Can you use a credit card for payroll?

Can payroll be paid by credit card

What credit cards are accepted You can make your Payroll Tax Deposit (DE 88) payments and pay other payroll tax liabilities with American Express, Discover/NOVUS, MasterCard, and Visa.

Cached

Can I have my paycheck deposited to my credit card

There's no such thing as a direct deposit to a credit card account. Credit cards don't have routing and account numbers that can be used in the ACH system. Direct deposit is limited to checking accounts and savings accounts.

Can you pay payroll with a credit card on Quickbooks

Under Bank Account, select the pass-through account created in Step 1. Select the payroll liabilities paid by credit card from the list. Then select Create. Next, go to Banking, then select Enter Credit Card Charges.

Cached

Is it legal to use a company credit card for personal use

Technically, putting your personal purchases on your business credit card isn't illegal. But making personal purchases on a business credit card likely violates the terms and conditions of your card agreement, which can have some serious consequences.

Can you pay federal payroll taxes with a credit card

The IRS uses third party payment processors for payments by debit and credit card. It's safe and secure; your information is used solely to process your payment.

What bills can be paid with a credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

Can a business put payroll on a credit card

By placing your employees' payroll on your credit cards, delayed customer payments become less of a headache. Businesses no longer have to worry about having to pay out your employees, freelancers and agents before your customers pay you for their jobs done.

What happens if you deposit money into a credit card

When a credit card is “secured,” it means money must be deposited with the credit card issuer in order to open an account. That money is known as a security deposit. And it's held by the credit card issuer while the account is open, similar to the security deposit given to a landlord to rent an apartment.

How much does QuickBooks charge to accept credit card payments

These fees are charged every time you do a transaction. At QuickBooks, we charge 2.9% for invoiced cards, plus $0.25 per transaction. The fee is lower for card reader transactions because the card is present and cardholder info can be verified.

What happens if an employee uses a company credit card for personal use

While it's not illegal to pay for personal expenses using a company card, it goes against company expense policy and will likely result in disciplinary action if it happens regularly. It will also have adverse effects on the company's tax liabilities. In more serious cases deliberate card misuse is considered fraud.

Is misuse of company credit card a crime

This kind of financial fraud involving expense accounts, credit cards or cash allowances from an employer can result in allegations of either fraud or embezzlement. These white-collar crimes can result in financial consequences, jail time and difficulty moving your career forward.

Is it OK to pay taxes with a credit card

Yes, you can pay taxes with a credit card, but the real question is, should you Unlike paying your taxes with a bank account transfer, credit card payments aren't free. You'll wind up incurring a fee that's a percentage of your tax payment. The fee you're charged varies by the payment processor you choose.

Is it worth it to pay taxes with a credit card

Given the fees, in many cases it's simply not worth it to pay taxes with a credit card. If your card earns less than 1.85% back on the transaction, you'll lose ground even after collecting your rewards. And even if you can eke out a higher rate, the fees will take such a big cut that you might not bother.

Can you use a credit card for a direct debit

Direct Debits cannot, however, be set up against savings accounts, such as fixed term savings accounts and ISAs, or mortgage accounts. They also cannot be set up from a credit card. Instead, regular credit card payments can be made using a 'Continuous Payment Authority' (CPA).

Is paying a bill with a credit card considered a cash advance

Paying a bill using a credit card or line of credit is treated the same as getting a cash advance. You'll be charged interest from the time you make the payment, just like you would for a cash advance. Was this information helpful

Can I put myself on payroll as a business owner

Business owners can pay themselves through a draw, a salary, or a combination method: A draw is a direct payment from the business to yourself. A salary goes through the payroll process and taxes are withheld. A combination method means you take part of your income as salary and part of it as a draw or distribution.

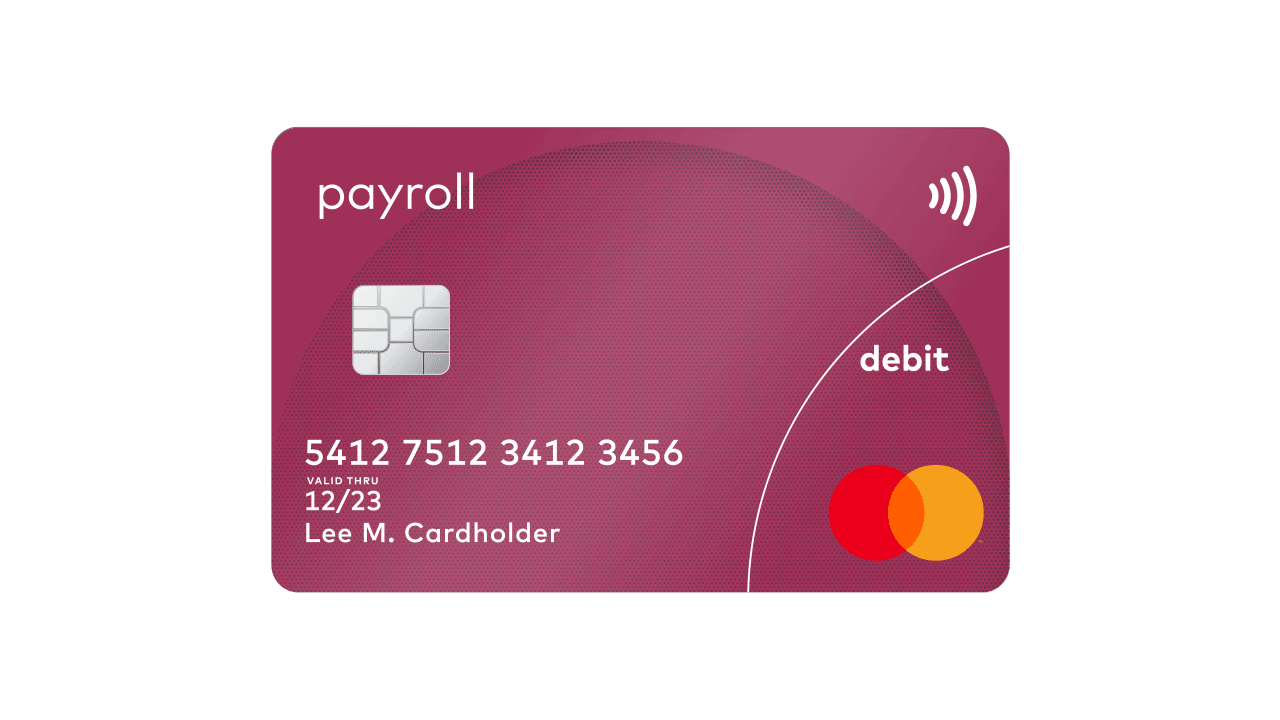

What is a disadvantage of using a payroll card

For employees, advantages to payroll cards include the ability to pay bills online, shop online, make automatic bill payments, and get cash at an ATM. Disadvantages include the possibility of monthly maintenance fees, out-of-network ATM fees, and balance inquiry fees.

Can you use a credit card to deposit money at ATM

You can use most ATMs these days to deposit checks or cash, check your balance, or withdraw cash from a checking or savings account with a debit card. But can you use a credit card at an ATM The short answer is yes.

Can I overpay my credit card to increase limit

An overpayment will not help boost your credit limit, not even temporarily. Your credit limit remains the same – you'll just have a negative balance that will be applied toward your next statement. Details like credit score and income are usually factored into a credit limit increase.

Can I charge the credit card fee to the customer in QuickBooks

To add a credit card processing fee to your invoice, you can create a service item, then manually add it to your invoice. You can also consider a third-party app and integrate it with your QuickBooks.