Did federal taxes decrease 2023?

What are the new federal tax rates for 2023

For the 2023 tax year, there are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in tax year 2023. Tax returns for 2023 are due in April 2024, or October 2024 with an extension.

Has federal withholding changed for 2023

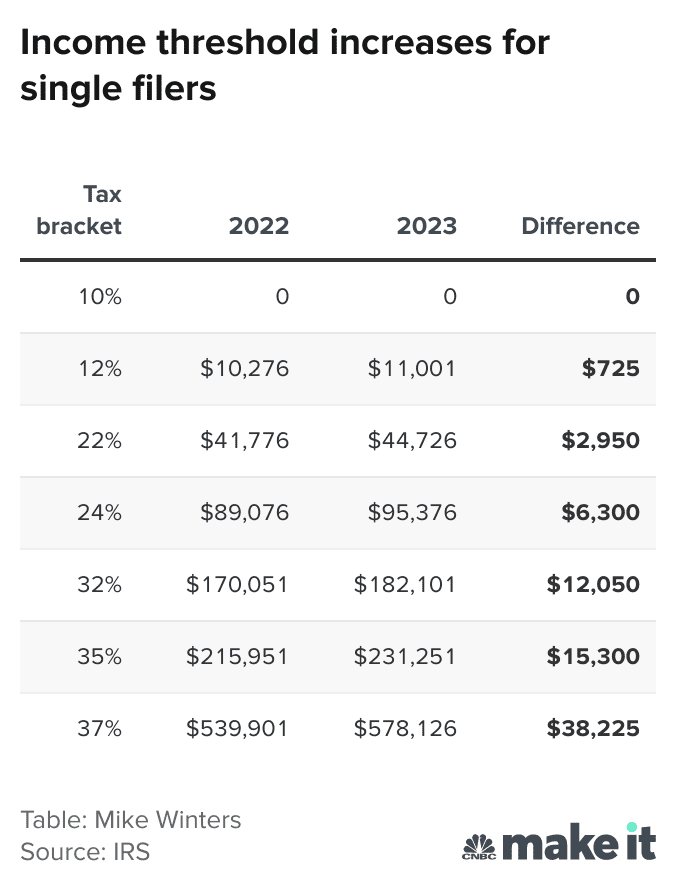

Broadly speaking, the 2023 tax brackets have increased by about 7% for all filing statuses. This is significantly higher than the roughly 3% and 1% increases enacted for 2023 and 2023, respectively.

Cached

Why are tax refunds lower for 2023

The IRS previously forecast that refund checks were likely to be lower in 2023 due to the expiration of pandemic-era federal payment programs, including stimulus checks and child-related tax and credit programs.

Will 2023 taxes be the same as 2023

With federal tax brackets and rates, the tax rates themselves aren't changing. The same seven tax rates in effect for the 2023 tax year – 10%, 12%, 22%, 24%, 32%, 35%, and 37% – still apply for 2023.

What is the IRS inflation adjustment for 2023

Inflation last year reached its highest level in the United States since 1981. As a result, the IRS announced the largest inflation adjustment for individual taxes in decades: 7.1 percent for tax year 2023.

What will the standard deduction be for 2023

Standard Deduction Amounts for 2023 Taxes (Returns Due April 2024)

| Filing Status | Standard Deduction 2023 |

|---|---|

| Single; Married Filing Separately | $13,850 |

| Married Filing Jointly & Surviving Spouses | $27,700 |

| Head of Household | $20,800 |

Apr 20, 2023

How do I have less withheld from my paycheck 2023

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

Will tax refunds be better in 2023

Changes for 2023

When you file your taxes this year, you may have a lower refund amount, since some tax credits that were expanded and increased in 2023 will return to 2023 levels. The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit.

What to expect 2023 tax refund

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2023). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

What will the 2023 standard deduction be

Standard Deduction: How Much It Is in 2023-2023 and When to Take It. The 2023 standard deduction is $12,950 for single filers, $25,900 for joint filers or $19,400 for heads of household. Those numbers rise to $13,850, $27,700 and $20,800, respectively, for tax year 2023. Tina Orem is an editor at NerdWallet.

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

What percentage of my paycheck is withheld for federal tax 2023

Federal payroll tax rates for 2023 are: Social Security tax rate: 6.2% for the employee plus 6.2% for the employer. Medicare tax rate: 1.45% for the employee plus 1.45% for the employer. Additional Medicare: 0.9% for the employee when wages exceed $200,000 in a year.

What are the payroll changes for 2023

For 2023, the Social Security tax wage base for employees will increase to $160,200. The Social Security tax rate for employees and employers remains unchanged at 6.2% on wages up to $160,200. Medicare tax will also apply to all wages and will be imposed at a rate of 1.45% for both employees and employers.

Are people getting smaller tax refunds this year

The average tax refund is 10.4% lower than last year according to the latest Internal Revenue Service data, and inflation is taking more of those dollars. Consumers have helped keep the economy humming with higher wages, surplus savings and pandemic stimulus among the sources of increased cash and spending.

Why did I get less in my tax return

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset. If your tax refund is lower than you calculated, it may be due to a tax refund offset for an unpaid debt such as child support.

Why is my federal tax return so small

Although the average may change as more returns are processed, taxpayers are likely to see a lower refund due to a number of key tax credits returning to pre-pandemic amounts. The IRS expects more than 168 million individual tax returns for this tax season.

Why is my federal refund so low

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset. If your tax refund is lower than you calculated, it may be due to a tax refund offset for an unpaid debt such as child support.

Did federal payroll taxes go up in 2023

What is the employer FICA rate for 2023 The employer FICA rate is 7.65% in 2023. Employees pay an additional 7.65% FICA tax, and self-employed workers pay the full 15.3%.

Will payroll taxes go up in 2023

1. Social Security Wage Base Increases by Nearly 9% The social security wage base — the maximum income subject to social security tax — will increase from $147,000 to $160,200 starting January 1, 2023. This increase will reflect a nearly 9% jump.

Will refunds be smaller in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.