Can you write off a RV loan?

Can you write off RV mortgage

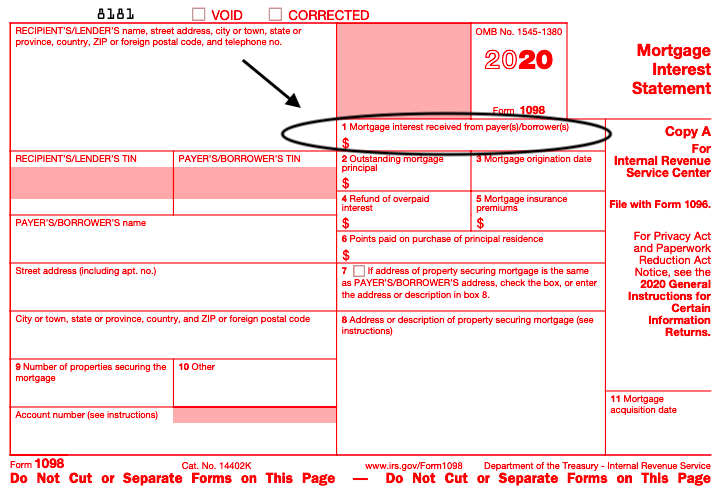

If you took out a loan on your RV, you may be able to deduct the interest on it. To do this, your RV will need to qualify as either a primary or secondary home. Then, your RV loan is treated as effectively the mortgage on your home. This qualifies you to deduct the interest that accrues on your RV loan.

Cached

Can I write off an RV as a business expense

RVs Used Solely for Business

In fact, the whole RV may qualify as a business deduction. The kicker here is that you won't be able to use your RV for personal use. Even using it a few times a year for personal trips can disqualify it from being a full business deduction.

Cached

Is an RV loan considered a mortgage

Is an RV considered a mortgage No. An RV loan is a type of installment loan. While similar to a fixed rate mortgage in that there are fixed monthly payments for the life of the loan, it is not considered a mortgage.

Does an RV qualify for Section 179

RV rentals only qualify for Section 179 deductions if used more than 50% for business. If you don't have more than 50% business use, you can still depreciate the RV based on the percentage of business use. This is if you report the activity on Schedule C and have active participation.

Is an RV considered an asset

Asset Examples: – Motor vehicles – the current Blue Book value of any cars, motorcycles, boats, RVs, etc. you own. – Real estate – the value of your home, land, a condo, or other property you own even if you have a mortgage.

Can you depreciate an RV

Like all vehicles, RVs depreciate over time. You can determine an RVs depreciation by the vehicle's age, mileage, wear and tear, and the type of RV you own. Class A and Class B vehicles depreciate similarly, while Class C RVs depreciate more slowly and hold value slightly better.

Is an RV a depreciating asset

Like all vehicles, RVs depreciate over time. You can determine an RVs depreciation by the vehicle's age, mileage, wear and tear, and the type of RV you own. Class A and Class B vehicles depreciate similarly, while Class C RVs depreciate more slowly and hold value slightly better.

How do you depreciate an RV for a rental business

The IRS figures out the percentage by comparing total days rented to the total days used during the year. For example, you use your RV for 30 days and rent it out for 90 days. The IRS allows you to deduct 75% (90/120 total rental and personal days) of RV taxes and interest against your rental income.

Is getting into a RV loan the same as a car loan

Available through online lenders, banks, credit unions and even some RV dealerships, the application process for an RV loan is similar to an auto loan application. However, RV loans provide larger amounts of cash than typical auto loans, and the qualification requirements are often slightly more complex.

What is the difference between a car loan and an RV loan

RV loans generally work the same way as auto loans, but loan terms and interest rates may vary compared to new or used car financing. The monthly payment for RV loans tends to be higher, and the maximum and minimum loan amount for an RV loan may also vary.

Can you depreciate an RV as a rental property

The IRS figures out the percentage by comparing total days rented to the total days used during the year. For example, you use your RV for 30 days and rent it out for 90 days. The IRS allows you to deduct 75% (90/120 total rental and personal days) of RV taxes and interest against your rental income.

What assets don’t qualify for Section 179

Intangible assets like patents or copyrights do not. Buildings and land also don't qualify, although some equipment attached to the building does, including things like fire suppression systems, alarms, and air conditioning units. Purchased. Leased property doesn't qualify.

How long do you depreciate an RV for tax purposes

After three years of ownership, your RV is likely to be worth approximately 30% less than when you purchased it. After ten years of ownership, your Class A RV will depreciate to less than half of what you paid for it.

What is the depreciation rate for RV

Of all the motorized campers, the Class C vehicles depreciate the slowest. With a length of 33 feet, a Class C RV is the sweet spot between a camper van and tour bus. After five years of life with a Class C vehicle, you can expect a rate of about 38% depreciation. After another five years, that rate barely trips 50%.

What are 3 assets that depreciate

Some examples of the most common types of depreciable assets include vehicles; buildings; office equipment or furniture; computers and other electronics; machinery and equipment; and certain intangible items, such as patents, copyrights, and computer software.

How many years can you depreciate an RV

The IRS dictates that RVs used for business purposes be depreciated over a 5-year period. Most accountants would use the straight-line method to linearly reduce the value of the RV asset from its original cost to its salvage value.

Can you take depreciation on an RV

Like all vehicles, RVs depreciate over time. You can determine an RVs depreciation by the vehicle's age, mileage, wear and tear, and the type of RV you own. Class A and Class B vehicles depreciate similarly, while Class C RVs depreciate more slowly and hold value slightly better.

What is the average term of an RV loan

10-15 years

How long is an RV loan term The loan term and details for financing a new or used RV or camper are very similar. On average, RV loans range from 10-15 years, but many banks, credit unions and other finance companies will extend the term up to 20 years for loans of $50,000 or more on qualified collateral.

What is the average interest rate on a RV loan

APR range: 7.99% to 16.64% with AutoPay (Rates vary by loan purpose.)

What is a good interest rate on a RV loan

There are several factors to keep in mind when considering an RV loan. The best RV loan interest rates currently start around 4.49 percent for borrowers with excellent credit. However, the actual rate you receive depends on factors such as your credit score, debt-to-income ratio and annual income.