Can you transfer American Express balance to another card?

How do I transfer my Amex balance to another card

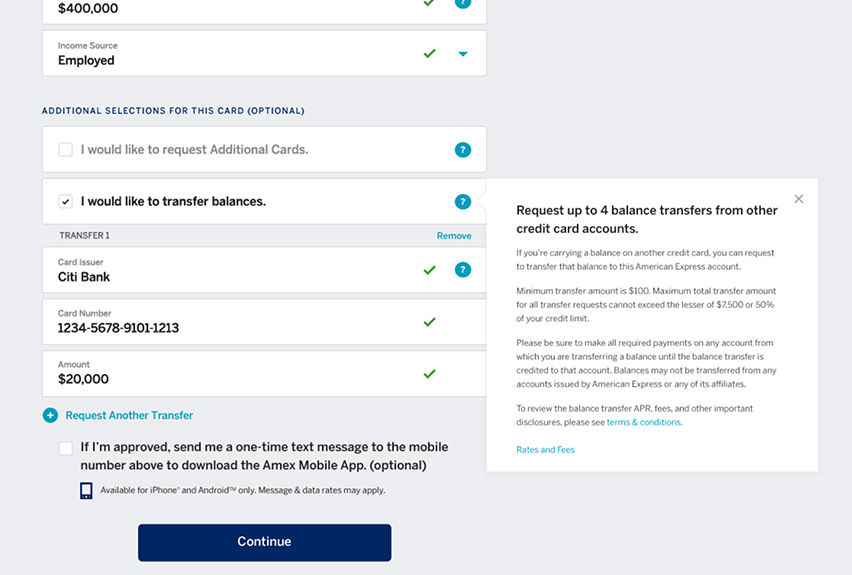

Once in your account, head to “Account Services.” Then, select “Payment & Credit Options.” From there, you'll click on “Transfer Balances.” Then, enter the requested information like the name of your other credit card issuer, your other credit card account number and the amount you want to transfer.

Cached

Can I use my Amex card to pay off another credit card

You can use your American Express credit card to pay off another credit card by doing a balance transfer, getting a cash advance, buying a money order or using a mobile payment service. It is not possible to use an American Express card as the primary payment method for another credit card account.

Can you balance transfer on American Express cards

Since Amex does not currently allow balance transfers, finding zero interest credit cards with no transfer fees is not possible. However, you can choose from a few 0% APR cards with no annual fees. A simple cash back card that's best for everyday purchases.

Cached

Can I transfer money from my Amex to a bank account

Select “Pay With Bank Transfer” as your payment method. Choose the payment amount. Confirm the payment date (payments can only be made on the same day) Select your bank from the list.

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Can I transfer my Amex balance to Capital One

You can transfer balances from other credit cards, personal loans, student loans and auto loans. You will not be able to transfer a balance from another account issued or acquired by Capital One or any of its affiliates or subsidiaries.

Is it illegal to use a credit card to pay off another credit card

The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card from a different company. Often, the fees for these types of transactions are too high for credit card companies to allow it.

Can I transfer balance from Amex to Capital One

Capital One accepts balance transfers from other issuers' credit cards, along with personal loans, student loans, and auto loans.

Can I transfer balance from Amex to Wells Fargo

Your balance transfer amount including any fees must be less than the total credit limit of the card you're transferring to. You can transfer almost any kind of debt to your Wells Fargo card, including other credit card balances, personal loans, home equity loans, auto loans, etc.

What money app works with American Express

Cash App supports debit and credit cards from Visa, MastercCard, Amex, and Discover.

What is the downside of a balance transfer

A balance transfer generally isn't worth the cost or hassle if you can pay off your balance in three months or less. That's because balance transfers typically take at least one billing cycle to go through, and most credit cards charge balance transfer fees of 3% to 5% for moving debt.

What is the catch to a balance transfer

But there's a catch: If you transfer a balance and are still carrying a balance when the 0% intro APR period ends, you will have to start paying interest on the remaining balance. If you want to avoid this, make a plan to pay off your credit card balance during the no-interest intro period.

Can I transfer my credit card balance to another card

Transferring a credit card's balance to a new card requires getting the new card provider to approve the transfer. The process begins when you submit a balance transfer application. While a typical balance transfer may process in up to seven days, some card providers say it might take up to 21 days.

Why can’t you use a credit card to pay off a credit card

The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card from a different company. Often, the fees for these types of transactions are too high for credit card companies to allow it.

Can I transfer money from American Express to cash App

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover.

Can I transfer money from American Express to PayPal

Sending money from the AmEx app

This option allows you to use your AmEx card to send money to any PayPal or Venmo customer without paying the usual transaction fees that would apply to credit card payments. (Normally, if you were to use a credit card this way through PayPal or Venmo, you'd incur a fee of about 3%.)

Do balance transfers hurt credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.

Do balance transfers hurt

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Is it a good idea to do a balance transfer

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.

How much does it cost to transfer balance from one credit card to another

around 3% to 5%

A balance transfer fee is a fee that's charged when you transfer credit card debt from one card to another. It's usually around 3% to 5% of the total amount you transfer, typically with a minimum fee of a few dollars (often $5 to $10).