Can you use your debit card with a negative balance?

Can I use my debit card as credit with insufficient funds

If you don't have enough funds in your account, the transaction will be declined. When you choose to run your debit card as credit, you sign your name for the transaction instead of entering your PIN. The transaction goes through Visa's payment network and a hold is placed on the funds in your account.

Can I spend my negative account balance

A negative balance usually means the cardholder has received a refund for a purchase, a reversal for a fraudulent purchase, a credit card reward or a statement credit. Use up a negative balance by making purchases with the card or by requesting a refund from the card issuer.

Cached

What does a negative balance mean on a debit card

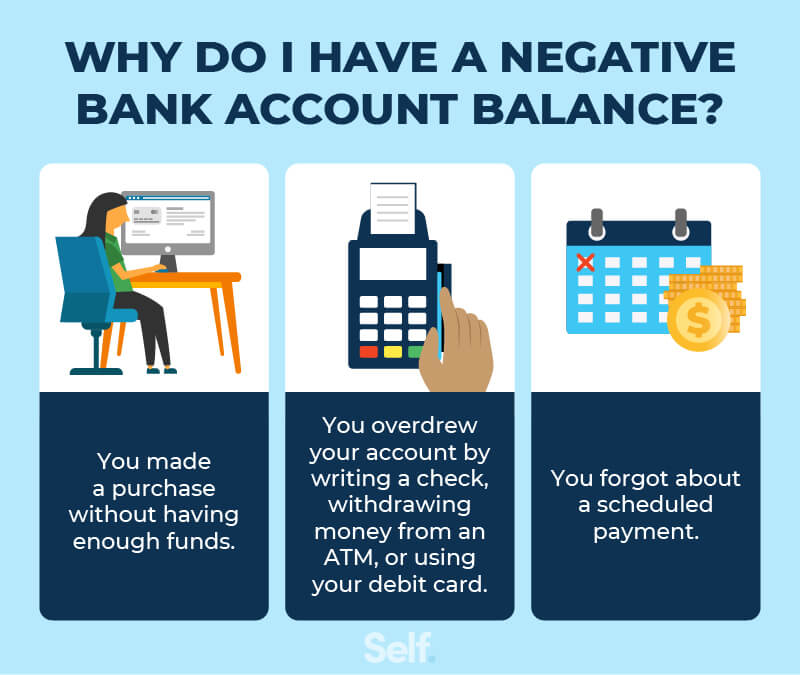

A negative balance occurs when the amount of money in your account is less than zero. A negative balance may decrease your credit score and result in an overdraft protection fee or wage garnishment. You can opt-in to overdraft protection.

Cached

Can you overspend on a debit card

You may trigger a fee if you overdraw your account using your debit card, just as you would if you "bounced" a check. Or, there could be a charge if you use your debit card as an ATM card at a machine that is not operated by your financial institution.

Cached

Can I pay for something with insufficient funds

Yes. Banks and credit unions may charge a fee if there are insufficient funds to cover a transaction. Each financial institution determines its fees — and while the federal government doesn't limit fee amounts, states do typically limit the maximum amount financial institutions can assess.

How can I withdraw money from ATM with insufficient funds

First, you'll need to make sure that you have you have opted in to your bank's overdraft coverage or that overdraft protection set up on your account. This will allow you to make purchases with your debit card or withdraw money from an ATM even if you don't have enough money in your account to cover the transaction.

How many times can you go negative in your bank account

Every bank and credit union has its own limit on the number of overdraft fees it will charge in one day. You can commonly expect banks to charge a maximum of 4 to 6 overdraft fees per day per account, though a few outliers do allow as many as 12 in one day.

How long can I have a negative balance in my account

In most cases, banks will close a checking account after 60 days of being overdrawn.

How long can you have a negative balance on debit card

In most cases you have 5 business days or 7 calendar days to fix your balance before the extended overdraft fee takes your account even deeper into the red. Some banks charge this fee once every 5 days, while others go so far as to assess the fee every day until you bring your balance back above zero.

Does a negative balance mean you owe money

A negative credit card balance is when your balance is below zero. It appears as a negative account balance. This means that your credit card company owes you money instead of the other way around. Typically, this happens when you've overpaid your outstanding balance or if you've had a credit returned to your account.

Can a debit card exceed a limit

Yes, you can go over your credit limit, but there's no surefire way to know how much you can spend in excess of your limit. Card issuers may consider a variety of factors, such as your past payment history, when deciding the risk of approving an over-the-limit transaction.

What is the maximum amount you can use on a debit card

Your ATM Withdrawal and Daily Debt Purchase limit will typically vary from $300 to $2,500 depending on who you bank with and what kind of account you have. There are no monetary limits for withdrawals from savings accounts, but federal law does limit the number of savings withdrawals to six each month.

Will my card declined for overdraft

If you have not opted in to ATM and debit card overdraft, debit card purchases and ATM withdrawals will generally be declined if your account doesn't have enough funds at the time you attempt the transaction.

Can you overdraft a debit card with no money

Yes, you absolutely can overdraft a debit card.

What is the overdraft limit for a debit card

An overdraft limit is the maximum amount that banks allow you to withdraw. For example, you might have a bank account balance of $5,000 with an overdraft limit of $500. It means that you can spend up to $5,500, but you can't withdraw or request for an added money if the payment exceeds the limit.

Can you withdraw money if you are in your overdraft

Yes, you can withdraw cash from your overdraft facility by using a cash machine. How much you can take out depends on what your daily limit is.

What happens if your bank account is negative for 2 days

The bank could close your account, take collection or other legal action against you, and even report your failure to pay, which may make it difficult to open checking accounts in the future. Note: typically, your bank won't close your account right away after an overdraft, so you have some time to sort this out.

What happens if your bank account is negative for a few days

Your bank may charge you in the following scenarios: A fee for each transaction until your balance is restored or each time it transfers money from your backup savings account to your checking account. There could also be a monthly service fee and daily fees for each day your account is negative.

What happens if you don’t pay a negative balance

Ultimately, nothing really happens if you have a negative credit card balance. It doesn't hurt you. But still, you want to check in on your account regularly to make sure you don't wind up with a negative balance.

What is the overdraft limit

An overdraft limit is the maximum amount that banks allow you to withdraw. For example, you might have a bank account balance of $5,000 with an overdraft limit of $500. It means that you can spend up to $5,500, but you can't withdraw or request for an added money if the payment exceeds the limit.