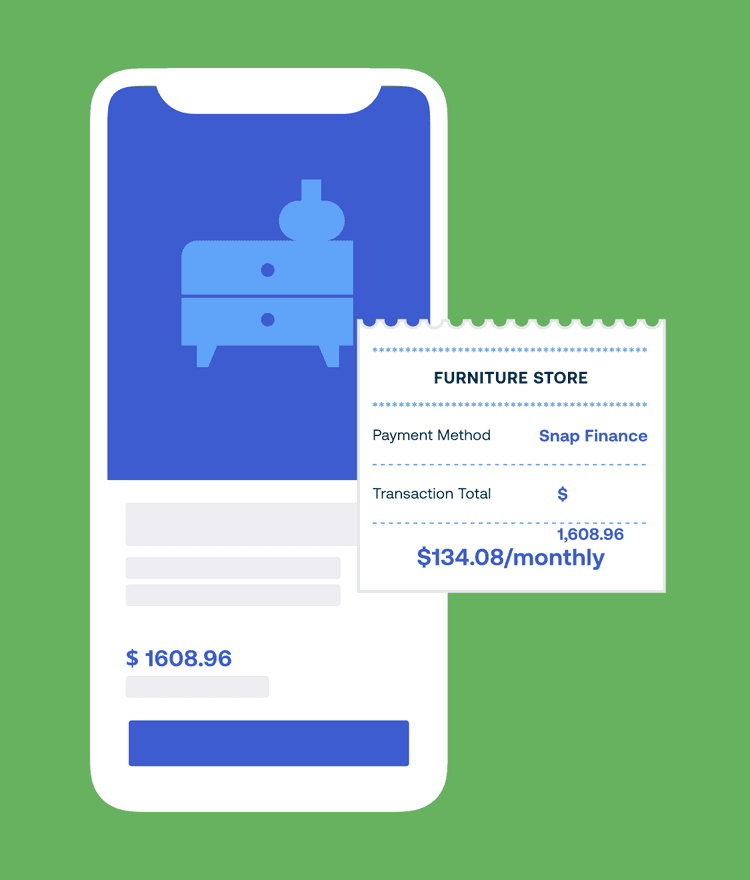

Even if you have no credit, Snap is a great way to finance the things you need. It's not a traditional loan, but a consumer lease that spreads out your purchase over 12 months of easy payments.

Cached

Why can’t you pay off a loan early

Paying off the loan early can put you in a situation where you must pay a prepayment penalty, potentially undoing any money you'd save on interest, and it can also impact your credit history.

Does snap finance affect your credit

While their process is easy and flexible, getting financing can be a costly decision. Snap Finance does not report your payments to the three major credit bureaus. This financing option is not a credit-building opportunity that could help you qualify for better loans in the future.

Does snap finance affect your credit score

Snap Finance does not report your payments to the three major credit bureaus. This financing option is not a credit-building opportunity that could help you qualify for better loans in the future.

What is the 100-day payoff option for snap finance

For the lowest overall cost, you may choose to pay off your lease within the first 100 days. To use the 100-Day Option, consumers must ensure the full amount is paid within 100 days by contacting Customer Care at (877) 557-3769 or by scheduling payments in the Customer Portal at customer.snapfinance.com.

Does snap finance mess up your credit

Applying with Snap will affect your credit score with these CRAs, but is unlikely to affect your FICO score or scores from the three major credit bureaus – Experian, Equifax, and Transunion. Note: Experian is used for Credit+ applications and as a result, credit scores may be affected.

Does snap Finance mess up your credit

Applying with Snap will affect your credit score with these CRAs, but is unlikely to affect your FICO score or scores from the three major credit bureaus – Experian, Equifax, and Transunion. Note: Experian is used for Credit+ applications and as a result, credit scores may be affected.

Does snap Finance affect your credit

While their process is easy and flexible, getting financing can be a costly decision. Snap Finance does not report your payments to the three major credit bureaus. This financing option is not a credit-building opportunity that could help you qualify for better loans in the future.

Is it bad to pay off finance early

If you're able to pay your loan off earlier, you could be saving yourself a lot of money from the interest found across the monthly payments. However, if you're thinking of paying it off sooner and you're in negative equity, you might not want to.

Is it worth paying off a loan early

Paying off a loan early could save you money in the long term as it can reduce the total amount you need to repay. Bear in mind that you need to account for any early repayment charges to help decide if it's the right choice for you.

What happens if you miss a payment with snap finance

But what happens if you miss a payment, due to a job loss or other financial hiccup The thing to understand is that based on the contract the lender can: Start charging interest of 18-38% once you stop making payments. Charge back interest for the previous months.

Can snap finance sue

Yes, Snap Finance can sue you. Snap Finance can hire a lawyer to file a breach of contract lawsuit against you for the underlying debt, fees, and costs. If you've been sued by Snap Finance, do not ignore the lawsuit; you may have defenses.

Can you pay over snap

Send money on SnapChat through SnapCash:

To receive money, the person sending you money will need your phone number or email address associated with your Snapchat account. They will also need to have a debit card linked to their account.

What is the lawsuit against snap Finance

Snap Finance has established a $5 million fund to settle a class action lawsuit that claimed it routinely violated federal law by using an automatic telephone dialing system to call people who did not give consent.

Can you have more than one snap Finance account

Snap Finance is available for existing partners so only one set of credentials per merchant account will be provided for integration. If you are a third-party developer, please work with your merchant to get their account credentials for integration.

Can you pay off a 72 month car loan early

Some lenders make it difficult to pay off car loans early because they'll receive less payment in interest. If your lender does allow early payoff, ask whether there's a prepayment penalty, since a penalty could reduce any interest savings you'd gain.

Does paying off a car loan early hurt credit

Paying off your car loan early can hurt your credit score. Any time you close a credit account, your score will fall by a few points. So, while it's normal, if you are on the edge between two categories, waiting to pay off your car loan may be a good idea if you need to maintain your score for other big purchases.