Can you write-off RV loan interest?

Can you deduct interest from an RV loan

Yes, in most states, the interest on your RV financing is tax-deductible. This is typically available whether your RV is your primary or secondary home, though some states may have their own requirements.

Cached

Is an RV loan considered a mortgage

Is an RV considered a mortgage No. An RV loan is a type of installment loan. While similar to a fixed rate mortgage in that there are fixed monthly payments for the life of the loan, it is not considered a mortgage.

Can you write-off the purchase price of an RV

If you purchased an RV in 2023, good news: you (probably) qualify for a deduction. In all but five states (Alaska, Delaware, Montana, New Hampshire, and Oregon), you'll have to pay sales tax on the purchase of a new RV. Because you've already paid that tax, you can deduct it from your 2023 taxes.

Cached

How do I deduct RV interest on Turbo tax

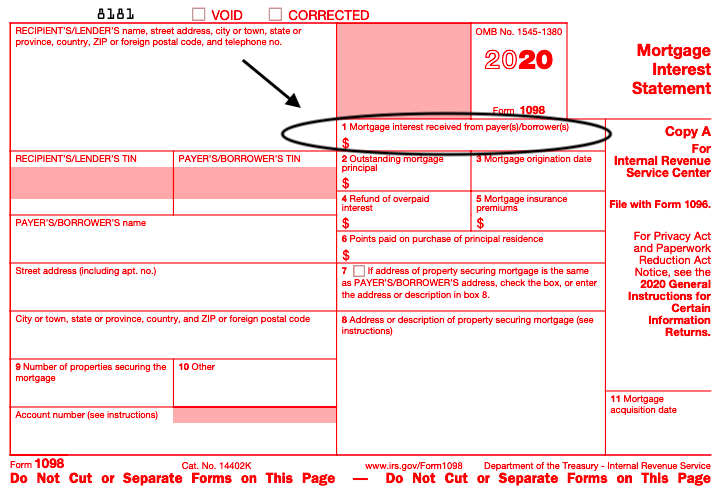

In TurboTax online,After sign-in and select Pick up where you left off.At the right upper corner, in the search box, type in 1098and Enter.Select the 1st choice on the search results – Jump to 1098 and follow the prompts to enter the amount.

What is a typical RV loan interest rate

RV Payment and Affordability Calculator Help

| FICO Score | APR |

|---|---|

| 760-850 | 3.442 % |

| 700-759 | 3.664 % |

| 680-699 | 3.841 % |

| 660-679 | 4.055 % |

What time of year is best to buy an RV

You'll generally find the best time to buy an RV is during late fall and winter. Fewer people shop during this period, and less competition means you'll have more negotiating power. You can also find bargains right before a new RV model is released, when gas prices are up, and at RV trade shows.

Is getting into a RV loan the same as a car loan

Available through online lenders, banks, credit unions and even some RV dealerships, the application process for an RV loan is similar to an auto loan application. However, RV loans provide larger amounts of cash than typical auto loans, and the qualification requirements are often slightly more complex.

What is the difference between a car loan and an RV loan

RV loans generally work the same way as auto loans, but loan terms and interest rates may vary compared to new or used car financing. The monthly payment for RV loans tends to be higher, and the maximum and minimum loan amount for an RV loan may also vary.

Where do I write off my RV on my taxes

Standard Tax Deduction for the 2023 Tax Season

Business expenses related to business RV travel and an RV rental business will be listed on a Schedule C and you always want to deduct these. That said, sales tax deductions and RV loan interest write-offs must be listed as itemized deductions.

Does an RV qualify for Section 179

RV rentals only qualify for Section 179 deductions if used more than 50% for business. If you don't have more than 50% business use, you can still depreciate the RV based on the percentage of business use. This is if you report the activity on Schedule C and have active participation.

Is RV interest tax deductible for IRS

Yes. You're allowed to deduct the interest on a loan secured by your main home (where you ordinarily live most of the time) and a second home.

Where do I write-off my RV on my taxes

Standard Tax Deduction for the 2023 Tax Season

Business expenses related to business RV travel and an RV rental business will be listed on a Schedule C and you always want to deduct these. That said, sales tax deductions and RV loan interest write-offs must be listed as itemized deductions.

Is an RV a tax write off

The benefit of treating a boat or RV as your primary residence, is to take allowable homeowner tax deductions that can decrease your overall tax bill. As long as the boat or RV is security for the loan used to buy it, you can deduct mortgage interest paid on that loan.

How long is a typical loan for an RV

10-15 years

On average, RV loans range from 10-15 years, but many banks, credit unions and other finance companies will extend the term up to 20 years for loans of $50,000 or more on qualified collateral.

Will the price of RVs go down in 2023

Inflation and a continuation of the supply and labor shortage that lingered from 2023 have been keeping prices from falling back to pre-pandemic numbers. However, as 2023 continues we expect prices will continue to fall and we might get there. You just might have to wait a bit longer.

Is it financially smart to live in an RV

It is financially smart to live in an RV. Living in an RV means living a lot smaller with a lot less stuff. You have less room for everything – clothes, toys, tools and more saving you a lot of money. Along with less space, you save on utilities and home-improvement projects if you own your home.

What is a good interest rate on a RV loan

There are several factors to keep in mind when considering an RV loan. The best RV loan interest rates currently start around 4.49 percent for borrowers with excellent credit. However, the actual rate you receive depends on factors such as your credit score, debt-to-income ratio and annual income.

What is the average interest rate on a RV loan

APR range: 7.99% to 16.64% with AutoPay (Rates vary by loan purpose.)

How do I depreciate an RV IRS

The IRS figures out the percentage by comparing total days rented to the total days used during the year. For example, you use your RV for 30 days and rent it out for 90 days. The IRS allows you to deduct 75% (90/120 total rental and personal days) of RV taxes and interest against your rental income.

Can you depreciate an RV as a rental property

The IRS figures out the percentage by comparing total days rented to the total days used during the year. For example, you use your RV for 30 days and rent it out for 90 days. The IRS allows you to deduct 75% (90/120 total rental and personal days) of RV taxes and interest against your rental income.